FTX saga: what happened to FTX and Sam Bankman-Fried in 2023

Explore the comprehensive breakdown of what happened to FTX in 2023: from Sam Bankman-Fried going to jail to his ex-girlfriend’s confessions.

The crypto industry has always been filled with captivating stories of massive success, overnight failures, notorious scams, and overwhelming frauds. However, few stories have impacted the world of cryptocurrency and finance as much as the rise and fall of FTX.

The FTX saga was unveiled under the leadership of Sam Bankman-Fried, a young entrepreneur who rapidly ascended to the upper echelons of the crypto world. It is a tale of ambition, innovation, and a dramatic downfall. In this article, we’ll explore the details of the FTX fraud, from its meteoric rise to its ultimate failure, resulting in the criminal conviction of Sam Bankman-Fried.

FTX’s rise and prominence

Bankman-Fried’s journey in the crypto world began in 2017 when he established Alameda Research, a quantitative trading firm. His successful ventures in Bitcoin (BTC) arbitrage in 2018 provided the capital and experience to launch FTX in 2019.

FTX soon became a titan in the crypto exchange industry, poised to take over Binance as the market leader. The popularity of the exchange was sky-high, with celebrities like American football star Tom Brady endorsing it and the historic American Airlines Arena changing its name to the FTX Arena in 2019. Bankman-Fried, an MIT graduate and a former quantitative trader, became the face of FTX and a poster child for the entire crypto industry.

By 2021, FTX had established itself as the third-largest crypto exchange by volume, an impressive feat in an industry characterized by intense competition and rapid innovation. The platform boasted over 1 million customer accounts, underscoring its widespread acceptance and trust within the crypto community. FTX’s growth was not limited to its core exchange operations. Bankman-Fried also launched a $2 billion venture fund to seed other crypto firms and startups, further expanding the company’s influence in the sector.

FTX moved its headquarters from Hong Kong to the Bahamas in September 2021, purchasing a significant office complex and investing heavily in local properties. The move coincided with the company’s aggressive marketing and sponsorship campaigns, including high-profile sports sponsorships such as the Miami Heat’s NBA arena and Formula 1 race cars.

Bankman-Fried’s influence extended beyond the business side of crypto and into the political arena. He became a prominent donor to the Democratic Party in the U.S., seeking to shape the legislative landscape of the cryptocurrency industry by advocating for favorable regulatory environments for crypto enterprises.

How FTX collapse began

The downfall of FTX began to materialize in early 2022, marked by a series of troubling revelations and financial missteps.

Alameda Research was initially a quantitative trading firm but had become deeply intertwined with FTX. The crux of the problem lay in Alameda’s significant holdings of FTX’s native token, FTT. This interdependence raised questions about both entities’ solvency and financial practices, particularly regarding the use of customer funds.

When the crypto market experienced turbulence in spring 2022, driven by the collapse of Terra LUNA and its stablecoin, UST, Bankman-Fried attempted to position himself as a savior of the industry. FTX provided financial assistance to struggling firms, like Voyager Digital and BlockFi. These actions, while initially viewed as a stabilizing force, would later be scrutinized for their role in the broader financial troubles that engulfed FTX.

