Best crypto ETF by performance in 2024

Discover the top 5 crypto ETFs to watch in 2024. Insightful analysis of their performance, liquidity, and how to choose wisely in a dynamic market.

After the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin exchange-traded funds (ETFs) on Jan. 10, 2024, the crypto market has seen a significant upsurge. The price of Bitcoin (BTC) soared to 201% higher than a year ago, shattering previous all-time highs in the process.

As investors eagerly search for the best cryptocurrency ETF to invest in 2024, the question arises: among the top crypto ETFs, which is the best performing, and which holds the promise to continue this remarkable growth?

This article spotlights the top 5 crypto ETFs, aiming to guide investors toward the most promising and best-performing funds in this landscape. However, remember, this is not financial advice, and all aspiring investors should be sure to do their own research and talk to professionals before putting money into any crypto-related investment.

Table of Contents

What is a cryptocurrency ETF?

A cryptocurrency ETF is a type of investment vehicle designed to track the performance of one or several crypto assets. It allows investors to buy digital currencies without owning the assets.

How do crypto-ETFs work? They are very similar to traditional financial market ETFs, where investors can buy shares of stocks or commodities. Their profits or losses depend on the price movement of these shares, which is determined by the price fluctuations within the crypto market.

The concept of blockchain ETFs has captured the attention of investors looking for dependable and mature investment avenues in the market. These products are paving the way for the widespread acceptance of cryptocurrencies by addressing various challenges that have hindered their mainstream adoption.

Bitcoin and Ethereum (ETH) are the most popular ETF cryptocurrencies, mostly because the SEC’s approval of spot BTC ETFs significantly broadened access while bolstering its legitimacy as an asset class.

Top 5 crypto ETFs

Selecting a crypto ETF requires even more careful consideration of several factors, including in-depth chart analysis and utilizing aspects of the CAN SLIM method devised by William J. O’Neal to identify the highest-performing stocks.

A robust market capitalization and ample daily average volume typically signify a strong and liquid ETF. Many experts recommend that potential crypto investors focus on leading ETF cryptocurrencies, such as BTC and ETH, which have shown consistent growth and adoption rates.

The price of an ETF cryptocurrency can be influenced by myriad factors, including shifts in supply and the emergence of new use cases, each impacting its performance differently. It’s also crucial for investors to gauge the market direction accurately, as even high-performing stocks can falter in a market trending downward.

Though the crypto market currently showcases an optimistic trend, experts caution investors, reminding them of the ongoing worries about recession risks and persistently high inflation. Bearing these considerations in mind, here are some of the best performing crypto ETFs garnering significant interest from investors as the year unfolds:

ProShares Bitcoin Strategy ETF (BITO)

One of the best crypto ETF to buy now is the ProShares Bitcoin Strategy ETF (BITO). Not only does it stand as the pioneering BTC-based ETF in the U.S., but is also one of the most liquid ones in its category as of the time of writing.

Despite its higher expense ratio of 0.95%, in the last three months, BITO has had an average volume just north of 18 million, according to VettaFi, making it one of the good crypto ETFs to watch for investors seeking liquidity.

Additionally, BITO has amassed assets under management (AUM) valued at $2.04 billion and recorded a year-to-date (YTD) return of 51.66%, showcasing its robust performance in the dynamic crypto market. With such attributes, BITO could likely earn a place among many investors’ top 5 crypto ETFs.

