Bitcoin’s Rising Hash Power Suggests High Interest In Pioneer Cryptocurrency

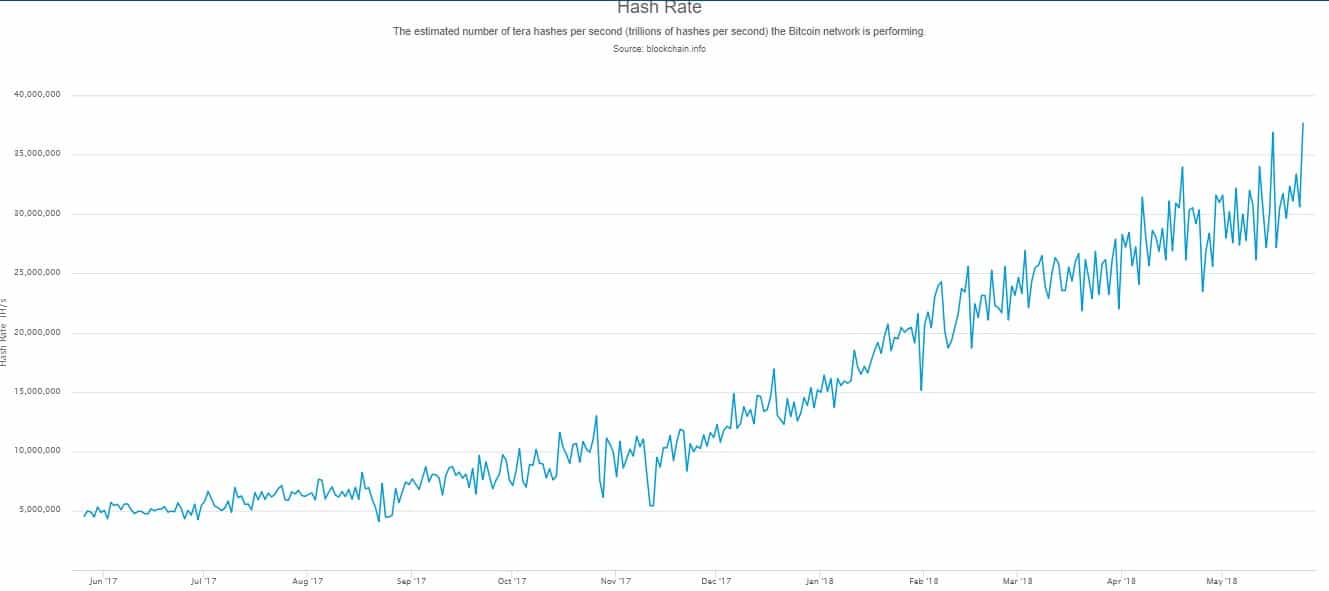

Since bitcoin’s impressive price rise in December 2017, which saw the world’s first digital asset touch $20,000 on some exchanges, the cryptocurrency market has undergone a slow bleed in value, falling to a total market cap of $300 billion in March 2018 as opposed to $800 billion in December 2018. However, Bitcoin mining statistics continue to suggest a positive sentiment for the virtual currency.

Miners Bullish on Bitcoin

According to a report on May 25, 2018, the Bitcoin blockchain is experiencing a surge in the number of miners maintaining the network, regardless of the plunging prices. While the statistics may not equate to a bull run anytime soon, it is indicative of the rising number of individuals, organizations, and mining pools interested in keeping the network running.

The trading charts for bitcoin currently provide a grim outlook, with most traders depending on a thorough technical analysis before entering a trade. But, miners can be classified under “fundamental” investors, who evaluate several governing factors before investing their resources.

With this in mind, it is understandable that a large part of the market would not expend their computing resources, electricity, and time, in an asset they don’t ascertain a long-term outlook for.

Increasing Hashrate. Source: Blockchain

Thus, bitcoin’s short-term downtrend is apparently doing little to miners, and the strong network support may serve to provide relief to concerned investors.

Undeniably an essential part of Bitcoin’s ecosystem, miners work together to unlock new blocks, verify and confirm transactions, and ensure the network’s security.

Centralized Mining Pools Incite Concerns

Notwithstanding the network activity, the presence of increasing hashrates fails to provide a quantitative figure for the number of miners entering the network. By all means, it could be possible that the existing entities are expending more of their resources, in an ultimate bid to increase their profits.

As reported on BTCManager after the launch of Bitmain’s ETHash ASIC miner, Ethereum’s developer community expressed its concerns on GitHub and wondered if this move would make GPU mining obsolete and if it could lead to the centralization of miners.

Due to the mining power of ASICs, industry observers believe that adopting the powerful miners leads to centralization of mining pools to large operations, which might misuse their power and repel individuals from setting up their private mining units.

Furthermore, as the mining difficulty increases – due to ASICs – mining rewards for those using weaker systems dramatically decreases, leading to a loss of incentive for individuals to fully implement the “decentralized” ethos.