Coinbase urges U.S. lawmakers to bring clear stablecoin regulation as ‘cash is outdated’

The U.S.-based crypto exchange Coinbase is doubling down on its efforts to bring more regulatory clarity for stablecoins.

In a blog post on Monday, Dec. 4, 2023 the San Francisco-headquartered crypto exchange noted younger adults feel the “everyday pain points of dealing with the current financial system,” saying stablecoins offer consumers “all the benefits of cash without the drawbacks.”

Coinbase being a stakeholder in Circle, the issuer of the USDC stablecoin, claims that physical cash “no longer meets the needs and expectations of today’s digitally savvy consumers” as interbank transfers can take days, while its crypto-alternatives are way cheaper and faster to move.

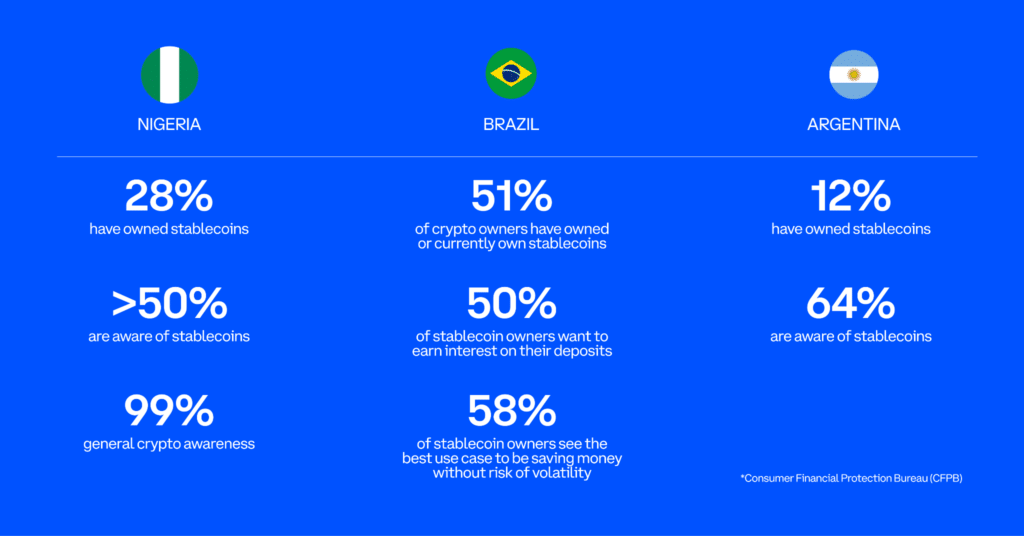

Yet, regulatory hurdles still keep the U.S. from becoming a “crypto hub,” while Nigeria and Brazil are proving to be “pivotal in encouraging the adoption of stablecoins and cryptocurrencies around the world,” Coinbase says.

“Clear, sensible stablecoin rules are needed now in order to make sure the U.S. doesn’t fall behind.”

Coinbase

Although no specific suggestions regarding stablecoin regulation were provided by the exchange, Coinbase called on the crypto community to call members of Congress to support legislation that “will enable stablecoins while protecting consumers, and become a part of communities advocating for crypto regulations.”

However, stablecoins appear to be still suffering from liquidity risks should extreme conditions occur. In March 2023, reports surfaced that Coinbase offered a $3 billion credit line to Circle in an effort to bring the stablecoin back to its $1 peg. The credit test came shortly after USDC lost its peg to the U.S. dollar due to Circle’s $3.3 billion exposure to Silicon Valley Bank, which was taken over by the Federal Deposit Insurance Corporation following a run on the lender.