Bitcoin funds decline as crypto investors flock to Ether and XRP

Bitcoin-related investment products decline, as investor outflow is visible for the first time since Blackrock’s filing for a spot Bitcoin ETF.

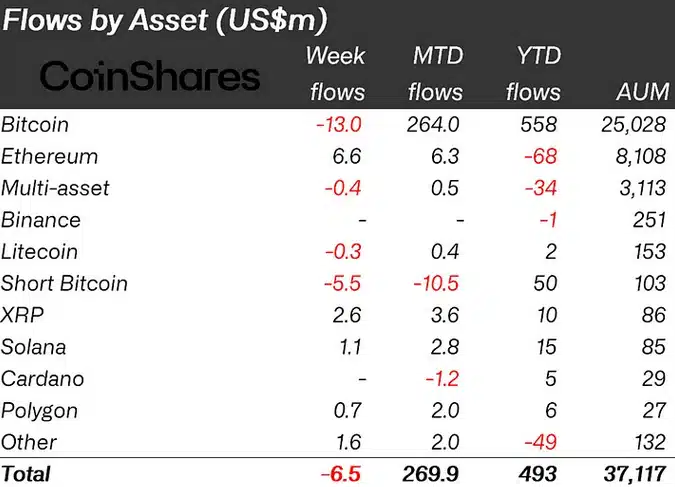

The outflow was revealed in a report by James Butterfill, CoinShares’ head of research. Bitcoin (BTC) investment products saw a notable outflow of $13 million during the week ending July 21. A reversal came after five consecutive weeks of inflows.

The overall digital asset funds also witnessed weekly outflows of $6.5 million, following four weeks of substantial inflows totaling $742 million.

During the same period, short Bitcoin products also experienced outflows totaling $5.5 million.

Ether and XRP lead altcoin surge

In contrast, investment products related to Ether (ETH) and XRP (XRP) recorded a combined inflow of $9.2 million over the past week.

Ether emerged as the top performer, attracting $6.6 million in inflows, while XRP funds also garnered investor interest with an influx of $2.6 million.

Other altcoins, such as Solana (SOL) and Polygon (MATIC), also witnessed some attention, tracking inflows of $1.1 million and $0.7 million, respectively.

The latest trend reversal for BTC investors seems to be linked to a lack of positive news following some major catalysts in recent weeks. Notably, global asset management giant BlackRock filed for a long-awaited spot BTC exchange-traded fund on June 15, leading to increased investments in BTC-focused funds over the following month at a rate not seen since October 2021.

Other financial institutions that have filed for Bitcoin spot ETF applications with the SEC since mid-June include ARK Invest, Fidelity, Galaxy Digital, VanEck, Valkyrie Investments, NYDIG, SkyBridge, and WisdomTree.

Moreover, XRP’s partial court victory over the U.S. Securities and Exchange Commission (SEC) on July 13 initially boosted BTC’s price to a yearly high before it fell below $30,000. However, this ruling improved investor confidence in altcoins, as indicated by positive fund flows in the past week.

Notably, Bitcoin continues to dominate the digital asset market, attracting $558 million in inflows in 2023. Its total assets under management amount to $25 billion, accounting for 67.4% of the total market share.

At the time of writing, BTC is exchanging hands at $29,186, experiencing a 2% drop over the last 24 hours.