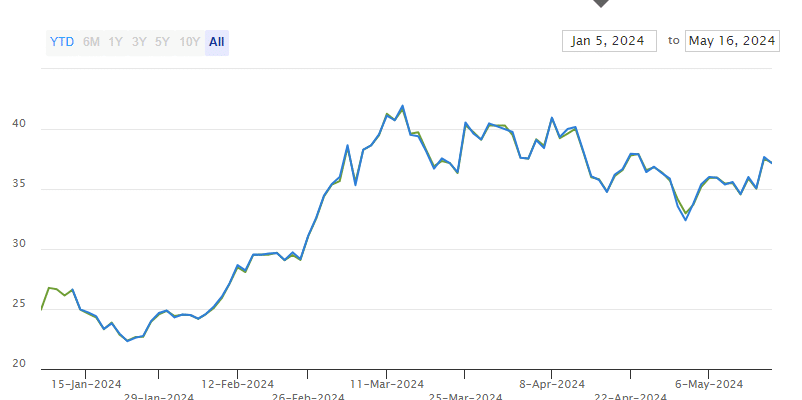

iShares Bitcoin Trust (IBIT)

Managed by BlackRock, the iShares Bitcoin Trust ETF (IBIT) has rapidly established itself as one of the good crypto ETFs to watch in 2024. Launched earlier in the year, IBIT facilitates investment in BTC via conventional brokerage accounts, marrying the allure of cryptocurrency with the reliability of traditional investment structures.

Distinguishing itself with AUM of $16.5 billion, this fund has seen exponential growth and set unprecedented benchmarks in the ETF space within a short span.

Just weeks into its debut, its managed assets surged past $10 billion, underscoring its overwhelming acceptance and the dynamic expansion of the crypto ETF market.

A particular highlight was a week in February, during which IBIT captured a hefty $3.3 billion in fund inflows, spurred by a simultaneous rally in BTC prices and mounting investor enthusiasm.

Initially, BlackRock enhanced this momentum by temporarily halving its fees from 0.25% to 0.12%, offering a more enticing expense ratio. This move, coupled with its significant AUM, makes a strong argument for putting IBIT on the crypto ETF list of 2024, offering a blend of substantial growth potential and cost efficiency for those looking to venture into crypto investments.

Grayscale Bitcoin Investment Trust (GBTC)

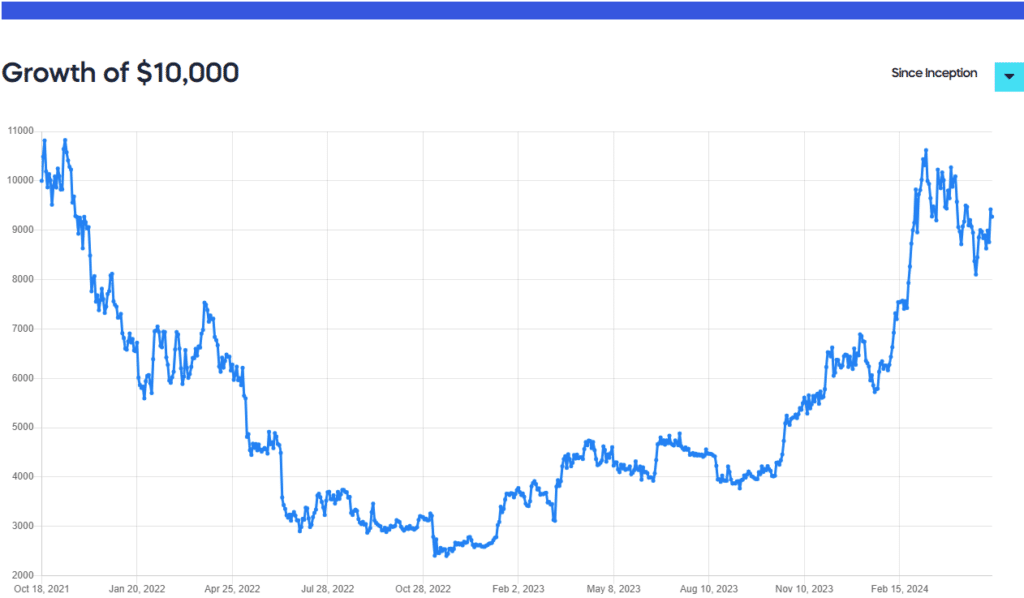

Launched in 2013, the Grayscale Bitcoin Trust (GBTC) initially carved a niche within the BTC investment space as a vehicle offering over-the-counter trading opportunities.

