Crypto deposits to Chinese precursor makers surge 600% in 2023

Blockchain intel firm TRM Labs says China-based precursor manufacturers received over $26 million in crypto in 2023, with around 60% of payments were made in Bitcoin.

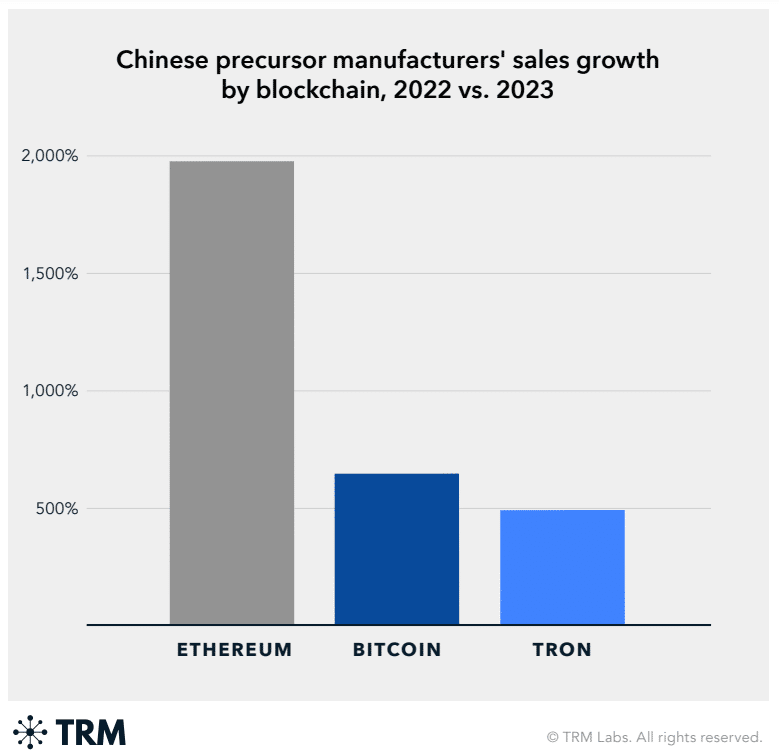

Cryptocurrency appears to be becoming a more preferred payment method for Chinese drug manufacturers as the amount of crypto deposited into wallets linked to these entities soared sixfold from 2022 to 2023, according to TRM Labs, a blockchain intel firm backed by JPMorgan Chase, Visa, Citi, and PayPal among others.

In a recent research report shared with crypto.news, analysts at TRM Labs revealed that deposits into addresses linked to Chinese drug producers more than doubled in the first four months of 2024 compared to the same period in 2023. In 2023, Chinese precursor networks received over $26 million, with 11 manufacturers accounting for “over 70% of all crypto-denominated sales of drug precursors.”

“Crypto funds sent to Chinese precursor manufacturers primarily come from unhosted wallets, cryptocurrency exchanges, and payment services; the manufacturers’ wallets are most commonly hosted at exchanges.”

TRM Labs

Approximately 60% of crypto payment volume to Chinese precursor manufacturers occurred on the Bitcoin blockchain, followed by 30% on the TRON blockchain and about 6% on the Ethereum blockchain, the data shows. Despite the surge in crypto payments, Chinese manufacturers also appear to be comfortable with accepting payments in fiat currencies via PayPal, MoneyGram, Western Union, and bank transfers.

According to TRM Labs’ study, Chinese drug precursors mainly target Canada, the Netherlands, Australia, Germany, and the U.S., as their top countries for shipping. However, there are also advertisements targeting Russia and neighboring countries for mephedrone precursors.

In April, a U.S. congressional committee reported that China subsidizes the production of illicit fentanyl precursors, fueling the U.S. opioid crisis. The committee reportedly found that China provides value-added tax rebates to companies manufacturing fentanyl analogs, precursors, and other synthetic narcotics, provided they sell them outside China.

As another blockchain intelligence firm, Elliptic, earlier noted, fentanyl is favored by drug cartels due to its lower production cost compared to heroin and its potency, which is 50 times stronger, making it the leading cause of death for Americans aged 18-45.

A spokesperson for TRM Labs told crypto.news that Bitcoin’s dominance could be attributed to its historical familiarity and the “ease of access, purchase, spend” compared to other tokens.

The blockchain intel firm also pointed out a “sharp rise in ETH’s popularity” recently relative to BTC among precursor buyers and Chinese drug manufacturers, likely driven by the “high BTC transaction fees which have been regularly hitting the network.”