What is a crypto bubble? Navigating the storm

What is a crypto bubble and how does it work? Discover their intricacies and explore their history and warning signs.

The crypto market appears to again be on the brink of new highs, with Bitcoin (BTC) recently smashing through the $64,000 mark for the first time since 2021. Yet, the often fleeting nature of these peaks has left experts and investors grappling with a pressing question: is there a crypto a bubble destined to pop?

While some assert the resilience of cryptocurrencies, others warn of an imminent crypto collapse.

In this article, we delve into the meaning of the term ‘crypto bubble’, dissecting its anatomy, exploring its parallels with traditional financial bubbles, and offering prudent strategies for investors navigating these uncertain waters.

Table of Contents

What are crypto bubbles?

Crypto bubbles represent a frenzied surge in cryptocurrency prices driven primarily by hype and speculation, far surpassing their intrinsic value.

Unlike traditional assets, most cryptocurrencies lack tangible assets or revenue streams, rendering their valuation a speculative endeavor that is vulnerable to market sentiment and hype.

Much like the dot-com bubble in the late 1990s or the housing bubble in 2008, crypto bubbles lure investors in with promises of astronomical gains, culminating in a sharp and potentially devastating collapse.

The parallels between crypto bubbles and their traditional counterparts are hard to ignore. Both are characterized by exuberance and euphoria, driving prices to dizzying heights, and fueled by the fear of missing out (FOMO) and speculative frenzy.

The absence of clear valuation metrics and the proliferation of new investment products often further exacerbate market volatility, echoing the patterns seen in past financial bubbles.

How does a crypto bubble work?

Below is how a typical crypto bubble works:

Initial hype and adoption: A new cryptocurrency, technology, or blockchain project gains attention due to its potential utility, innovative features, or promises to disrupt existing industries. This often leads to an initial surge in interest and investment as early adopters and enthusiasts buy into the idea.

Speculative investment: As more people become aware of the potential for high returns, speculative investors enter the market, hoping to profit from the rising prices. This influx of investment further drives up demand and prices, creating a positive feedback loop.

Media attention and FOMO: As prices continue to rise, mainstream media outlets and influencers on social media platforms start covering and pushing the crypto craze, attracting even more investors. Fear of missing out sets in, prompting people to invest hastily without fully understanding the technology or risks involved.

Irrational exuberance: Prices may then soar to unsustainable levels, often far exceeding the actual value or utility of the underlying assets. Here, greed may take over, and investors may disregard fundamental analysis to chase quick profits.

Peak and correction: Eventually, the bubble peaks as buying pressure subsides or negative news emerges. At this point, some early investors may begin to sell their holdings to realize profits, which could trigger a sell-off. As prices plummet, panic selling ensues, exacerbating the decline.

Bubble burst: The bubble bursts when prices collapse dramatically, wiping out significant portions of investors’ wealth. It can be triggered by various factors, such as regulatory crackdowns, security breaches, technological flaws, or simply a loss of confidence in the market.

Recovery and consolidation: After the bubble bursts, prices typically stabilize at a lower level as the market undergoes a period of consolidation. Surviving projects with strong fundamentals may eventually recover and continue to thrive, while weaker or fraudulent projects may fade away.

Examples of past crypto bubbles

Crypto bubbles have had a fascinating history since the debut of Bitcoin in 2009, with the coin witnessing numerous cycles of boom and bust. Market speculation, technological advancements, and regulatory influences often drove these fluctuations.

