ARK Invest purchases another $9.2m worth of Coinbase shares

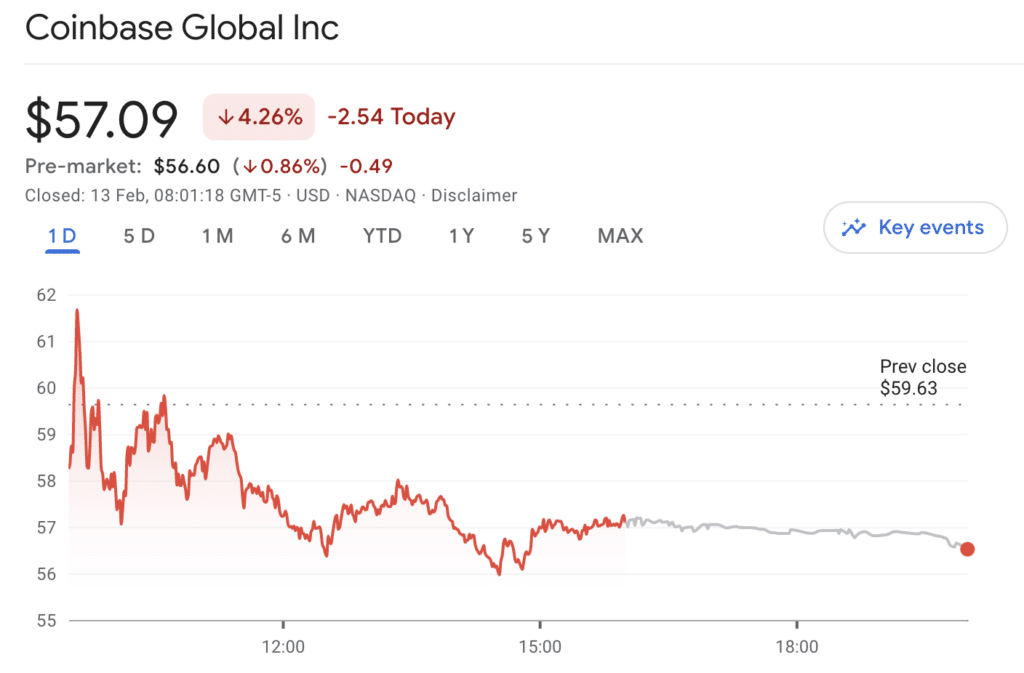

Cathie Wood’s ARK Invest has announced the purchase of $9.2 million worth of Coinbase (COIN) shares. COIN has been down by 0.86% in the pre-market trading on Feb. 13.

Unwavering in its strong optimism over the long-term potential of centralized crypto exchange Coinbase, Cathie Wood’s ARK Invest has added another $9.2 million (162,325 shares) worth of COIN to its existing holdings which stood at 8.596 million shares as of January.

Due to the global crypto market downturn exacerbated by a barrage of high-profile bankruptcies such as Sam Bankman-Fried’s FTX scandal, COIN has lost more than 70% of its value since last year.

The firm’s latest COIN purchase comes just one month after it added $5 million worth of shares to its ARK Innovation ETF (ARKK) treasury.

As reported by crypto.news last month, Ark Invest took advantage of the recent surge in the bitcoin (BTC) price to take some profit in its Grayscale Bitcoin Trust (GBTC) holdings, selling off 500,000 GBTC shares.

Wood condemns SEC’s war against crypto

The past week saw the United States Securities and Exchange Commission (SEC) hammer down Kraken’s staking product, forcing the Jesse Powell-led crypto trading venue to pay a hefty penalty of $30 million.

As expected, the regulator’s enforcement action has attracted condemnation from Web3 enthusiasts and crypto proponents, with SEC Comm. Hester Peirce describing the agency’s regulatory approach as lazy and paternalistic.

In the same vein, Wood, who recently forecasted the price of bitcoin (BTC) to surpass $1 million by 2030, has opined that an SEC’s ban of crypto staking products on centralized exchanges will do more harm to the country than good.

In related news, Coinbase’s Brian Armstrong has made it clear that the exchange may file a lawsuit against the SEC if the agency bans its staking product.