Changpeng Zhao’s journey: from McDonald’s to crypto magnate

Discover how Changpeng Zhao’s unique path took him from McDonald’s to the pinnacle of the crypto world, redefining success in the digital age.

What can a poor emigrant whose father became a victim of political persecution achieve? The kid who had to cook burgers at McDonald’s and refuel cars at night? In reality, he may well turn out to be one of the richest people in Asia and the crypto industry.

Early years

Changpeng Zhao (CZ) was born in 1977 in the Chinese province of Jiangsu. His father worked as a professor, but due to his pro-bourgeois views, he was expelled from the country shortly after his son’s birth.

Zhao lived in China until he was 12 years old, then emigrated to Canada with his mother and sister. To obtain visas, they waited three days in line at the embassy entrance. The family settled in Vancouver, where the father already lived. Despite the difficulties associated with emigration, Zhao claims that the move opened up “limitless opportunities” for him.

CZ began developing an interest in technology while still a teenager. His father gave him a 286 DOS computer for $14,000. When Zhao was 16, he was already writing code.

After high school, Zhao enrolled in computer science at McGill University in Montreal. After graduating, CZ developed software for the Tokyo Stock Exchange.

In 2001, he moved to New York and took a job at Bloomberg Tradebook, where he was involved in developing a futures trading platform. Within two years, he was promoted several times and led teams in New Jersey, London, and Tokyo.

In 2005, Zhao began taking his first steps into entrepreneurship. He moved to Shanghai and, together with partners, launched Fusion Systems, an IT startup. The company developed services for exchange platforms and traders. Within a few years, it has become one of the leading consulting firms in its field.

First steps in crypto industry

Zhao once played poker with venture capitalist Bobby Lee, who introduced him to Bitcoin (BTC) and suggested investing 10% in the first cryptocurrency.

The businessman was inspired by digital assets and, in December 2013, became the head of development at Blockchain.com. The following year, he took the chair of technical director at the largest Chinese crypto exchange at that time, OKCoin. Also, in 2014, Zhao sold an apartment in Shanghai and invested the proceeds in Bitcoin.

Binance creation

Zhao launched the Binance cryptocurrency exchange in the summer of 2017 in China. Through Binance Coin’s (BNB) initial coin offering (ICO), he raised $15m. This cryptocurrency could be used to cover commission costs on the platform.

It took the company only 8 months to become the largest cryptocurrency exchange by trading volume in the world. During this period, Binance earned $200m.

The Binance platform had significant competitive advantages – speed and a user-friendly interface. By combining blockchain technologies and his developments in high-frequency trading systems, Zhao was able to qualitatively speed up the information exchange process, due to which the platform processed over a million transactions per second. Fantastic speed made it possible to reduce commission fees, which only increased the audience’s interest in the new exchange.

Zhao paid attention not only to technical aspects but also to the convenience of the interface – he simplified the exchange structure to make it easier for clients to navigate the resource. He also became the first in his industry to provide the project with first-class technical support, establishing direct communication with users.

The list of innovations implemented within Binance does not end there – Zhao was able to turn the trading platform into a digital asset converter by integrating the crypto-to-crypto mechanism into it to exchange funds quickly. Changpeng was also one of the first to introduce a loyalty program, allowing Binance Coin holders to receive special bonuses for exchange tokens. For example, with BNB, clients could reduce commission costs.

Outside the system

Changpeng, who did not recognize conventions, set himself a goal that at that time seemed unattainable even to the bravest enthusiasts – the programmer decided to take Binance out of the influence of government regulators and traditional financial institutions. In other words, Binance had to be outside the system – Zhao did not want banks, laws, and governments to influence the fate of his brainchild.

Over several years, the platform has turned into a full-fledged cryptocurrency ecosystem – the site’s functionality includes spot, margin, and futures trading, as well as a P2P service. Binance provides a full range of tools for working with decentralized finance and applications. Using the platform, you can invest funds, pay for research and educational programs, make charitable transfers, and receive modern infrastructure solutions.

Threats to Binance existence

Although Zhao’s crypto empire managed to avoid sinking like FTX, his company faced threats to its existence. Binance, which claims to have no single headquarters, has already exited the market or been banned in at least ten countries.

In June 2023, the U.S. Securities and Exchange Commission (SEC) accused Binance of 13 violations, including manipulating trading volumes, failing to restrict U.S. customers from accessing an unregulated platform, and diverting billions of dollars of customer funds “at its own discretion.”

Since the SEC charges were announced, trading volumes on the platform have dropped 32%. In the US, where the company serves more than 5m customers, volumes have fallen by more than 75%. In addition, the SEC requested a freeze of more than $2.6b in assets, effectively halting Binance’s operations in its largest market.

The beginning of the end

Amid numerous claims from regulators, Binance and Zhao itself faced a number of problems and criminal proceedings.

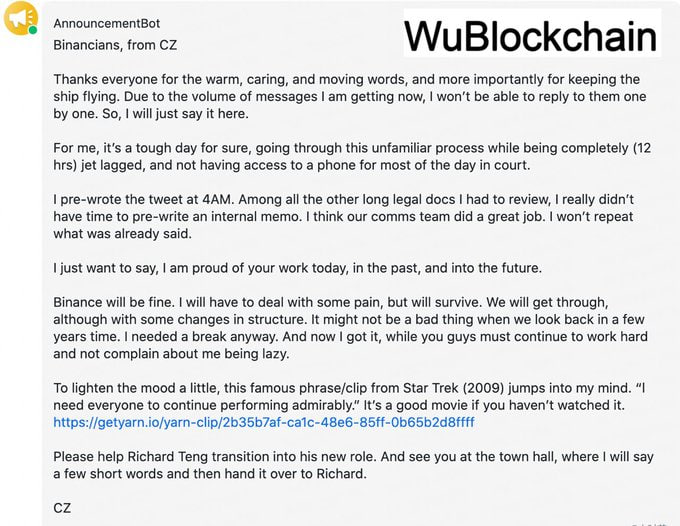

On November 21, Zhao resigned after agreeing to plead guilty to violating anti-money laundering laws. In addition to Zhao’s resignation, Binance will pay a fine of $4.3b under the terms of the plea deal, US business publications report. The court allowed Zhao to retain a majority stake in the company. He will pay a fine of $50m. The US Department of Justice, which brought charges against the exchange and its founder, announced a press conference “on topics related to cryptocurrency.”

Zhao will be replaced by Richard Teng, who previously served as head of regional markets at Binance. Teng joined Binance in 2021 as CEO in Singapore and was promoted to his current role in May this year.

What will happen to Zhao after leaving Binance?

Zhao left his post as part of a settlement with the U.S. Department of Justice and is prohibited from holding a leadership position at Binance for at least three years after the appointment of an independent monitor. However, he is still the majority owner of Binance.

CZ also said that he plans to take a break and pursue other interests related to cryptocurrencies and technology.