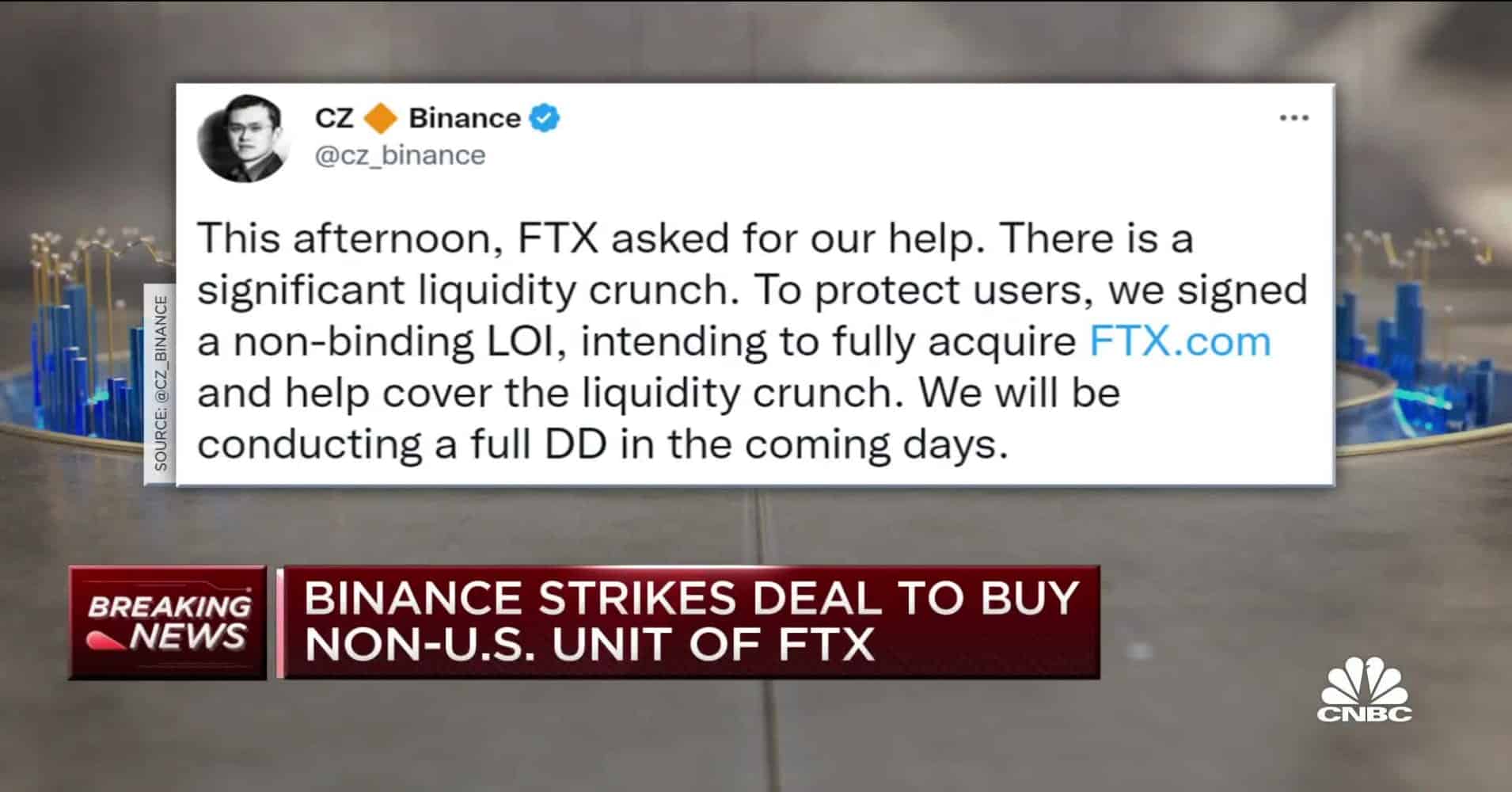

The unraveling accelerated in November 2022 when reports emerged that FTX had allegedly transferred substantial customer deposits to Alameda Research. These transfers, purportedly backed by FTT tokens and shares in trading company Robinhood, raised serious concerns about the misuse of customer funds and the overall financial stability of FTX.

The situation reached a tipping point when Binance decided to liquidate its holdings in the token, triggering a sharp sell-off in FTT. The resulting liquidity crisis at FTX led to a flood of customer withdrawal requests, which the exchange struggled to fulfill. Ultimately, the revelation of these financial irregularities and the ensuing liquidity crisis precipitated the collapse of FTX and Alameda Research.

FTX’s bankruptcy filings and legal implications

FTX and Alameda Research declared bankruptcy in November 2022 as the crisis unfolded. The bankruptcy filings revealed a chaotic and financially unsound environment within FTX, with court documents suggesting that the company owed over $3 billion to its top 50 creditors. Newly appointed CEO John Ray III, overseeing the bankruptcy process, stated that he had never seen “such a complete failure” of corporate controls in his career.

Amidst the bankruptcy of FTX, a hacker stole around $477 million worth of funds from the exchange and began laundering it through various means. Additionally, Bahamian securities regulators seized some of FTX’s assets, adding to the complexity of the legal battles over the exchange’s remaining assets.

The collapse also had an immediate and profound impact on the crypto ecosystem, triggering a significant decline in the prices of major cryptocurrencies, including Bitcoin and Ethereum (ETH). The industry faced a crisis of confidence, with questions arising about the safety of customer funds and the need for more robust regulatory oversight in the crypto market.

Sam Bankman-Fried’s legal troubles

In December 2022, the narrative around the FTX saga took a decisive turn as Sam Bankman-Fried was arrested in the Bahamas, where he lived and where the exchange was based. This marked the beginning of a series of legal proceedings that would see him facing serious charges.

Following his arrest, Bankman-Fried agreed to be extradited to the U.S. and subsequently appeared in a Manhattan federal court. The court granted him release to home detention at his parents’ home in Palo Alto, California, on a $250 million bond.

Sam Bankman-Fried’s trial in 2023

The charges against the FTX founder included several fraud and conspiracy allegations related to the operation of the exchange and Alameda Research. On Jan. 3, 2023, Bankman-Fried pleaded not guilty, subsequently a trial was scheduled for October 2023.

