Global Bitcoin Mining Industry Set to Bring in $4 Billion Per Year

When Bitmain claimed that it is valued at several billions of dollars by its investors including leading venture capital firms IDG and Sequoia, the cryptocurrency communities were taken by surprise. However, that is because only a small portion of the community are aware of the revenues the global Bitcoin mining industry generates.

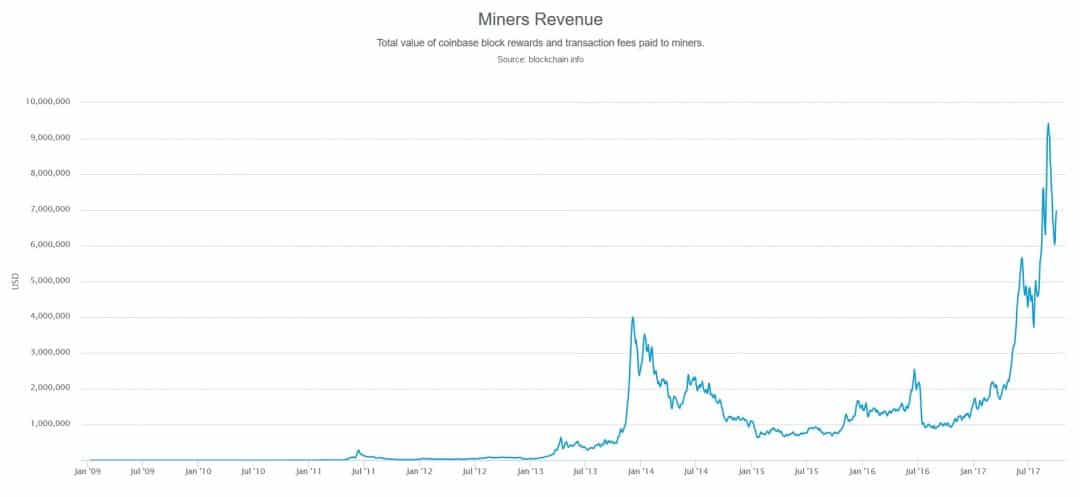

Chris Burniske, a prominent crypto analyst, the founding partner at Placeholder VC and former lead at ARK Invest, revealed in a statement that the Bitcoin mining industry is set to generate annual revenue in the range of $3 to $4 billion.

Because of the Bitcoin network’s fee market, despite the integration of the transaction malleability and scaling solution Segregated Witness (SegWit) which has drastically decreased the size of the Bitcoin mempool, in the upcoming years, mining revenues will significantly increase if the current growth of demand for the cryptocurrency can be sustained over time.

The Bitcoin mining industry has been dominated by Chinese mining companies and pool operators since 2012. Bitmain has secured its position as the world’s largest Bitcoin mining equipment manufacturer, as it supports the overwhelming majority of miners globally with its hardware.

But, the mining sector may face a restructuring in the upcoming months. Multi-billion technology conglomerates in Japan and influential government officials in Russia have begun to eye Bitcoin mining. For instance, GMO, one of Japan’s leading technology and Internet giants, announced that it would soon launch its own line of ASIC miners and the next-generation 7 nanometer semiconductor chip.

GMO also revealed in a corporate announcement to its clients and investors that it will operate a large-scale bitcoin mining center in Northern Europe. For a company like GMO that is capable of investing hundreds of millions of dollars in a new venture, the establishment of a bitcoin mining center in Northern Europe would allow the operation of large batches of bitcoin mining equipment. More importantly, the colder climate in Northern Europe will provide a natural cooling ecosystem to prevent ASIC miners and semiconductor chips from overheating.

The company’s statement explained, “We will operate a next-generation mining center utilizing renewable energy and cutting-edge semiconductor chips in Northern Europe. We will use cutting-edge 7nm process technology for chips to be used in the mining process, and jointly work on its research and development and manufacturing with our alliance partner having semiconductor design technology.”

In a public statement to its investors, GMO specifically emphasized that it intends to spend upwards to $31 million the first phase of its Bitcoin mining venture that is the roll out of its equipment and construction of mining facilities in Northern Europe.

“We expect to incur expenses for establishment of the next-generation mining center and research and development and manufacturing of hardware including the next-generation mining chip. We will not disclose the specific amount due to the non-disclosure agreement with our alliance partner, but it will be more than 10 percent of the consolidated noncurrent assets as of December 31, 2016 (¥3.489 billion/$30.45 million),” revealed GMO.

An increasing number of companies both within and outside the bitcoin sector are starting to realize the opportunities that exist in the mining industry. For this reason, Burniske also sees no long-term impact on the rumors that the Chinese government will ban bitcoin exchanges. Already, close sources of Litecoin creator Charlie Lee and Bitmain co-founder Jihan Wu stated that there is no truth to the restriction of Bitcoin mining companies. Because of the emergence of major companies such as GMO, Burniske explained that it would not have a major impact on Bitcoin.

“Short-term volatility and decreased security of the network, followed by gold rush of new miners in other geographies. Long term, don’t care,” he stated in regards to the question: “What’s your take in case China government bans Bitcoin miners in China?”