Its evolution took a significant leap forward when, in January 2024, it successfully transitioned into a Bitcoin ETF, securing approval from the SEC. This marked a monumental stride in its progression and further solidified its position in the crypto investment landscape.

Notably, the ETF has emerged as one of the top assets by YTD performance, boasting a return of 67.59% and a one-year daily total return of 317.61% per data from Yahoo Finance.

GBTC stands out for its performance and liquidity, with an average daily volume of 16 million shares traded and its substantial scale, managing one of the largest AUM in its class at $18.82 billion.

While its fee structure, with a 1.5% annual management fee, is on the higher side relative to other offerings, GBTC’s leading performance indicators and significant liquidity make it one of the best crypto ETF to buy now.

Its large AUM and performance metrics underscore the trust’s foresight and commitment to providing an infrastructure for Bitcoin investing, reassuring investors seeking a well-established entry point into the crypto market.

Fidelity Wise Origin Bitcoin Fund (FBTC)

Unlike fellow asset manager Vanguard, Fidelity Investments embraced the crypto revolution, launching its own Bitcoin ETF, FBTC, and ensuring it was readily tradable on its platform.

This strategic move mirrored the success of BlackRock’s iShares Bitcoin Trust, with FBTC quickly amassing over $1 billion in inflows shortly after its launch.

Fidelity’s decision to reduce the expense ratio to 0.00% until August 1, 2024 was a notable draw for investors. Currently, FBTC boasts AUM valued at $9.71 billion.

This combination of a zero expense ratio and substantial assets under management showcases FBTC’s appeal and firmly positions it on our best crypto ETF list.

Bitwise Bitcoin Strategy Optimum Roll ETF (BITC)

Despite having one of the lower AUM figures and average daily volumes in its category, the Bitwise Bitcoin Strategy Optimum Roll ETF distinguishes itself as one of the standout performers of 2024 within the alternative ETFs sector, according to VettaFi data.

With a YTD return of 72.71%, BITC, an offering from Bitwise Asset Management — a leader in crypto index funds— has secured its position among the best performing crypto ETFs.

The ETF’s strategy focuses on capital appreciation through managed exposure to Bitcoin futures, aiming for directional exposure to the coin via regulated futures contracts while optimizing potential roll returns through strategic futures market analysis.

Despite its relatively modest size, with an AUM of $4.5 million, an average daily volume of 13,144, and an expense ratio of 0.85%, BITC has proven its mettle by leveraging its performance metrics.

How to find the best ETFs

To find the top blockchain ETFs, investors should consider factors such as solid performance and trading volume, exposing themselves to the broad crypto market or specific digital coins, and opting for ETFs with low fees.

Looking out for ETFs with a significant trading volume (at least 50,000 shares a day) and those with a strong track record in returns, specifically in major cryptocurrencies like BTC and ETH, may be advisable.

Additionally, choosing ETFs from reputable providers with assets over $10 million could help reduce risks. However, it’s essential to be mindful of the high volatility in the cryptocurrency market, management fees that could impact overall returns, and the current limited options in blockchain ETFs, mainly confined to significant cryptocurrencies.

FAQ

Are crypto ETFs safe?

Crypto ETFs come with risks. For one thing, cryptocurrencies are highly volatile, and this volatility can affect the performance of crypto ETFs. Additionally, the regulatory environment for these ETFs is still evolving, which can add uncertainty. Management fees and trading costs can also affect returns.

Investors should approach crypto ETFs with caution, conduct thorough research, and consider consulting a financial advisor. As with any investment, it’s essential to understand the risks and determine if it fits your monetary strategy.

Are crypto ETFs a good investment?

As always, there is no objective answer to this. Although blockchain ETFs have benefits and limitations, whether or not they are well-suited to an investor will depend on many factors, including their knowledge of the market and attitude towards risk.

Investors should do their own thorough research into ETFs to determine which, if any, would be the right one for them.