CME Bitcoin futures down 10%, still ahead of Binance

The Chicago Mercantile Exchange remained traders’ preferred platform for Bitcoin futures even as BTC saw a 4% price correction amid a wide-ranging market dip.

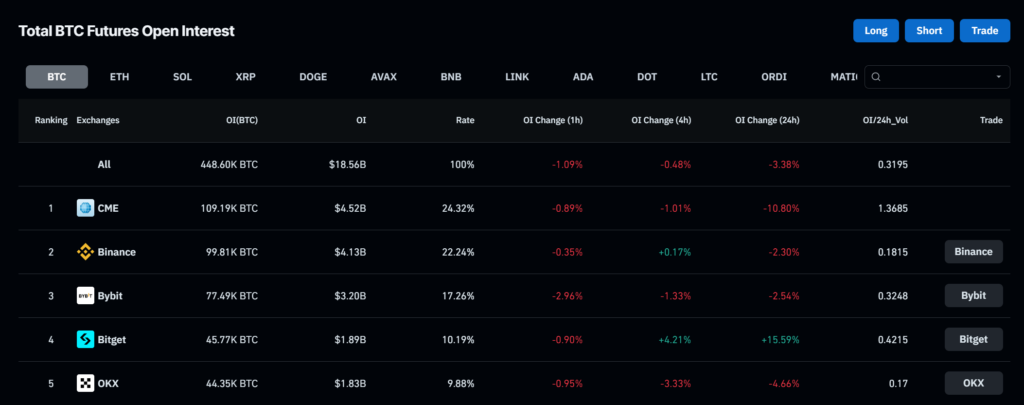

Bitcoin (BTC) futures positions on the Chicago Mercantile Exchange (CME) fell over 10% between Dec. 11 and Dec. 12, according to CoinGlass. The decline in open interest (OI) amounted to some 11,000 Bitcoins, the largest drop among exchanges within that time.

Despite the change, CME was the top venue for BTC futures open interest at press time and eclipsed the second closest contender, Binance, by at least 10,000 BTC. CME had previously upstaged Binance as the leading platform for Bitcoin OI in early November 2023 for the first time in two years.

Bybit, Bitget, and OKX filled the remaining three spots for the top five exchanges where investors trade standard BTC and perpetual futures.

No need for Bitcoin panic

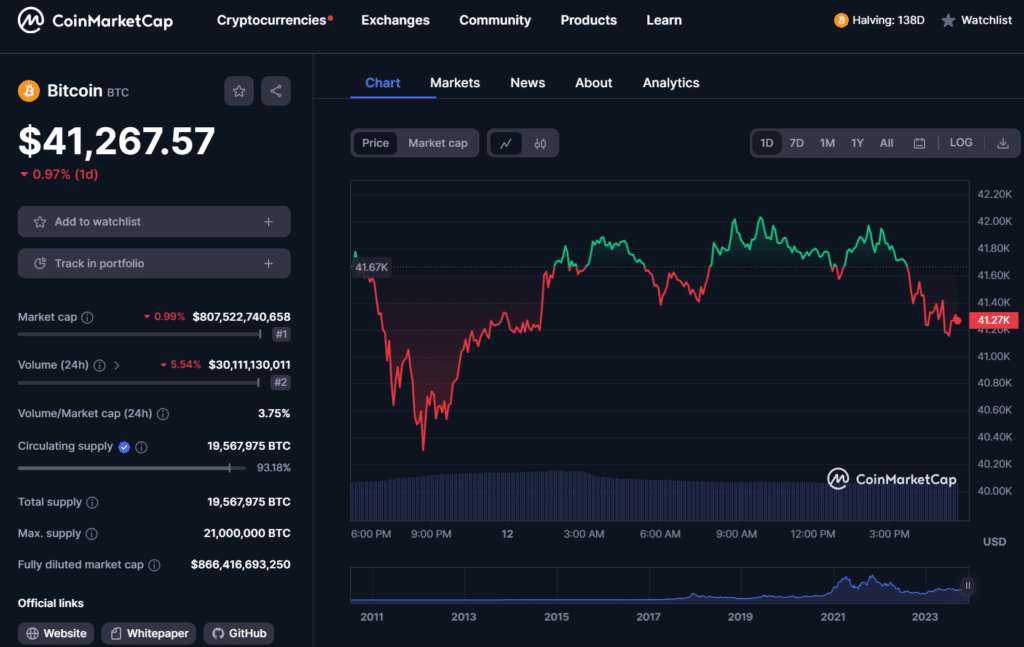

Notably, the downturn in BTC OI affected most exchanges, including CME and Binance, as crypto’s top token slid under the $42,000 mark. BTC’s dip below this level indicated a 4% drop within 24 hours, although experts opined that this is healthy for the market.

Analysts advised against investor panic and said the pullback in market price would likely be short-term rather than an aggressive crash to much lower levels.

BTC traded around $41,200 at press time, with the token down less than 1% per CoinMarketCap data. Amidst “buy the dip” calls from BTC proponents on social media, there is also anticipation that the U.S. Securities and Exchange Commission (SEC) would soon greenlight spot BTC ETFs.