Binance keeps its market share as Coinbase loses its grip

Binance has retained the top spot on the market per trading volume. Meanwhile, its competitor Coinbase suffered a share drop amid market instability and Silvergate issues.

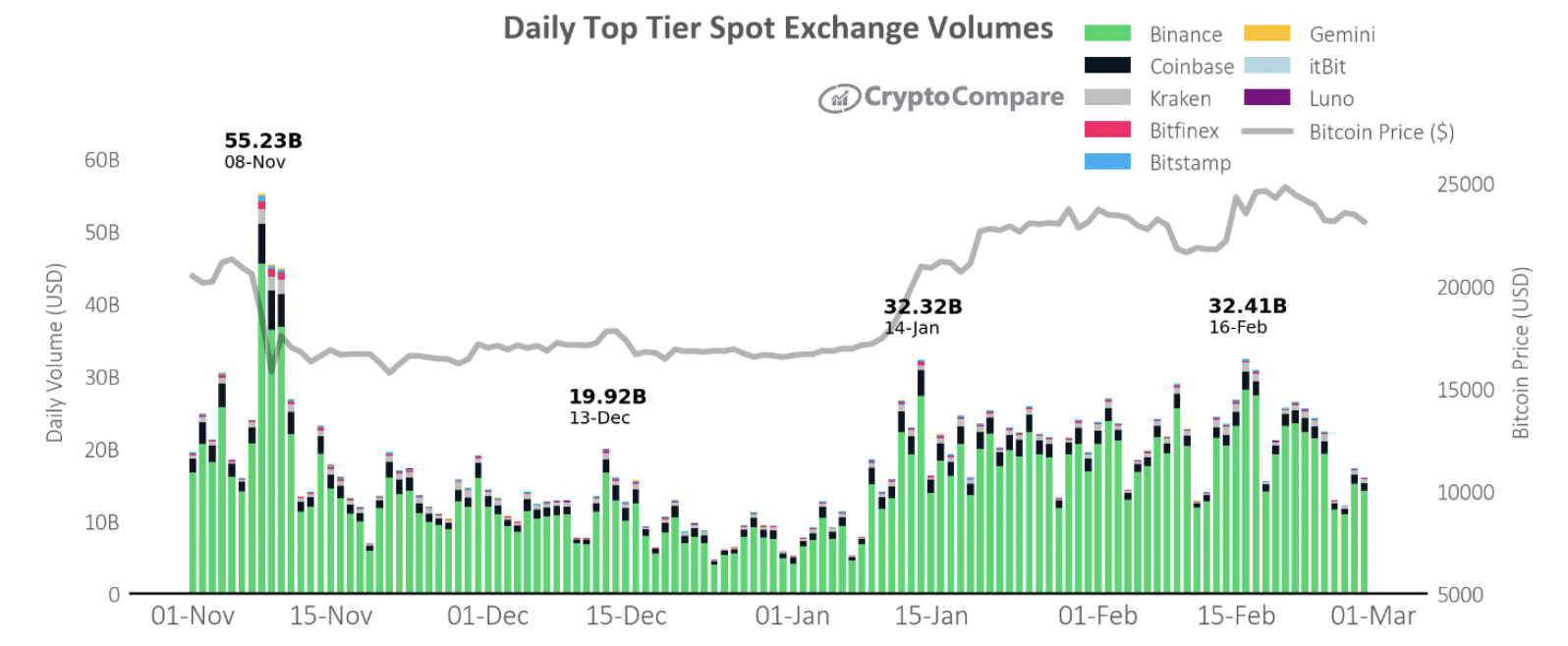

Binance maintained its position as the major cryptocurrency trading platform in terms of the trading volume.

Its spot market share among top-tier exchanges climbed for the fourth month in February, from 59.4% in January to 61.8% in February. This growth resulted from a 13.7% jump in spot volumes, bringing the total to $540 billion.

Binance’s market share across all exchanges for derivatives also increased by 62.9%, reaching its highest-ever recorded monthly market share as per a recent report by CryptoCompare.

Although trade volumes in the crypto industry increased in February, such levels are still 71% lower than their all-time highs observed in May 2021. Throughout the month, Binance achieved a record-breaking high market share for spot and derivative exchanges combined, per CryptoCompare.

Coinbase and Silvergate stocks plunge

Coinbase has also been going through a tough week amid the recent market events that have caused a mild plunge. The firm’s stock valuation has also experienced a 7.8% plunge within the same period despite cutting ties with the troubled crypto-friendly bank Silvergate.

Silvergate’s stock also plummeted over 60% amid liquidity concerns that led to the bank’s collapse. This plummet is relatively high compared to other financial firms, as Signature bank only saw a puppet of 12% in stock valuation within the same period.

What next after Silvergate

Several bitcoin exchanges and other digital currency businesses rely on Silvergate Bank’s banking services. It may be difficult for them to continue operating as they have lost their banking partner due to the bank’s failure.

Moreover, the financial system as a whole is likely to feel the effects of a single bank’s failure. This may lead to a contraction in the credit market, making it harder for firms to get loans and other sources of finance. The general cryptocurrency market might suffer if investor trust drops as a result.

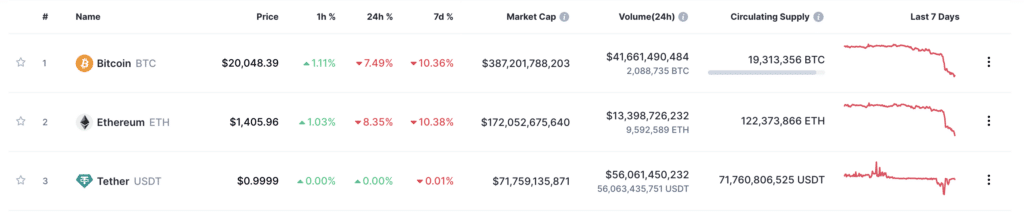

As a result of this development, bitcoin (BTC) and ethereum (ETH), the two digital assets with the highest market capitalization, are also on a bad day, having lost more than 7% and 10% in price within 24 hours, respectively.