What happened to Terra Luna: one year after collapse

In May 2022, the crypto community was shattered by the crash of the Terra ecosystem. One year after, we are reconstructing the events, from luna’s depeg to Terraform CEO Do Kwon becoming a criminal.

Terra and its sibling token LUNA have charted a rollercoaster journey across the crypto universe one year after its catastrophic crash. Their breathtaking highs, profound lows, and now indications of resurgence have kept observers on edge.

Do Kwon, the visionary architect of this cosmos, has himself navigated a whirlwind path. He has been exalted, vilified, and mysteriously disappeared, only to reappear in the most unlikely places.

Terraform Labs, an ambitious project rooted in blockchain technology, was the brainchild of Do Kwon, a Stanford University graduate with experience at Apple and Google.

The lab aimed to create a decentralized finance network using TerraUSD (UST) and Luna (LUNA) tokens. UST was designed to be an algorithmic stablecoin, maintaining a steady value of 1 USD, backed up by the floating rate cryptocurrency Luna.

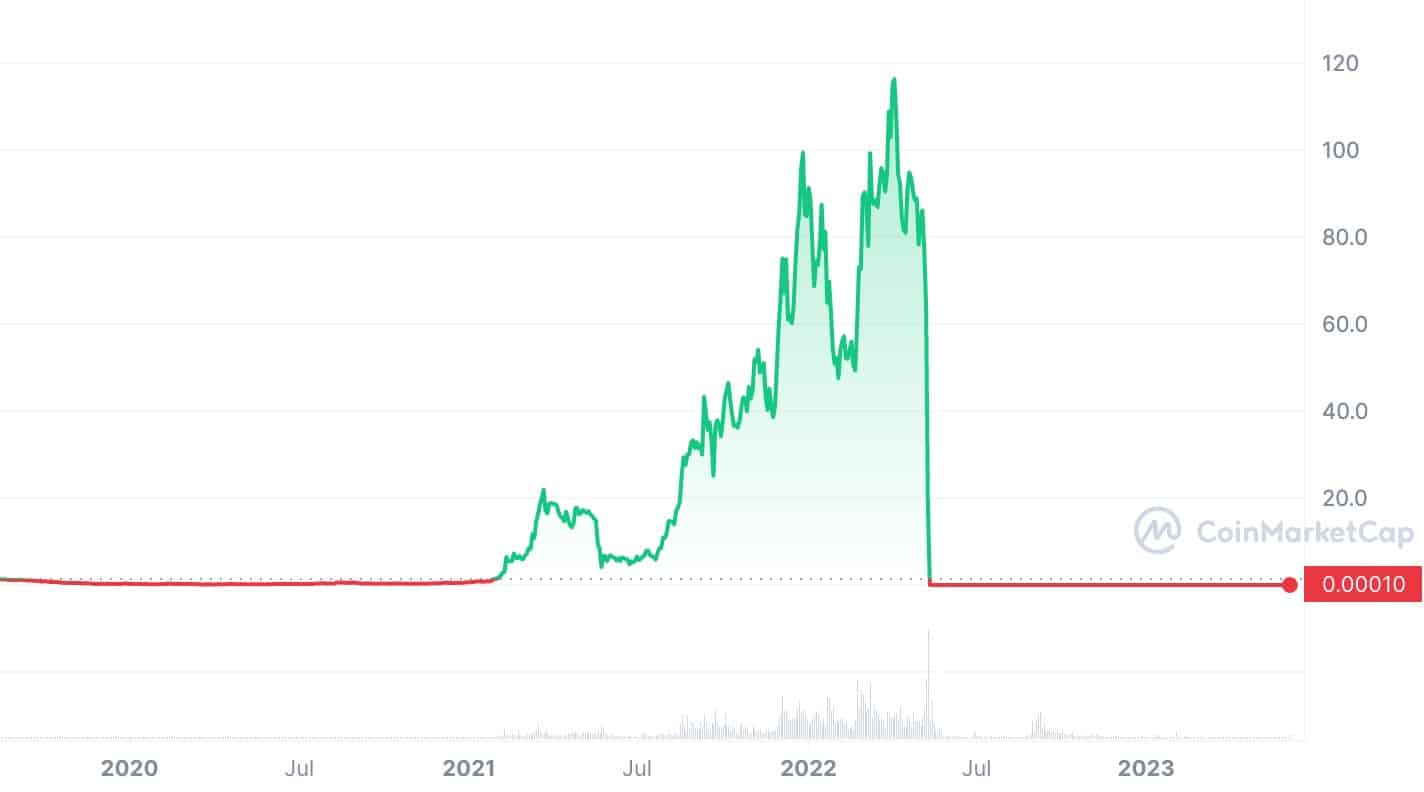

By March 2022, Luna soared to an all-time high of nearly $120 a token, creating a dedicated fandom that dubbed themselves ‘lunatics’ with Kwon as their ‘king.’

