Bitcoin retests STH realized price amid break below $29k

Bitcoin (BTC) has retested the short-term holders’ realized price (STHRP) following the break below the $29,000 psychological support.

Prominent on-chain analytical resource CryptoQuant recently called attention to this development. In an elaborate article, a CryptoQuant analyst highlighted the significance of the metric and its bearing on the market.

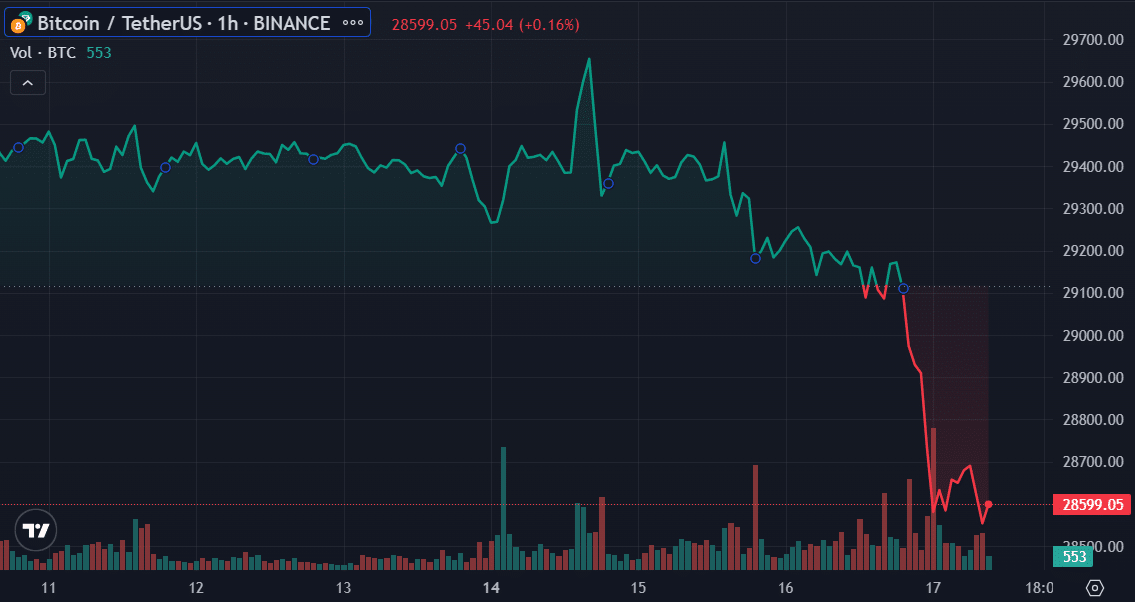

BTC recently witnessed a notable decline, slipping from $29,500 to $28,300. This drop marked a substantial shift that brought it close to the short-term holders’ realized price.

The CryptoQuant report emphasized that the STH RP indicator’s relevance cannot be understated. It represents the average cost at which investors holding BTC for 155 days or less purchased their coins.

Bitcoin‘s drop close to the metric presents a pivotal moment. What’s at stake here is not just a numerical value but the confidence of these investors. Should the price remain below this level for an extended period, it could signal a waning belief among these holders per CryptoQuant analyst.

An equally important consideration is the potential impact on market dynamics. Short-term holders are known to be more reactive to changes in the market environment.

Moreover, the ongoing downward pressure might prompt them to consider selling their holdings if the trend continues, possibly exacerbating the prevailing bearish sentiment.

The report also draws upon historical context for better insights. The analysts offer a cautionary perspective that parallels significant corrections witnessed in March and June 2023.

Bitcoin at pivotal point

These historical events act as a reference point, suggesting what could transpire if the crucial support level is breached. The analyst examines the possible emerging scenarios, depending on whether BTC breaks below the metric or rebounds from it.

Furthermore, a bullish trajectory could unfold if the price rebounds from the STHRP level, which would reinforce the strength of this support and hint at a potential resurgence in an upward trend.

Conversely, a bearish outlook looms if the price decisively breaks through the STH RP level. This could trigger a more profound correction, with short-term holders potentially offloading their assets, compounding selling pressure.

Meanwhile, this analysis comes as BTC dipped below the $29,000 threshold for the first time in a week, recording a 2% decline over the past 24 hours.

This downward trajectory follows a recent peak at $30,244 on Aug. 8. The asset has seen a series of seven intraday losses within nine days. Bitcoin is trading at $28,583 at the reporting time.