A guide to crypto passive income opportunities

The allure of passive income in crypto has drawn in droves of investors. Read on as we take a look at some of the opportunities available and the risks involved.

Table of Contents

Since the inception of the first cryptocurrency, the crypto space has evolved from an obscure trend to a thriving industry worth billions of dollars. Today, it encompasses numerous blockchains, digital currencies, decentralized finance (defi) protocols, and collections of non-fungible tokens (NFTs).

At the core of crypto’s expansion are passive income opportunities, often promoted as “easy,” “lucrative,” and even “guaranteed.”

However, despite the existence of such products, they fall short of the easy guarantees presented in marketing. Numerous potential crypto investors have faced significant losses, enticed by promises of yields reaching up to 18% annually.

Before delving into available opportunities, let’s establish a clear definition of what passive income is.

What is crypto passive income?

Earning passive income means making money from a venture without active participation. This concept isn’t groundbreaking; traditional finance (tradfi) has long provided avenues for individuals to gain passive income, like using a savings account where deposited money accrues interest.

In the cryptocurrency realm, there are similar opportunities for you to earn yields with minimal involvement. These include hodling, hunting for airdrops, participating in cryptocurrency affiliate programs, engaging in staking, exploring defi passive income projects, and using crypto mining apps.

11 ways to generate passive income with crypto

Hodling

One of the easiest ways to earn a passive crypto income is by practicing a strategy known as hodling. Hodl, short for “holding on for dear life,” was coined by a Bitcointalk user named GameKyuubi. This method involves purchasing crypto and holding onto it for extended periods, with the hope that it will appreciate over time, generating income for you.

Think of hodling as similar to traditional finance savings, but instead of growing wealth in fiat money, you’re doing it with crypto. Despite its apparent simplicity, hodling demands patience and a strong resolve to navigate the inherent volatility of the crypto market.

Keep in mind that while bull markets can encourage spending and investment, they can also shift into bear markets, potentially reducing your funds.

The most significant advantage of hodling is its simplicity, requiring only a crypto wallet and a way to track your transactions. As a result, it can be an excellent long-term investment strategy for those willing to weather the market’s highs and lows.

Disadvantages of hodling

One drawback of hodling is that, although it can lead to significant gains during bullish cycles, losses can accumulate rapidly during bear cycles, potentially erasing those gains in no time.

Another disadvantage is the time required to see profits, particularly with less popular cryptocurrencies. Moreover, hodlers might overlook opportunities to capitalize on short-term price fluctuations.

Hodling might discourage using cryptocurrencies actively, like Bitcoin, as a medium of exchange. When investors hold onto their coins with the aim of future profits, it can unintentionally impede the development of a cryptocurrency and limit the growth of businesses accepting it.

Airdrop hunting

Airdrops are complimentary giveaways of digital assets such as cryptocurrencies or NFTs by blockchain and crypto projects aimed at growing their visibility and rewarding their user base.

They also serve as promotional tools for new projects, potentially stimulating the utility and demand for their native tokens.

Types of airdrops

There are primarily four types of airdrops: standard, bounty, holder, and exclusive airdrops.

- Standard airdrops require creating an account with the project in question. Such airdrops usually happen within a specific period, and the number of tokens on offer is limited and distributed on a first-come, first-served basis. Unfortunately, standard airdrops are susceptible to Sybil attacks, where a user creates a large number of active, pseudonymous accounts that they use to fraudulently acquire as many of the airdrop tokens on offer as possible.

- Bounty airdrops require participants to complete specific activities, including signing up for a project’s Telegram or Discord channel or engaging with their social media posts, before they can claim their free cryptocurrency or NFTs.

- A holder airdrop is a way to give back to early adopters or contributors involved with a project before a specified date.

- Exclusive airdrops are targeted at active members of a crypto community who have invested time and effort to support the project, be it by engaging with its social media posts or shilling it on their own.