But this crypto utopia was short-lived, and by May 2022, Terra and Luna crashed spectacularly. The media was divided on whether to label it a Ponzi scheme or a rug-pull scam.

What is Terra LUNA

The Terra ecosystem’s core was a dynamic equilibrium between UST and Luna. Theoretically, one UST token would always equal $1 of Luna, and the two could be freely exchanged.

To maintain this peg, smart contracts were employed to reduce the quantity of the sold token and increase that of the bought token.

However, this system’s genius and Achilles’ heel lay in its underlying mechanics. If the price of UST fell below $1, traders would buy it for less and swap it for $1 worth of Luna tokens, effectively making a profit.

The smart contract would then reduce the amount of UST and increase Luna tokens, thus driving the UST price back to $1. Conversely, if UST rose above $1, the process would reverse.

Anchor Protocol and Luna Foundation Guard (LFG)

Further support for UST’s stability came from the Anchor Protocol, which offered attractive interest rates of around 20% on UST deposits, which was reduced to about 18% just days before the crash.

Meanwhile, Luna Foundation Guard (LFG), an organization founded by Kwon, had been buying bitcoin (BTC), amassing a substantial holding of $1.5 billion in BTC and other cryptocurrencies.

With an ambitious plan to acquire up to $10 billion worth of bitcoin, the LFG presented a good safety net for the flailing Terra and Luna ecosystems.

However, despite such an impressive safety net, Luna’s value remained volatile and uncertain. The value of UST was intrinsically tied to LUNA. But what was Luna’s value based on? The short answer: faith.

Why did Terra LUNA crash

The catastrophic collapse of Luna and UST on May 7, 2022, was a series of unfortunate events that started with an unprecedented unstaking of UST. Over $2 billion worth of UST was rapidly taken off the Anchor Protocol, causing a cascading effect that would ultimately lead to the downfall of both UST and Luna.

As a significant portion of the unstaked UST got liquidated, the value of UST fell below its peg, dipping to $0.91 from its stable $1. This devaluation sparked a frenzy among traders who, seizing the opportunity, started exchanging 91 cents worth of UST for $1 worth of Luna.

This arbitrage opportunity, created due to the depegging of UST, led to more UST being sold, causing further devaluation.

The panic selling of UST led to an excessive minting of Luna, resulting in an unexpected surge in Luna’s circulating supply. The over-supply, coupled with the under-demand, caused a sharp decline in the value of Luna.

The situation worsened when crypto exchanges started delisting Luna and UST pairings in response to the depegging and the freefall of Luna’s value. This move effectively stranded Luna, leading to its abandonment as it became virtually worthless.

In this scenario, one might expect the LFG to step in, selling off their bitcoin holdings to buy Luna, stabilizing the market. However, this had two significant drawbacks: selling bitcoin could pressure the price of bitcoin and other cryptocurrencies, and the funds in the LFG’s war chest were limited. If the LFG sold all its bitcoin, it couldn’t support Luna and UST.

Terra Classic and LUNA 2.0: a tale of two chains

In the aftermath of the UST/LUNA crash, Terraform Labs underwent a significant transformation, creating two distinct blockchains: Terra Classic (LUNC) and LUNA 2.0 (Terra 2.0).

While necessary for the recovery plan, this separation created a dynamic interplay between two versions of Terra’s native token, each with unique features and potential.

What is Terra Classic

Terra Classic, or LUNC, is the rebranded version of the original Terra LUNA coin, associated with the old chain now known as Terra Classic. Established after creating a new chain’s genesis block on May 28, 2022, LUNC carries the legacy of the original Terra Luna coin into this new phase.

