Ark ETF Sells Most of Its Bitcoin Due to Poor Performance and Regulation

Bitcoin’s rise as an investment tool, which often supersedes its popularity as a digital means of payment, has resulted in the creation of several digital currency financial products. Among them is a feature of the traditional financial markets, the Exchange Traded Fund (ETF), which allows investors to track and invest in multiple assets using a single over-laying product.

ETFs a Popular Product

Similarly, a Bitcoin ETF allows institutional investors to trade the price movements of the pioneer cryptocurrency, without possessing any actual bitcoin. The offering has proven to be popular in Sweden and Germany, which allow investors to invest in a derivative of the digital asset.

However, U.S. based digital ETFs haven’t enjoyed similar success, with a popular ETF offering shutting its doors to investors on May 18, 2018.

Ark’s BTC Futures Losing Sheen

In April 2018, Ark Innovation’s Bitcoin futures product (ARKK) bagged the “ETF of the Year” award. The firm was true to its promise of serving up access to the disruptive digital asset and often held the top spot in BTC holdings. Moreover, the firm’s bitcoin allocation at ARKK was always between six percent and ten percent.

Currently, only the ARK Web x.0 ETF (ARKW) rivals ARKK, with the firm making huge profits in 2017. The Bitcoin Investment Trust (GBTC), which was used to access bitcoin, was a significant driver behind both these funds’ returns last year.

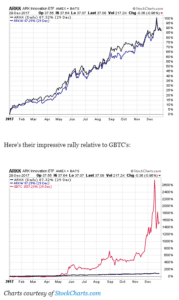

As shown in the chart below, the ARKK and ARKW were each up more than 87 percent in 2017, and the GBTC recording a rise of 1,550 percent:

(Source: CNBC)

However, bitcoin is fast losing out its center of attention at ARKK and ARKW, with the pioneer digital currency now only making up .5 percent and .6 percent of the indices respectively. As per reports, the cutting out of bitcoin at these firms started out earlier in 2018 and can be attributed to rising tax concerns and regulations as the driving force behind the decision.

Another factor to have led to this decision was poor performance, such as the massive drop in 2018 after bitcoin’s all-time-high price of $19,000 in December 2017. GBTC already faces a 37 percent drop.

However, if the performance of GBTC would increase in the coming months, any improvement in the value of bitcoin will reflect in their allocation. ARK was undoubtedly earning profits on its earlier allocation, and the trimming only began when the prices began to struggle.