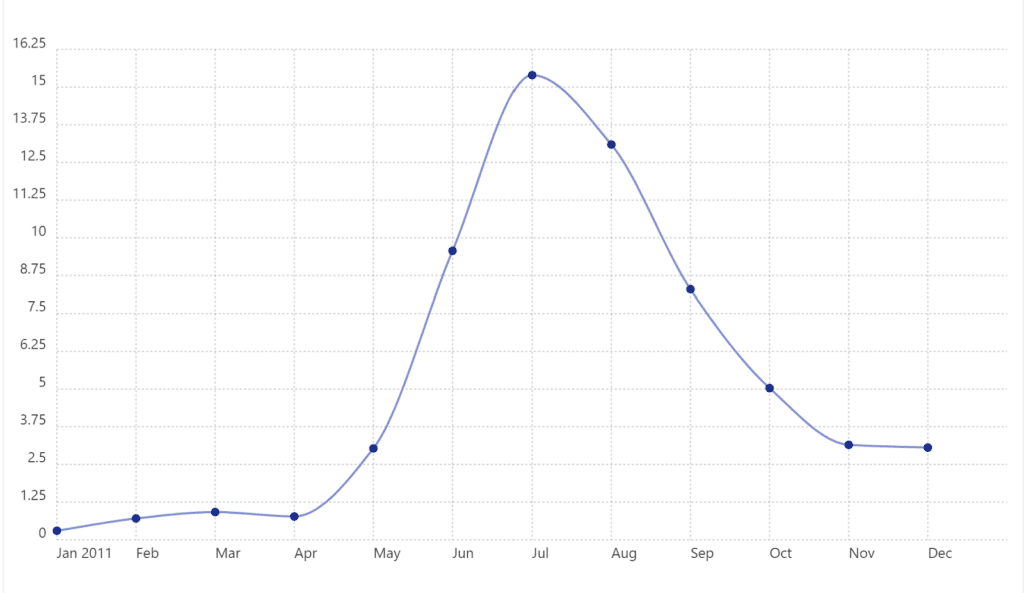

The first notable crypto bubble emerged during Bitcoin’s early days in 2011. The cryptocurrency’s price surged from a few cents to around $30 from April to June of that year. This sparked a frenzy of investment and media attention. However, the crypto bubble burst, causing Bitcoin’s price to plummet to single digits, resulting in significant losses for early investors.

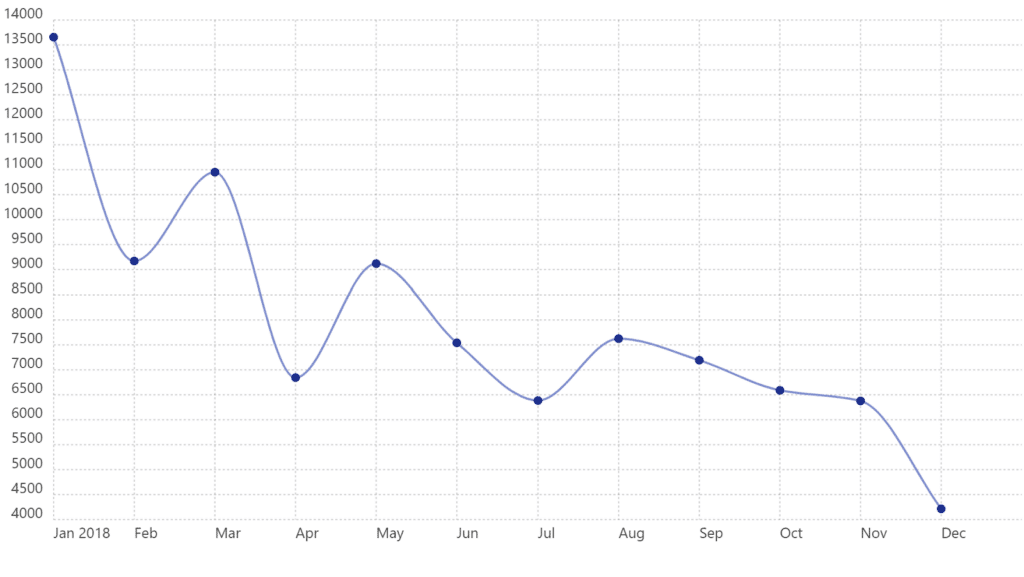

Another example is the infamous Bitcoin bubble of 2017, which is etched in the memories of many investors. BTC’s price soared to nearly $20,000 at the end of 2017, before crashing to around $3,000 within a year.

Around the same time, the crypto space was also experiencing the initial coin offering (ICO) bubble, where numerous cryptocurrencies were introduced through ICOs, often without tangible products or services. Many of these projects turned out to be scams, inevitably leading to a cryptocurrency crash and causing substantial losses for those who had bought into the hype.

Similarly, the altcoin bubble of early 2018 saw alternative cryptocurrency prices reach all-time highs, mainly driven by hype. However, by December 2018, many had lost nearly all their market value, once again causing significant losses for investors.

In 2021, non-fungible tokens (NFTs) gained widespread attention, with some selling for millions of dollars. However, the NFT bubble burst in 2022, with trading volume plummeting significantly.

In the same year NFTs were enjoying the limelight, Bitcoin went through another phase that many market watchers termed a bubble, surging to an all-time high of over $68,000 before undergoing a significant correction.

Warning signs for crypto bubbles

Detecting a crypto bubble isn’t an exact science, but there are clues to watch for.

