Bitcoin nears $40K: bullish indicators suggest upward momentum

Bitcoin’s value is approaching the coveted mark of $40,000 — a height it hasn’t experienced since the sudden destabilization of TerraUSD in May 2022.

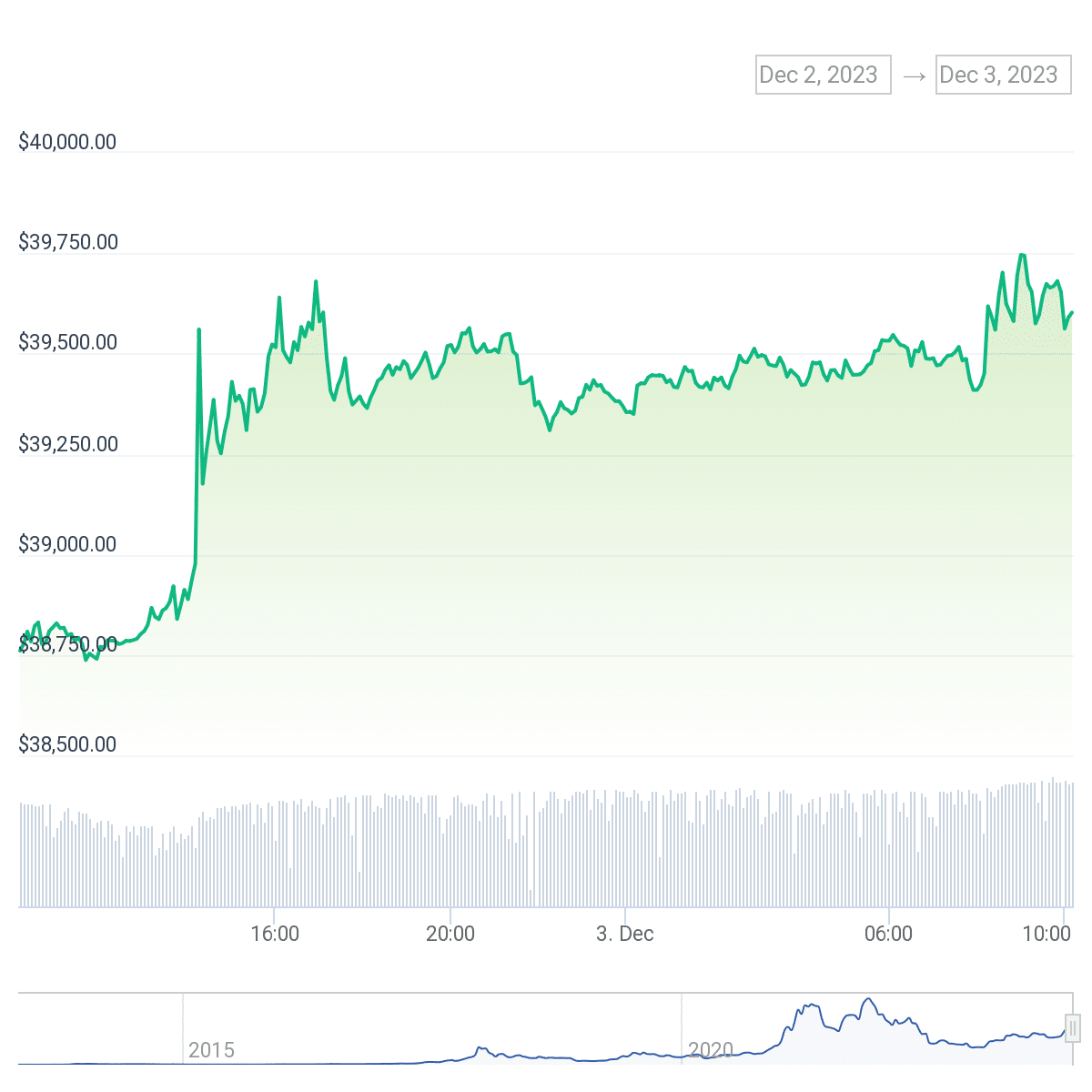

At the time of writing, the value of Bitcoin (BTC) was hovering around $39,653, having seen a 2.1% increase in just 24 hours, according to data from CoinGecko.

BTC’s bolstering indicators, such as the Relative Strength Index (RSI) and the Awesome Oscillator (AO), suggest a positive momentum maintained by the bulls.

Per analysts, the increased buying pressure might propel the coin to exceed its current high and reach the $40,000 threshold.

They have pegged this bullish drive down to several factors. Firstly, the expected approval of spot Bitcoin ETFs between Jan. 5 and 10, 2024, has created a wave of anticipation.

Secondly, historical data shows that BTC typically sees strong performances in the final quarter of the year. Furthermore, the upcoming Bitcoin halving event scheduled for April 2024 is another significant milestone on the horizon.

But perhaps the most substantial driving force, according to market watchers, is the forthcoming Federal Reserve rate cuts, anticipated to commence by March next year.

Over the week, reports emerged that the Securities and Exchange Commission (SEC) had discussions with Grayscale, BlackRock, and Nasdaq about their Bitcoin ETF applications. This development could invite a broader audience to invest in Bitcoin without directly purchasing and storing the crypto.

Crypto trader Arthur Hayes was also at the forefront of pushing positive sentiment around BTC. In a recent blog post, he posited that a weakening dollar will allow China to implement a substantial round of stimulus.

Additionally, recent data shows BTC stored in exchanges decreased by more than $1 billion, suggesting increased confidence in long-term Bitcoin holdings.