Bitcoin long-term holders do not lose their grip, on-chain data shows

Bitcoin (BTC) long-term holders are not afraid of the current volatility. Distrust towards centralized crypto service providers continues to drive bitcoin off exchanges.

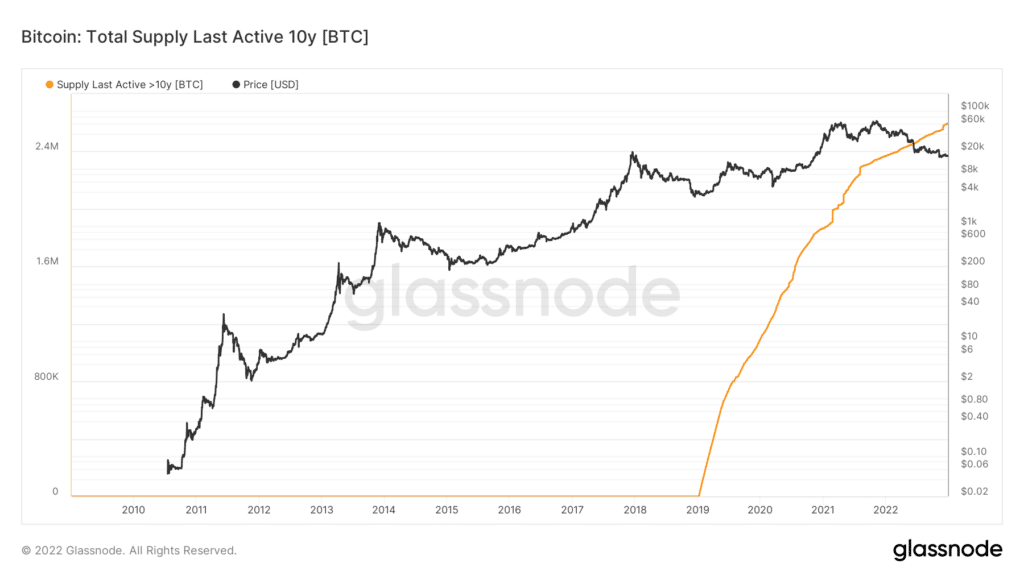

Blockchain analytics service Glassnode reveals that the amount of bitcoin supply last active ten years ago or more reached a new all-time high of 2,594,574.300 BTC on Dec. 30. On the same day, the number of bitcoin addresses holding at least 100 BTC — worth 1.66 million as of press time — also reached a one-time high of 16,133. The data suggest that the accumulation is ongoing among big holders again.

In addition, another chart also shows that the number of bitcoin addresses holding at least 1 BTC — worth about $16,600 as of press time — reached an all-time high of 978,000. Those metrics show that interest in bitcoin has not been critically damaged despite the recent market downturn.

The same cannot be said about public trust in centralized exchanges (CEX). Trust in those service providers collapsed with the fall of the major crypto exchange FTX, as proved by the ongoing exodus of bitcoin off the CEXes. Glassnode charts show that over the 24 hours to press time on Dec. 30, $29.1 million worth of bitcoin left cryptocurrency exchanges alongside $56.4 million worth of Ethereum (ETH).

The news follows recent reports that major crypto assets continue to move reliably off of centralized cryptocurrency exchanges despite the service providers’ best efforts to regain user trust after the fall of FTX. Self-custody is seen by many in the cryptocurrency community as a solution that allows them to hold their assets without the need to trust a third-party custodian not to mismanage them.

Still, Changpeng Zhao — the CEO of the world’s top cryptocurrency exchange Binance — seemingly disagrees. During a recent Twitter space event, he claimed that more cryptocurrency is lost to self-custody than centralized service providers and suggested that self-custody is not suitable for 99% of the users.