Can a crypto-friendly leader change Argentina’s economy amid hyperinflation?

Argentina’s economic turmoil has driven residents toward precious metals and digital currencies. Pro-Bitcoin candidate Javier Milei aims to use digital assets to create a fair financial market.

Argentina was once called the “Latin American economic miracle” for its success in economic development.

However, the decline of the local currency, the peso, reached catastrophic proportions, forcing residents of the country to look for ways to protect themselves from inflation risks. In light of the constant devaluation of the national currency, the popularity of precious metals and digital currencies is growing.

A new boom in interest in cryptocurrencies occurred during the presidential elections in the country. Moreover, one of the candidates is ready to support digital currency if elected.

What will change in Argentina with the presidential elections?

The rapid devaluation of the Argentine peso occurred during the presidential elections. According to the primary results from August 2023, Javier Milei, an active member of the crypto community, became the leader. The candidate for the presidency of Argentina sees digital assets as a tool that will make the financial market fair. He, among other things, plans to abolish the Argentine Central Bank.

Javier Milei considers Bitcoin as another asset class. The digital currency was created as an alternative to the Central Bank. If Bitcoin is legalized, Argentina could become the second state in Latin America after El Salvador to allow the use of cryptocurrency as a means of payment.

In the second round of elections, Milei will have to compete for the position of head of the country with the Minister of Economy, Sergio Massa. Massa is ahead of his opponent. Vote counts for the first round of elections, which took place on October 22, showed Massa with 36.6%. Only 30% of respondents voted for his rival, Milei. The second round of elections is scheduled for November 19, 2023.

The growing popularity of cryptocurrencies

Major global financial market players are adding fuel to the fire. Mastercard issued co-branded cards together with Binance to pay for goods and services with crypto. Stores naively play along by accepting such payments. Now, you don’t have to pay in national currency, and why should you when you can quickly convert a cue ball and pay for your purchase at the POS terminal with one touch?

Argentine citizens can transfer pesos to Binance accounts through a local payment partner. Reuters, citing a statement from the exchange, writes that the company decided to enter the local market taking into account customer requests. However, the real reason for the expansion may lie elsewhere – Argentina does not yet regulate the business of crypto exchanges.

Argentina also has internal crypto-corporate potential, for example, the crypto-startup Lemon Cash, a small and rapidly growing fintech company that created its own cryptocurrency wallet and then issued a Visa payment card.

Stablecoin issuer USDT Tether plans to expand its presence in the country and make the cryptocurrency accessible to people in dire need of a hedge in a volatile market.

On May 18, Tether announced a new partnership with on/off-ramp service KriptonMarket, which is working to increase the availability of stablecoins for Argentine users through the Central Market of Buenos Aires, a major player in the fruit and vegetable trading segment.

The desire to obtain cryptocurrency also led to the fact that in August, the number of users of the Worldcoin project in Argentina reached a record in one day. In total, approximately 9,500 Argentines verified their World ID in one day. Thus, “every nine seconds in Argentina, one person is verified”.

Bitcoin hits new highs

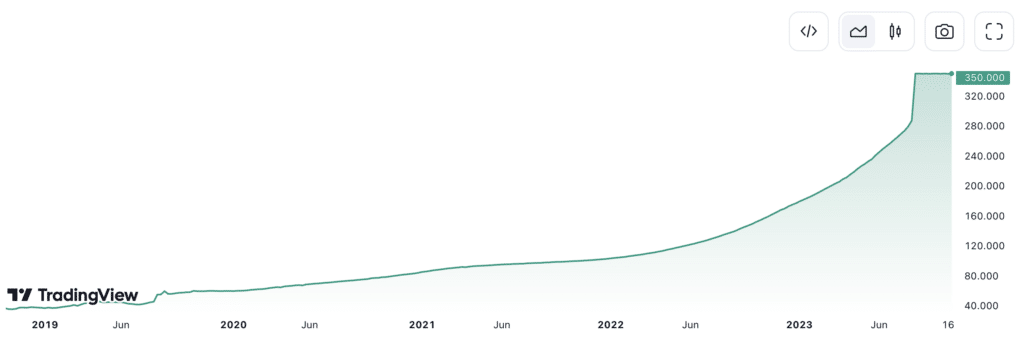

The growing interest of citizens in cryptocurrency has been observed in Argentina since the beginning of 2023. This is indicated, among other things, by the increased volumes of Bitcoin purchases for the country’s national currency. The reason for local interest in cryptocurrencies is rising inflation in the country. Argentines are forced to transfer their savings into coins such as Bitcoin to save their savings from depreciation.

On October 23, 2023, Bitcoin reached its absolute maximum value against the Argentine Peso (ARS). Over the past five years, the cryptocurrency has risen in price against the national currency of Argentina by 4,681%, over the year – by 256%, and over the last month – by 15%.