Bitcoin faces selling pressure as whale activity hikes

Bitcoin has gained bullish momentum over the past week. Despite the green market conditions, the flagship digital currency has already faced some selling pressure.

According to a tweet by the market analyst platform CryptoQuant, Bitcoin (BTC) should stay above the $32,000 mark to stay bullish and even “trigger a substantial price surge.”

The market analyst believes that the “current scenario suggests a positive outlook for Bitcoin’s price.”

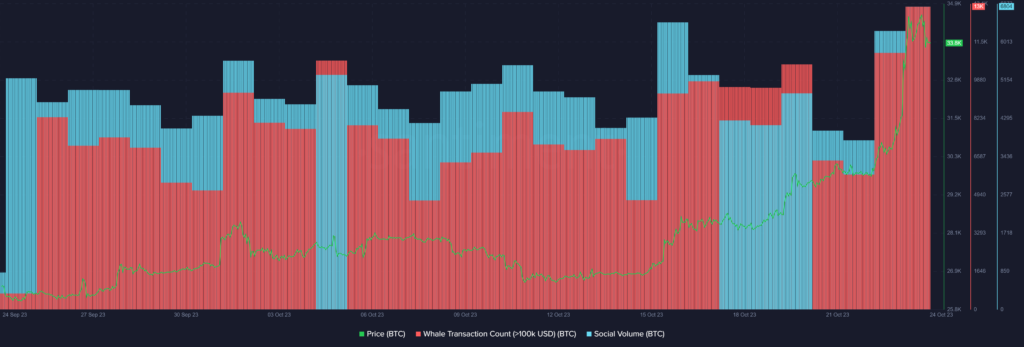

According to data provided by the market intelligence platform Santiment, Bitcoin’s whale activity and social volume have risen significantly since Oct. 21.

Per Santiment, whale transactions consisting of at least $100,000 worth of BTC surged by 19% in the past 24 hours, reaching 13,044 trades over the past day.

Moreover, Bitcoin’s social activity also witnessed a 9% hike in the past 24 hours, per Santiment data. It’s important to note that the asset’s social volume nearly doubled over the past three days.

On the other hand, Bitcoin’s price-daily active addresses (DAA) divergence suggests some incoming selling pressure. According to Santiment, the BTC price DAA divergence has dropped to negative 17.5%, suggesting a minor “sell signal” following the asset’s fall below the $34,000 mark.

It’s important to note that Bitcoin reached a local high of around $35,000 on Oct. 24 and soon witnessed a daily bottom of $33,270.

Bitcoin is up by 0.35% in the past 24 hours and is trading at around $33,900 at the time of writing. BTC’s market capitalization still holds above the $660 billion mark while its 24-hour trading volume plunged by 31.4%, closing down to $32 billion.

One of the main reasons for the recent market-wide rally is the high anticipation of a Bitcoin spot exchange-traded fund.