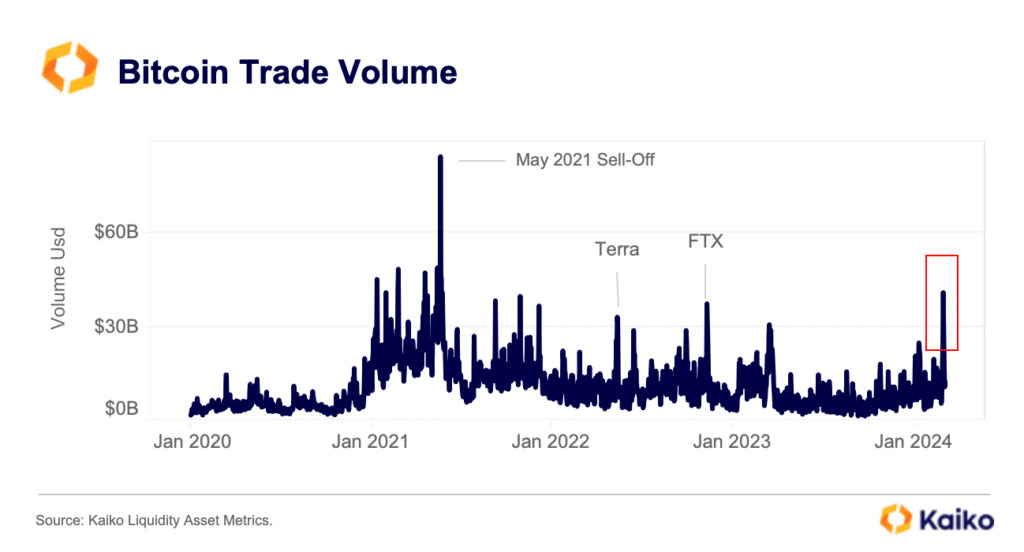

Bitcoin trade volume hits highest level since 2021, Kaiko says

Even though Bitcoin has not yet reached its all-time high, its daily trade volume has already exceeded $40 billion, the highest level since the May 2021 sell-off.

The daily trading volume of Bitcoin (BTC) has reached its highest level last seen in three years ago as BTC is continuously climbing to its all-time high, Kaiko revealed in a recent research report. According to the published data, Bitcoin’s daily trade volume exceeded $40 billion in early March, surpassing its previous peak hit in the aftermath of the FTX collapse in November 2022.

“Buying exceeded selling on most exchanges and trading pairs, with offshore platforms leading the way.” Kaiko

Analysts at Kaiko reveal that BTC saw net buying of nearly $1 billion since late February, while U.S. exchanges saw “significantly less buying activity.” Meanwhile, both BTC and ETH funding rates hit their highest levels since the approval of spot Bitcoin exchange-traded funds (ETFs) in early January suggesting rising demand for bullish leverage, the Paris-headquartered analytical firm added.

The heightened interest in Bitcoin’s price movement has led to significant liquidations, with total crypto liquidations surpassing $567 million in the past 24 hours. Short positions accounted for $316.83 million of liquidations, while long positions contributed $250.92 million.

Meanwhile, Wall Street investment giant BlackRock appears undeterred by the market volatility, as it recently filed a new application with the U.S. Securities and Exchange Commission to acquire even more Bitcoin ETFs. BlackRock’s fund, listed under the ticker symbol IBIT, currently dominates the market as the top-performing fund, with daily trading volume totaling $2.4 billion, representing approximately half of the total trading volume of spot Bitcoin ETFs.