Buterin uncovers another hidden gem? Meet RAI stablecoin that is not pegged

Vitalik Buterin — an Ethereum (ETH) co-founder known to uncover hidden crypto gems before they reach widespread attention — may have brought yet another hidden gem to our attention.

Buterin interacted with Rai Reflex-Index (RAI) — a stablecoin that is not pegged to any other asset. Its inner workings point to it being a very original decentralized finance (DeFi) market offering.

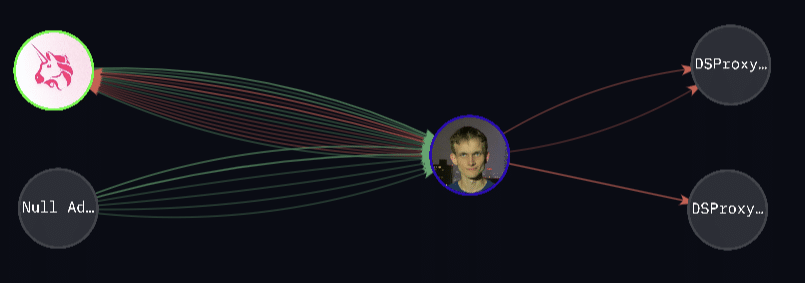

The ethereum co-founder first interacted with the RAI token about one year ago. Since then, he has signed 25 transactions involving this asset worth $5.44 million.

Most of Buterin’s interactions with RAI follow one pattern. Newly minted RAI are transferred to his wallet and then swapped for another token — often partly decentralized stablecoin DAI. This is in line with the suggested function of RAI, which, according to an official explainer, “can be used as collateral for a pegged coin.”

What is RAI stablecoin?

RAI is based on old ideas behind the DAI stablecoin, initially described in the DAI purple paper. RAI is not pegged to any other asset. Still, it leverages a system meant to delay most of the volatility its collateral is subjected to through a so-called reflex index. This system replaces the savings account that is employed by DAI and removes the savings rate that results in stablecoin holders earning interest.

In their whitepaper, the RAI team writes that reflex indexes are “a new asset type which will help other synthetics flourish and establish a key building block for the entire decentralized finance industry.” The paper explains:

“A reflex index’s purpose is not to maintain a specific peg, but to dampen the volatility of its collateral. Indexes allow anyone to gain exposure to the cryptocurrency market without the same scale of risk as holding actual crypto assets. We believe RAI, our first reflex index, will have immediate utility for other teams issuing synthetics on ethereum […] because it gives their systems a lower exposure to volatile assets such as ETH and offers users more time to exit their positions in case of a significant market shift.”

RAI whitepaper

The news follows recent reports that an address that received over $108 million from ethereum co-founder Vitalik Buterin has woken up from dormancy and started moving millions.