BTC whale activity declines amid extremely greedy market conditions

The daily Bitcoin (BTC) whale activity has declined while the market weathers extremely greedy sentiment.

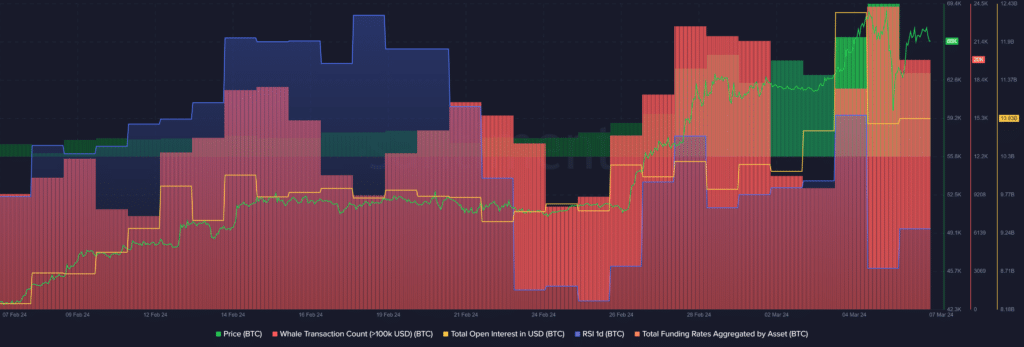

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of BTC declined by 17.5% in the past 24 hours — falling from 24,313 to 20,048 unique transactions per day.

The decline in whale activity comes as the Bitcoin price recorded a 0.6% drop over the past 24 hours. The flagship cryptocurrency is trading at $66,750 with a $1.31 trillion market cap at the time of writing.

Moreover, Bitcoin’s 24-hour trading volume plunged by 42%, currently hovering around $59 billion.

Data from CoinMarketCap shows that the market is still in the middle of extremely greedy conditions, with the fear and greed currently indicator standing at 88. Notably, Bitcoin recorded a new all-time high of $69,170 on March 5 when the greed index was at the 90 mark.

According to Santiment, Bitcoin’s total open interest (OI) increased from $10.76 billion to $10.83 billion in the past 24 hours. The asset’s total funding rate, however, declined from 0.08% to 0.04% over the past day.

The indicator shows that Bitcoin’s total OI might have increased with short positions and the amount of trades betting on a price decline has risen.

According to data from Coinglass, Bitcoin faced over $80 million in liquidations in the past 24 hours — $50.88 million in longs and $28.93 million in shorts.

Moreover, Bitcoin’s Relative Strength Index (RSI) rose from 73 to 76 over the past day. This shows that the flagship digital currency is hovering in a highly volatile zone and high price fluctuations would be expected.

For Bitcoin to stay bullish, its RSI would need to cool down below the 60 mark. An RSI of lower than 50 would mean that BTC’s price volatility has declined.