Bitcoin Begins to be Taken Seriously by Big Financial Players

The market cap of crypto hit $120 billion and bitcoin already seen its price go up more than 400 percent in 2017. Institutional investors are finding it harder to turn their back on the cryptocurrency.

In finance, many of the debates revolve around digital currencies and Blockchain technology. Many investors are looking to consult with the best financial advisors. There are concerns over how fast new entrants are raising funds, with initial coin offerings and fundraising now exceeding Internet angel and seed investing.

Goldman Sachs acknowledged the growth of digital currency is something investors cannot ignore. Robert Boroujerdi and Jessica Binder Graham, two Goldman Sachs Group Inc. analysts, clarified a few points about trading cryptocurrencies, ICO’s and how to define cryptocurrencies. They argue between the Currency and Commodity definition. Even so, Goldman strategists haven’t specified whether investors should buy digital currency.

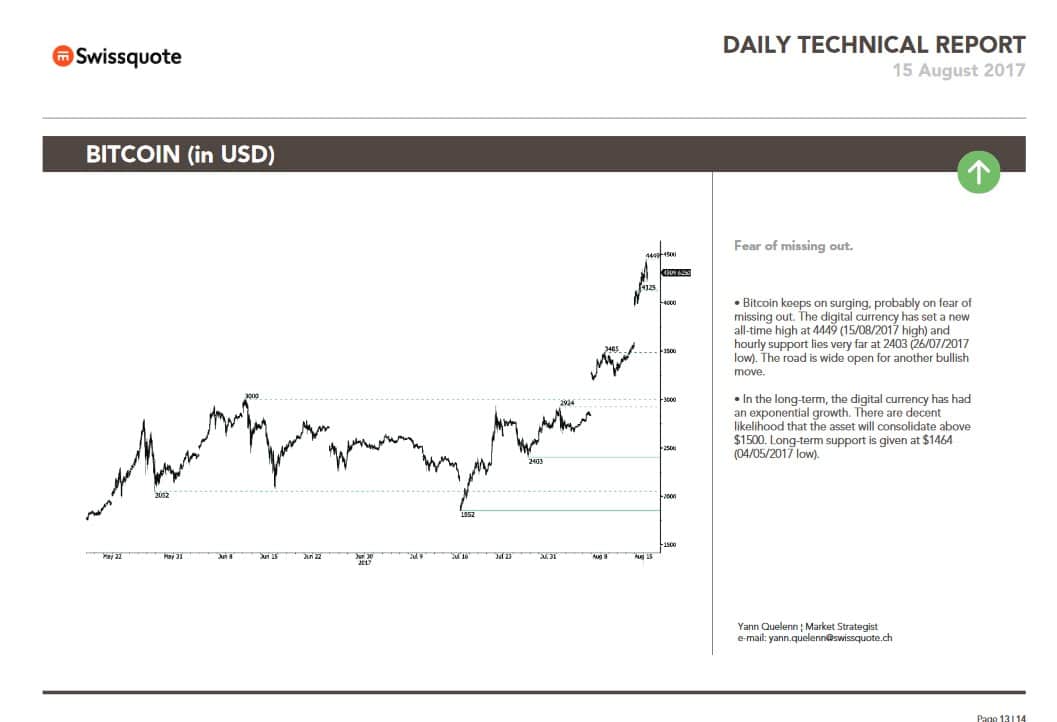

Bitcoin is also on the radar of other notable strategists. For example, Swissquote, a leading provider of online forex trading and research, now includes bitcoin in its daily market reports, as shown below.

The bottom line is that institutional investors are now more interested than ever. With a race to unleash Bitcoin futures and Bitcoin-based ETF’s, we can expect their appearance by 2018. Up until now, institutional investors have avoided the cryptocurrency market due to its relatively small size, the structure of mandates and volatility. But the times are changing as many companies are planning to offer Bitcoin investments. Even though the classification of cryptocurrencies varies by country, government and even application, all agree in giving Bitcoin a legal tender status while for tax purposes, it is treated as virtual currency as property. Well, this is exactly the definition used for investors to file for new cryptocurrency funds.

On August 11, a leading manager of gold-related investment funds filed for a bitcoin-related exchange-traded fund with the U.S. Securities and Exchange Commission. In the first quarter of 2017 the Winklevoss brothers saw their Bitcoin ETF refused by the SEC. Now VanEck filed with the SEC for an exchange-traded fund that would invest in Bitcoin futures contracts and trade on the Nasdaq. Derivatives like futures allow investors to bet on potential gains or losses in Bitcoin’s price without buying the digital currency itself. The fund will be an actively managed ETF seeking to a total return. Other firms have proposed digital currency trading products in the last several months.

In late April the SEC said it would review the Winklevoss brothers’ application for a Bitcoin ETF, but up until now the SEC has not commented on that and declined to comment on this recent filing.

Since then, the Chicago Board Options Exchange revealed in early August plans to offer Bitcoin futures as soon as the fourth quarter of 2017. The news followed the U.S. Commodity Futures Trading Commission’s approval for a digital currency trading platform LedgerX for clearing derivatives, which plans to offer Bitcoin options in early fall.

Ethereum is also receiving a lot of attention from financial groups. Bitcoin acts like virtual cash, Ethereum on the other hand, offers something much more complex; a platform that can run decentralized applications or Dapps and execute self-enforcing “smart contracts.” Ethereum uses its own currency called ether. The key function of ether is to facilitate and reward using the network.

For now, the Ethereum ecosystem is filled with unregulated ICO’s which are experiments that are most certainly going to fail. There is no doubt that we will be seeing the same interest in Ethereum from institutional investors.

For instance, one Swiss private bank will offer Ether to its clients from August 22. Arthur Vayloyan, Global Head Products and Services, explained that the decision to add three cryptoassets was down to the success of the Bitcoin service Falcon group introduced in July:

“We are pleased to add Ether, Litecoin, and Bitcoin Cash to our services just a month after introducing blockchain asset management solutions with Bitcoin, The first reactions to our Bitcoin services have been very encouraging, and we are convinced that by adding three new blockchain assets we will fulfil our clients’ future needs.”

Is Bitcoin the digital analogue of Gold? While many believe that Bitcoin will never surpass gold as a store of value, others see it stealing a lot of volume from the yellow metal. Experts believe it will take the price even higher. After hitting a peak above $4,300 on August 13, Ronnie Moas raised his price projection to $7,500. The Standpoint Research founder also claimed that a target of $50,000 by 2027 is viable.