ASIC Mining and How it Is Undermining the Decentralized Nature of the Blockchain

When the mysterious Satoshi Nakamoto put forth his ideas for the creation of bitcoin in the 2008 white paper, one of the most obvious philosophies was the elimination of centralized systems and their replacement with a decentralized network. This idea was not unique to Nakamoto alone as many of the pioneers of the blockchain were unanimous in their desire to see decentralized systems toppling the mainstream centralized financial market.

Profitability and Mining

While this philosophy looked good on paper, the reality of the blockchain has been anything but decentralized.

Just as an example to provide a bit of context: Coinbase, Binance, and many other notable cryptocurrency exchange platforms are all working with relatively centralized models. Even ICOs are becoming more and more centralized.

One of the key advantages ICOs offered to investors was the ability to invest in undervalued companies which were starting up, something which was not available in traditional markets.

IPOs, for instance, would only be launched after many rounds of funding by venture capitalists with firms having bubbled up valuations.

Now, it seems as though distributed networks themselves are moving slowly into the same centralized entities they sought to disrupt.

On March 29, 2018, a Reddit user by the name of r/Sjoerd266 submitted a post on the forum calling for the immediate dismantling of the ASIC industry altogether.

This call came after both Monero and SiaCoin rejected ASIC mining protocols developed by Bitmain, the dominant player in the crypto mining market.

ASIC resistance 101 #1 – ASIC resistance is the foundation for greater #decentralisation. The power stays in your hands, instead of the few.

— Vertcoin (@Vertcoin) February 15, 2018

Reading through the over 500 comments on the post, the general feeling is that ASIC miners are hurting the blockchain and its decentralized ethos.

A Little Bit of History

At the beginning of the bitcoin network, mining could be done with a laptop running a standard CPU.

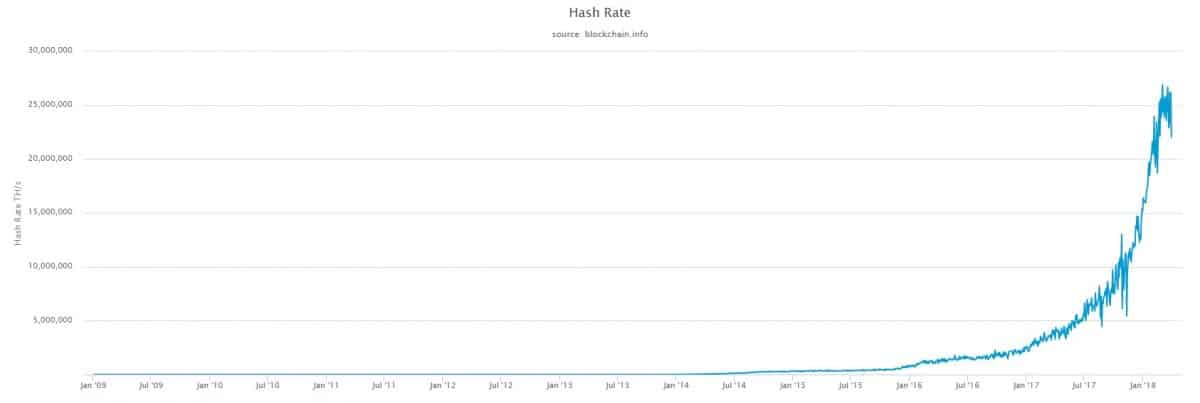

By 2010, Graphics Processing Units (GPUs) began replacing CPUs as the hashrate of the bitcoin network increased considerably.

(Source: Bitinfocharts)

More people were joining the network, and the mining race was heating up. Before long, GPUs were upstaged by Field Programmable Gate Arrays (FPGAs) and mining became an industrialized process

It didn’t end there though as Application-Specific Integrated Circuits (ASIC) mining hardware entered the market. These days ASICs are the industry standard for bitcoin mining.

The Growing Monopoly of Bitmain and Other ASIC Miners

With the price of bitcoin growing steadily in the last few years, mining became a lucrative proposition for a number of people.

Bitmain is the world’s largest manufacturer of cryptocurrency mining hardware, and they reportedly control nearly 35 percent of the Bitcoin hashing rate. This control has led to fears of a bitcoin mining monopoly in a system that is supposed to be decentralized.

In the current set up of the network, it isn’t possible to compete with industrial mining complexes. As such, Bitcoin is now a representation of the very system that is sought to replace.

Such is the dominance of Bitmain that in a recent article on TechCrunch, it was reported that the price of Ethereum fell after rumors emerged of a Bitmain-developed ASIC mining rig for the network.

Ethereum developers have always tried to make the crypto unappealing to ASIC miners. In fact, mining on Ethereum is done with GPUs, but it seems a few companies are working on ASIC dedicated to mining ether (ETH).

In a recent Twitter poll by Vlad Zamfir, a researcher with the Ethereum Foundation and one of the core members of the development team, 57 percent voted “Yes” for a hard fork that would make the Ethereum blockchain immune to ETH ASICs.

Would you support a hard fork that obsceletes ETH ASICs? (Just wondering, this is not a proposal)

— Vlad Zamfir (@VladZamfir) March 28, 2018

When trying to develop Litecoin, another crypto, Charlie Lee, its creator took steps to make sure that it was immune to ASIC mining.

Die-hard proponents of crypto and blockchain technology all hold to the decentralized ethos, and thus ASICs constitute a centralization attack that is probably second only to the 51 percent attack regarding its undesirability.

Many have praised the decision of Monero and SiaCoin to try and make their blockchains immune to ASIC centralization.

In any case, If centralized mining becomes the norm for all cryptos, then it would undoubtedly be a sad day for many crypto believers.