Bitcoin mining revenue rises 50% from December 2022

According to data from Blockchain.com, BTC mining revenue has soared to $24.4 million, a huge increase from the dip recorded in December last year. Although the rise comes as a relief for distressed bitcoin miners, revenue is still down more than 30% from last year.

Revenue from bitcoin mining exceeds $24 million in one month

Per Blockchain.com, bitcoin mining earnings soared to approximately $23 million in January, representing a 50% rise in 30 days. The increase follows a decline in mining revenue for the leading crypto in the world to $13.6 million on Dec. 28, 2022.

The revenue from bitcoin mining is still lower than in January 2022, when it was over $34.1 million. This is a reduction of more than 32% year over year. In February 2022, revenue surged beyond $50 million, but those gains were swiftly squandered as the crypto market crash worsened.

The recent 50% increase is a significant respite for the struggling bitcoin miners. In 2022, the crypto sector saw several mining companies go bankrupt, including the well-known Core Scientific.

The bitcoin miner, whose liabilities ranged from $1 billion to $10 billion, filed for Chapter 11 bankruptcy protection in December 2022.

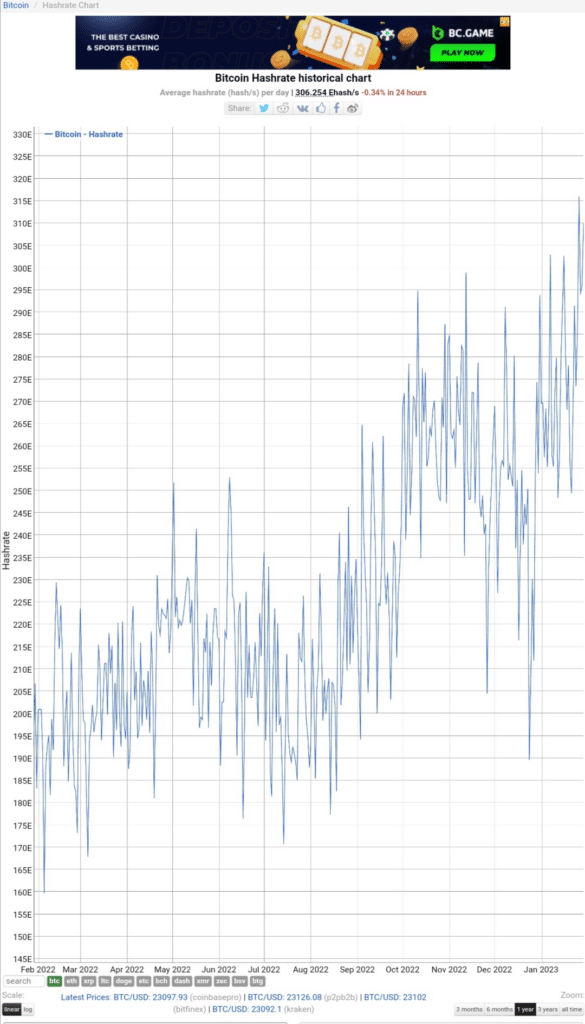

Hash rate peaks on Bitcoin network

As of late, the Bitcoin hash rate has recorded new recent highs. The hash rate measures the processing and computing power contributed to the bitcoin network by miners. From about 182 million EH/s in January 2022, it has increased to more than 300 million EH/s.

A rise in hash rate usually denotes increased network adoption and indicates that the network is getting more secure.

A rising hash rate is typically a favorable indication for BTC owners because it shows that the web is thriving despite the severe price decrease in 2022, even though it does not necessarily mean that the bear market for BTC is coming to an end.

Last year, the crypto market dip put tremendous pressure on the mining sector, as the US Federal Reserve raised interest rates repeatedly, pushing the US dollar to a two-decade high.

Risk assets, such as cryptocurrencies, were adversely affected by this, and some reached multi-year lows. Following the fall of FTX in November and Terraform Labs in May, the recession worsened.