The lead-up to the trial saw several key developments. In February 2023, Nishad Singh, the former director of engineering at the exchange, pleaded guilty to fraud charges and agreed to cooperate with prosecutors. Following this, other key figures like the exchange’s co-founder Gary Wang and Alameda CEO Caroline Ellison also pleaded guilty.

This cooperation added pressure on Bankman-Fried and potentially provided the prosecution with valuable inside information. In August 2023, the court revoked the former FTX leader’s bail after finding probable cause to believe he tampered with witnesses, resulting in his remand to Brooklyn’s Metropolitan Detention Center pending trial.

The trial of Bankman-Fried began on Oct. 3 and saw him stand before the jury with seven different fraud and money laundering charges. The trial featured testimonies from various witnesses, including those who had previously pleaded guilty to related charges. The defendant himself testified in his defense. He focused on the argument that the FTX collapse resulted from broader downturns in the crypto markets rather than deliberate fraud or mismanagement.

A pivotal testimony came from Caroline Ellison, the former CEO of Alameda Research and Bankman-Fried’s ex-girlfriend, who detailed the financial intertwinings and irregular practices between FTX and Alameda Research. Ellison’s testimony revealed Alameda had an unlimited line of credit with the exchange, which ultimately came from customer funds.

Nishad Singh revealed how Bankman-Fried could use customer funds and debts for political lobbying and celebrity endorsements. There were also several testimonies about how FTX co-founder Garry Wang, Nishad Singh, and Caroline Ellison took large-scale loans from the exchange for property purchases and personal expenses.

The trial also heard from financial regulation and cryptocurrency experts, who provided context on the industry standards and the extent to which FTX’s practices deviated from the norms. These testimonies played a crucial role in illustrating the broader implications of FTX fraud for the cryptocurrency market and financial regulation.

After a five-hour deliberation, the jury found Bankman-Friend guilty of all seven charges he faced. His sentencing is set to commence in late March 2024, he faces a maximum of 110 years in prison.

Will FTX 2.0 happen?

In the aftermath of the original exchange’s collapse, the concept of FTX 2.0 is actively being explored under the leadership of John Ray III. This initiative is still in its formative stages, with Ray and his team focusing on various aspects of restructuring and relaunching the exchange. Court filings from May 2023 revealed that Ray has been engaged in several meetings to discuss the structuring and restarting of the exchange, along with finalizing the materials necessary for this reboot. These developments suggest a proactive approach towards resurrecting FTX in a new avatar.

Despite these efforts, the exact details and timeline for the launch of FTX 2.0 remain uncertain. There have been mentions of a bidding process as part of the reboot strategy, indicating that the relaunch might involve new stakeholders or investors. As of now, FTX and its debtors have agreed with Bahamian liquidators to launch a settlement agreement for its customers.

Consequences of FTX collapse

The FTX collapse stands as a profound moment in crypto history. Bankman-Fried was once celebrated for his innovative vision for crypto, and the exchange was widely trusted not just by general users, but by giant corporations, celebrities, professional investors, and politicians. Some experts think that the scandal erased years’ worth of trust and credibility from the crypto sector that other organizations worked hard to establish.

The story of FTX’s rise and fall serves as a cautionary tale about the importance of transparency, ethical practices, and robust financial oversight in the crypto industry. As the market and its participants reflect on these events, the lessons learned will undoubtedly shape the future trajectory of the crypto industry.

Key events and dates in the FTX saga

- Nov 2022: FTX’s collapse, bankruptcy filings, and the revelation of financial mismanagement and misuse of customer funds.

- Dec 12, 2022: Bankman-Fried’s arrest in the Bahamas.

- Dec 21, 2022: Bankman-Fried extradited to the U.S.

- Jan 3-12, 2023: Bankman-Fried pleads not guilty, his trial is set for October.

- Feb 28, 2023: Nishad Singh, former FTX director of engineering, pleads guilty to fraud charges.

- Aug 11, 2023: Bankman-Fried’s bail is revoked due to witness tampering allegations.

- Oct 3, 2023: The trial begins.

- Oct 28, 2023: Bankman-Fried testifies in his defense.

- Nov 2, 2023: The jury finds him guilty on all seven charges.

FAQs

What happened to FTX customers?

FTX customers faced significant financial losses as the platform became insolvent and filed for bankruptcy, leading to frozen accounts and inaccessible funds. Customers are still awaiting settlement, but the exchange has recently agreed on a settlement plan.

What happened to FTX investors?

FTX investors experienced substantial losses due to the collapse of the exchange, as the value of their investments plummeted following the revelation of financial mismanagement and subsequent bankruptcy proceedings.

What happened to Sam Bankman-Fried?

Sam Bankman-Fried was arrested in December 2022 on fraud and conspiracy charges related to the collapse of FTX and was found guilty of all charges in November 2023. His sentencing is set for mid-March 2024.