Bitfinex’s Tether tokenized bond faces investment shortfall

Bitfinex’s newly introduced Tether tokenized bond, initially celebrated as the start of a “new era for capital raises,” has fallen short of attracting the expected level of investment and interest.

Bitfinex Securities, a platform specializing in the listing of tokenized real-world assets (RWA), announced the launch of its first tokenized bond, ALT2611, in October, with the new offering made available to the public on Nov. 15.

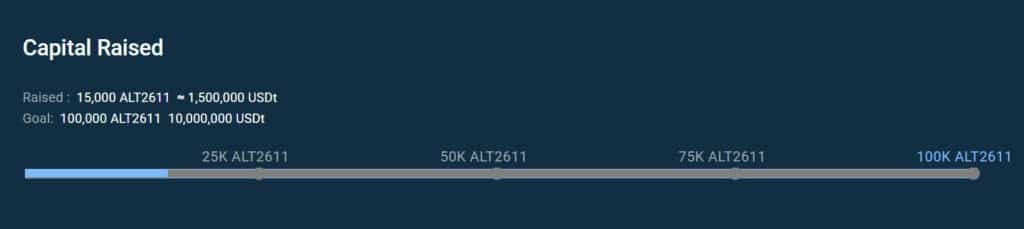

Yet, following a two-week offering period, the official website indicates that only $1.5 million has been raised, falling short of the $10 million target.

The target of 100,000 ALT2611 worth 10 million USDT was set for two weeks after launch in the announcement, but it appears to have been extended by another fortnight, with just 15,000 ALT2611, or 15% of the target reached so far.

The ALT2611 bond is a 36-month bond with a 10% coupon, denominated in USDT. It is issued by Alternative, a Luxembourg-based securitization fund managed by Mikro Kapital.

The bond’s minimum initial purchase size was set at 125,000 USDT, with secondary market trading allowed in denominations of 100 USDT.

Tokenized bonds represent a digital version of traditional bonds issued on a blockchain. They offer several benefits over paper bonds, including enhanced liquidity, accessibility, security, transparency, and the possibility of trading around the clock.

Notably, the ALT2611 bond is not available to American citizens or persons residing in the United States. The Security Note will be governed by and construed in accordance with the laws of the Grand Duchy of Luxembourg.

The bond’s launch was initially met with optimism, with Paolo Ardoino, Tether’s chief technology officer, describing it as heralding a “new era for capital raises,” with the expectation that USDT would become a key asset in this emerging financial system.

The bond is issued on the Liquid Network, a Bitcoin sidechain designed for rapid and compliant settlement of digital assets and tokenized securities.

However, the underwhelming response to Bitfinex’s first USDT bond issue has drawn criticism from some quarters.

Crypto trader Novacula Occami commented, “Bitfinex’s first USDT bond issue is a flop,” before adding, “Sorry Paolo, USDT ain’t going to dominate capital markets. BitFinex Securities Kazakhstan isn’t keeping investment bankers up at night.”

The latest development comes in the wake of Bitfinex addressing a phishing attack earlier in November. The exchange described the incident as a “minor information security incident” in a blog post, confirming that no funds were lost.

The attack targeted customer accounts through a phishing attempt on a Bitfinex customer support agent. Following this, the exchange has been working on enhancing its security measures.

Concurrently, the UK Financial Conduct Authority issued a warning against Bitfinex for unauthorized promotion of financial services and products.

As the extended offer period for the ALT2611 bond continues, the crypto community watches closely to see if Bitfinex can turn the tide and meet its investment target.