BNB Chain retains position as most active network

According to Nansen’s most recent monthly figures, the BNB Chain remains the dominant blockchain regarding user activity.

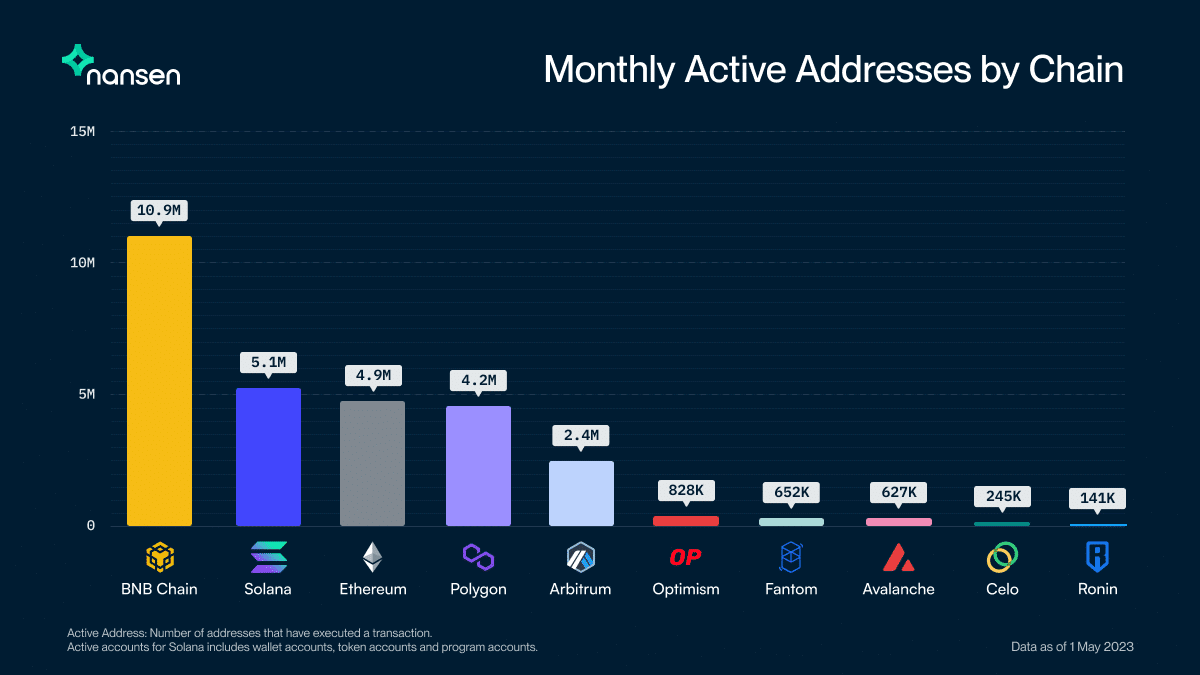

Data from blockchain research firm Nansen shows that over April, there were 10.9 million active wallet addresses on the BNB Chain.

Per Nansen, although BNB Chain registered the highest number of active network users in April, its month-on-month numbers decreased by about 11%.

Despite the drop, the number of operational addresses on the BNB Chain was still twice as many as those of the next most active network, Solana (SOL).

Combining its wallet, token, and program accounts, Solana had about 5.1 million active users, about 200,000 more than Ethereum (ETH), which came in third with 4.9 million operational addresses.

Other blockchains that registered over a million active addresses in April include Polygon (MATIC), with 4.2 million wallets making transactions, and Arbitrum (ARB), which had 2.4 million active users.

According to Nansen, BNB Chain’s heightened address activity was primarily pushed by Polyhedra, LayerZero, and Stargate Finance, which had a combined 300% increase in users on BNB Chain.

The NFT project Mad Lads, STEPN, and the Raydium Protocol drove Solana’s numbers.

Meanwhile, the highest number of on-chain transactions on Ethereum came from the Pepe (PEPE) meme coin community. Since its inception in mid-April, PEPE’s value has skyrocketed dramatically, and it has consistently been a trending topic on social media.

BUSD activity at a two-year low

However, despite BNB Chain’s dominance of on-chain activity, another product connected to Changpeng Zhao’s crypto empire isn’t doing well. The Binance-branded stablecoin Binance USD (BUSD) has seen its traffic plummet since regulators started targeting it.

According to data firm Glassnode, the number of addresses sending and receiving BUSD is at a two-year low.

BUSD activity has decreased since its maker, Paxos, received a Wells notice from the U.S. Securities and Exchange Commission (SEC) in February.

Following the regulator’s listing of BUSD as an unregistered security, Binance converted roughly $1 billion worth of the stablecoin held in its Industry Recovery Initiative fund into bitcoin (BTC), ETH, and BNB.

The crypto exchange delisted several BUSD pairs, including perpetual contracts for STEPN, Near Protocol (NEAR), and Avalanche.