Much like its predecessor, LUNC serves as the stabilizing mechanism for Terra Classic’s stablecoin, TerraUSD (UST). Despite the new branding, the core functionalities of LUNC remain unchanged, ensuring continuity in the Terra Classic ecosystem.

As of June 5, LUNC trades at $0.0001, boasting a circulating supply of nearly 5.85 trillion and a market cap of $586 million.

Earlier in the past, Terra Classic’s governance passed a proposal to impose a 1.2% tax on each LUNC transaction. This move is part of an extensive LUNC burn strategy aimed at reducing the circulating supply of LUNC.

Terra LUNA 2.0

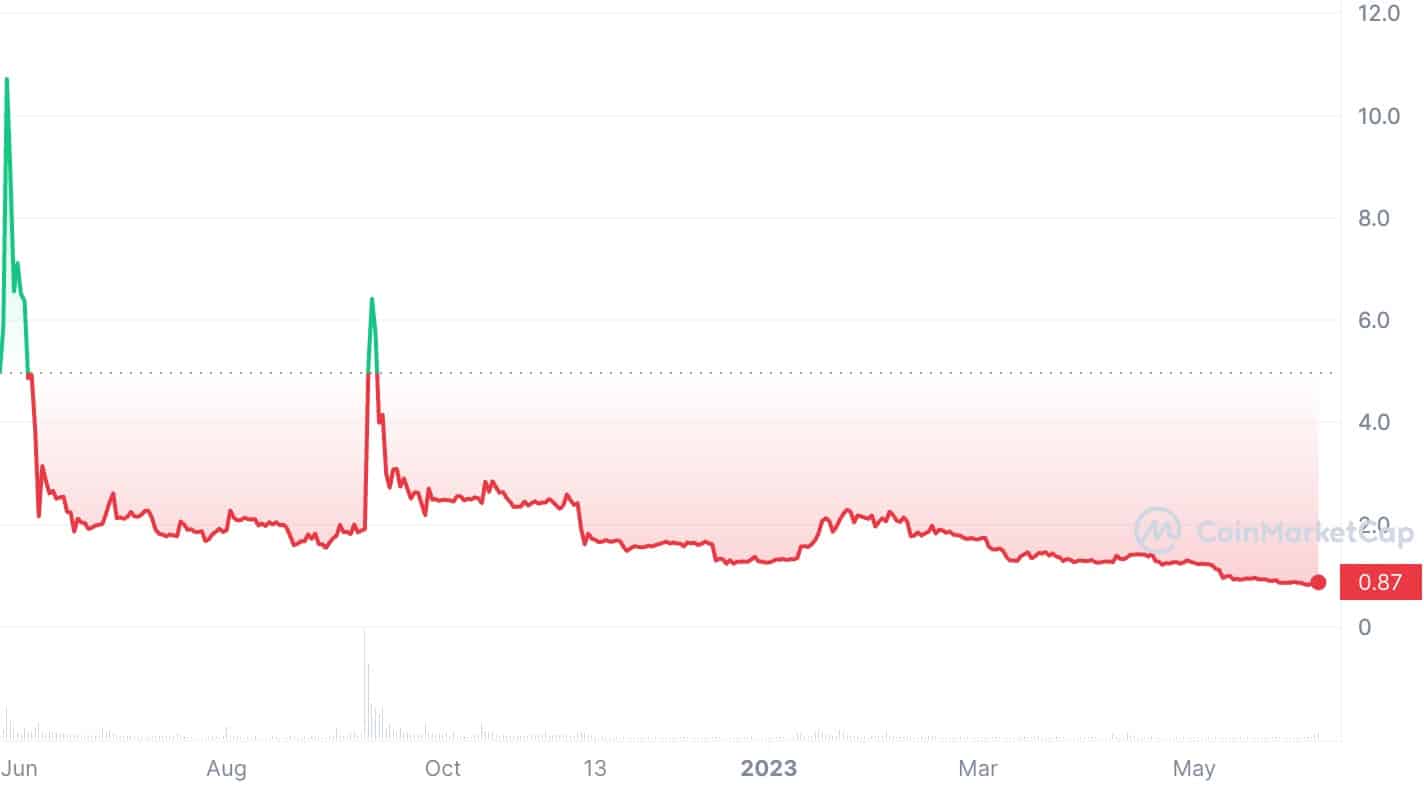

LUNA 2.0 operates via a proof-of-stake (PoS) consensus mechanism, with 130 validators participating in network consensus at a given time.

