Binance accelerates delistings as regulatory pressure intensifies

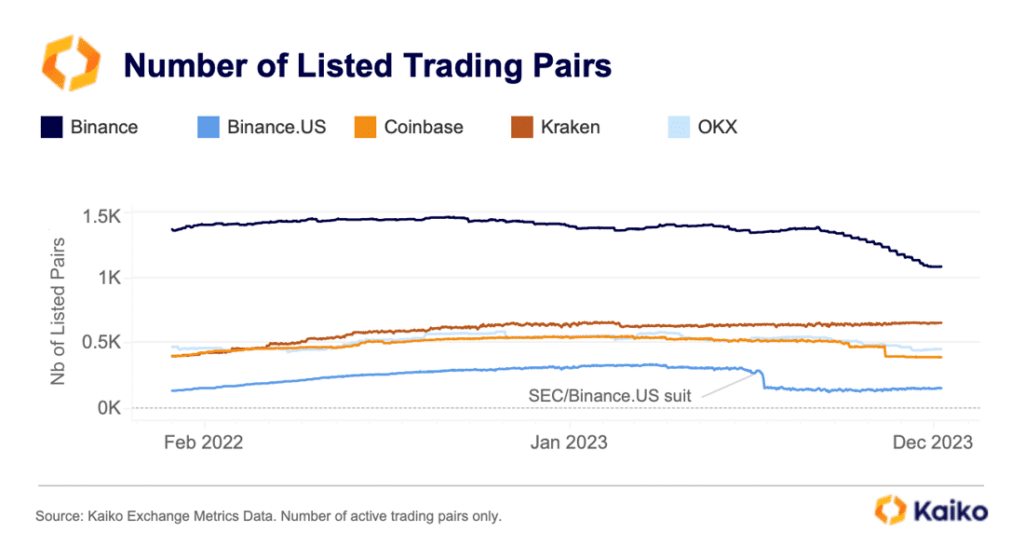

Crypto exchange Binance has tightened its listing policy as the number of listed trading instruments declined by 21% in 2023, Kaiko reports.

According to a new report published by Diving Into DEXs, Binance is now taking an accelerated approach to delisting entities at a rapid pace after its founder and former chief executive Changpeng Zhao settled a $4.3 billion case with U.S. regulators for, among other things, operating an unlicensed exchange.

Analysts at Kaiko admitted that Binance was not the only crypto exchange in 2023 to scale down its listing offerings, as Coinbase and OKX have delisted some instruments. In the meantime, U.S.-based crypto exchange Kraken, on the contrary, slightly increased the number of supported cryptocurrencies, according to Kaiko data.

In mid-October 2023, Kaiko revealed in a report that a total of over 3,445 tokens or trading pairs have either been delisted or rendered inactive on major trading platforms, representing a 15% increase in the amount of delisted instruments than for all of 2022. Analysts at Kaiko estimate that Coinbase removed a total of 80 trading pairs as of October 2023, bringing the total amount of delisted instruments from its platform to 176 in 2023.

In early December 2023, Binance’s newly-appointed chief executive, Richard Teng, acknowledged in an interview with CoinDesk that the compliance control the exchange had at launch was “inadequate,” adding that “mistakes were made.” His comments came after the U.S. Department of Justice said Binance’s staff “knew that the company’s anti-money laundering procedures were inadequate and would attract criminals to the platform.”