One telltale sign is a sudden surge in price over a short period. Imagine the value of Ripple (XRP) or Solana (SOL) doubling or even tripling in just a matter of days or weeks — that kind of rapid growth often signals a bubble brewing.

Another warning sign is hype. Bubbles tend to inflate alongside a surge in public interest, attracting a flood of inexperienced investors chasing fast profits. If a cryptocurrency suddenly dominates social media feeds and headlines, accompanied by a lightning-fast price hike, it’s often a red flag for a potential bubble.

Below are some other key financial indicators to watch for that may indicate you’re in the midst of a crypto bubble ready to pop:

Volatility: Keep an eye out for wild price swings happening in short bursts. These extreme fluctuations suggest speculative trading rather than stable investment strategies.

High trading volume: When trading activity spikes along with sizable buy or sell orders, it could signal emotional rather than rational decision-making driving the market.

Market capitalization: If the total market value of cryptocurrencies skyrockets beyond what seems realistic based on adoption and utility, it’s a sign that things might be overheated.

Fear and Greed Index: Extreme readings on sentiment indicators like the Fear and Greed Index can indicate irrational market behavior driven by extreme optimism or pessimism.

Increased margin trading: Rising levels of margin trading and leverage in the crypto market can amplify gains and losses, indicating heightened speculative activity.

Preparing for the burst

As crypto bubbles come and go, prudent strategies are paramount for investors seeking to weather the storm. Here are some strategies you can follow that could potentially help investors come through a crypto bubble burst relatively unscathed.

Reduce exposure: Some experts advice that when investors see the warning signs of a bubble forming, as explained above, they consider selling off some of their crypto holdings. This may help mitigate potential losses and even turn a profit if done strategically.

Monitor the market: Stay informed about crypto news and market trends. Keeping your finger on the pulse of the industry could assist in making informed decisions and navigate the bubble with greater ease.

Seek expert advice: Consider consulting with experienced traders or financial advisors. Their insights could provide valuable guidance on how to navigate the turbulent waters of the crypto market.

Think long-term: While bubbles may be temporary, the potential of cryptocurrencies is long-lasting. Adopting a long-term mindset may aid in riding out the storm and possibly even emerging stronger on the other side.

Implement stop-loss orders: Consider setting up stop-loss orders to automatically sell your assets if prices dip below a certain threshold. These can help protect your investments during periods of market volatility.

Stay disciplined: Stick to your investment strategy and avoid making impulsive decisions based on emotions or short-term fluctuations. Discipline is key to weathering the storm of a crypto bubble.

Can investors profit from crypto bubbles?

While the allure of quick gains during a crypto bubble is enticing, it’s essential to tread cautiously. There are significant cryptocurrency bubble risks, including the potential for substantial losses.

Crypto bubbles are a cocktail of speculation, hype, and human psychology. They epitomize the volatile nature of the crypto market, characterized by rapid price fluctuations and speculative fervor.

However, it’s important to note that while crypto bubbles can lead to significant financial losses for investors, they also serve as learning experiences for the market as a whole. They highlight the importance of conducting thorough due diligence, understanding the underlying technology, and investing with a long-term perspective rather than succumbing to short-term speculation.

They can also serve as a reminder that it’s imperative to approach crypto investing with caution, armed with knowledge, and with a steadfast commitment to sound investment principles.

What are the signs of a crypto bubble?

Identifying the signs of a potential crypto bubble can be complex, as various factors influence market dynamics. However, some common indicators include rapid and unsustainable price increases across multiple cryptocurrencies, heightened speculative activity driven by fear of missing out (FOMO), excessive media coverage emphasizing quick profits, and a disconnect between valuations and the underlying fundamentals of projects.

What are the main risks of cryptocurrency bubbles?

Cryptocurrency bubbles pose several risks to investors and the broader market. One significant risk is the potential for substantial financial losses when prices inevitably correct after reaching unsustainable levels. Additionally, bubbles can lead to increased regulatory scrutiny and interventions, which may impact market liquidity and investor confidence. Moreover, bubbles can fuel fraudulent activities and scams, as opportunists use the hype to promote dubious projects.

Is Bitcoin a bubble?

Whether Bitcoin is in a bubble is subject to interpretation and debate. Like other cryptocurrencies, Bitcoin has experienced periods of rapid price appreciation followed by significant corrections, which some observers characterize as bubble-like behavior. However, others argue that Bitcoin’s long-term value proposition as a decentralized store of value and medium of exchange warrants its current price levels.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.