The voting power of these validators is determined by the amount of LUNA 2.0 tied to each node. Grants are rewarded by gas fees and a 7% fixed annual LUNA 2.0 inflation rate.

LUNA 2.0 token holders can participate in consensus by delegating tokens to a validator. The rewards for delegates vary depending on the voting power of their chosen validator.

As of June 5, LUNA trades at $0.87, boasting a circulating supply of nearly 283 million and a market cap of $245 million.

The distinct paths of Terra Classic and LUNA 2.0

Terra Classic and LUNA 2.0, while originating from the same root, follow distinct paths.

LUNA 2.0, as the new version, focuses on new decentralized applications (dApps), development efforts, and overall utility. It does not, however, include an algorithmic stablecoin. LUNA Classic, on the other hand, retains sizable traits of the old chain despite the split.

In conclusion, separating into LUNA Classic and LUNA 2.0 is a critical chapter in Terra’s story. It represents a technical split and a community support and development focus bifurcation.

As both chains evolve, the crypto world will watch the outcomes, their implications for Terraform Labs, and the broader lessons for blockchain technology and decentralized finance.

Where is Do Kwon and what happened to him

Following the catastrophic failure of Terraform Labs and the collapse of the Luna and TerraUSD cryptocurrencies, the life of founder and ex-CEO Do Kwon has been tumultuous, marked by legal challenges and international intrigue.

In April 2022, with the collapse of the two digital currencies imminent, Kwon departed for Singapore, leaving behind a trail of financial devastation.

It’s estimated that around 200,000 investors suffered significant losses, with the entire ecosystem crashing from $60 billion to ashes.

Kwon was not to be found in the wake of this financial disaster. He became an international fugitive, with the Interpol issuing a red notice for alleged fraud and financial crimes connected to the collapse of Luna and TerraUSD.

Kwon’s trail led investigators to Serbia, where he established a new firm. However, the law finally caught up with him in the neighboring country of Montenegro.

On March 23, 2023, Montenegrin authorities arrested Kwon and another South Korean citizen, identified by the surname Han, while attempting to board a flight to Dubai using Costa Rican passports. Han Chang-Joon is believed to be Terraform Labs’ former Chief Financial Officer.

Kwon, under his full name Kwon Do-Hyung and Han were charged with using forged personal documents. The local court in Podgorica set bail for each at 400,000 euros ($437,000). However, it was later revoked by the court.

Despite their legal predicament, both men pleaded not guilty to the charges. Meanwhile, Seoul and the United States authorities sought Kwon’s extradition in connection with the Terraform collapse.

Yet, before any potential extradition could occur, Kwon’s legal journey in Montenegro is needed to reach its conclusion.

As per the statements of his Montenegrin lawyer and the country’s justice minister, Kwon would first have to stand trial for traveling on fake documents. He could face up to five years in prison in Montenegro if found guilty.

Amid these legal proceedings, Kwon made a surprising move. He remained silent when asked about his financial assets and how he intended to pay the bail. Instead, he stated that his wife, co-owner of a $3-million apartment in South Korea, would handle his bail.

This move fueled suspicions that Kwon might have hidden large amounts of money obtained from the alleged crypto fraud.

Currently, Do Kwon remains in Montenegro under police surveillance, facing the consequences of his actions. His journey from being the head of a promising blockchain firm to becoming an international fugitive is a stark reminder of the risks and the potential fallout within the volatile world of cryptocurrencies.

A cautionary tale for the crypto world

Beyond the immediate stakeholders, the saga of Terra and Do Kwon serves as a cautionary tale for the broader crypto world. It underlines cryptocurrencies’ inherent volatility and unpredictability, the potential for mismanagement and fraud, and the consequent legal implications.

As crypto evolves and matures, stakeholders must learn from such instances. This includes building more robust stabilization mechanisms for cryptocurrencies, implementing better governance structures, and ensuring greater transparency and accountability in the operation of blockchain firms.

The future of Terra, Luna, and Do Kwon is still unwritten, but the lessons learned from their journey will undoubtedly shape the road ahead for the broader crypto world.