Regardless of the type, airdrops are typically organized by the founders or developers of a project, and they are often announced in advance. This is where you can benefit—keep an eye out for such announcements and register or fulfill the minimal requirements to become eligible for an airdrop.

How to find crypto airdrops

Discovering crypto airdrops can be done in three primary ways. Here’s how you can hunt for them:

- Official project websites and social channels. Most crypto projects have official websites and active social media channels. They typically announce upcoming airdrops directly to their communities through these platforms. To stay updated, keep an eye on the project’s official social channels, such as X, Telegram, and Discord.

If you’re unsure where to start, conduct a search on social media using specific hashtags and keywords related to airdrops. However, exercise caution and be mindful of the results. Some may lead to scam airdrops with phishing links that pose a risk to your crypto wallet.

- Crypto airdrop tracking websites. If you find it challenging to keep up with a multitude of social media accounts to catch airdrop announcements, specialized websites and other platforms can be your go-to solution. Dedicated portals like Airdrops.io, Airdrop Alert, and Airdrops Mob provide comprehensive lists of upcoming airdrops and detailed participation instructions.

- Crypto forums and newsletters. Engaging with reputable crypto forums such as Bitcointalk and subscribing to well-regarded crypto newsletters can be a smart move. These platforms often feature dedicated sections for airdrop announcements. They usually implement a multi-layered scrutiny process, minimizing the risk of encountering fraudulent airdrops. While it’s challenging to eliminate all fake announcements, the majority on these forums are likely to be genuine.

Risks associated with airdrop hunting

Engaging in airdrop hunting can offer lucrative opportunities, but it comes with notable financial risks. The stakes rise, especially when dealing with new or untested protocols. Additionally, overlooking factors like gas fees and other financial expenditures can lead to complications.

It is also becoming increasingly challenging to track down and fulfill the tasks necessary to secure a potential airdrop as protocols develop more inventive criteria. There is a risk of wasting time and resources on non-qualifying activities.

Additionally, when navigating the world of airdrops, it’s crucial to prioritize thorough research to verify the projects’ legitimacy. If a platform prompts you to send crypto for an airdrop, be careful and resist making hasty decisions, especially when faced with the allure of a seemingly incredible opportunity.

Moreover, staying vigilant is key to steering clear of potential scams. Disregard messages from unfamiliar users on X, Telegram, or any social media platform urging you to visit questionable websites for supposed airdrop rewards.

Nowadays, it’s becoming harder to figure out genuine announcements on social media since bad actors have resorted to using SIM swap attacks to take over the social media accounts of famous figures in the crypto community and use them to announce their phony airdrops.

Crypto mining

Crypto mining forms the backbone of digital currencies like Bitcoin (BTC), involving a complex process where new transactions are grouped into blocks, and miners attempt to solve a challenging computational puzzle.

If you’re considering mining, it’s important to know that your profitability can vary. Factors such as the price of the mined cryptocurrency, the complexity of the mathematical problems to be solved, and the efficiency of your mining equipment all play a role.

Bitcoin remains one of the most profitable coins to mine due to its increasing market value. However, remember that Bitcoin’s mining difficulty has risen significantly over time, making it less accessible for individual miners who don’t have substantial computational resources.

Other potentially profitable coins to mine include Litecoin (LTC) and Monero (XMR). These coins have a lower mining difficulty than Bitcoin and could offer better returns for individual miners.

Disadvantages of crypto mining

Despite its potential benefits, crypto mining comes with notable disadvantages. One major hurdle is the cost, especially due to the significant electricity consumption required for the intensive computational processes.

Keep in mind that there’s a substantial upfront investment in equipment, like application-specific integrated circuits (ASICs) necessary for Bitcoin mining, which can be quite expensive, sometimes exceeding $3000.

For individual miners, the combination of equipment costs and the increasing complexity of mining computations poses a challenge to turning a profit without access to substantial resources. Therefore, while the potential for substantial earnings exists, it’s essential to weigh the costs to determine overall profitability carefully.

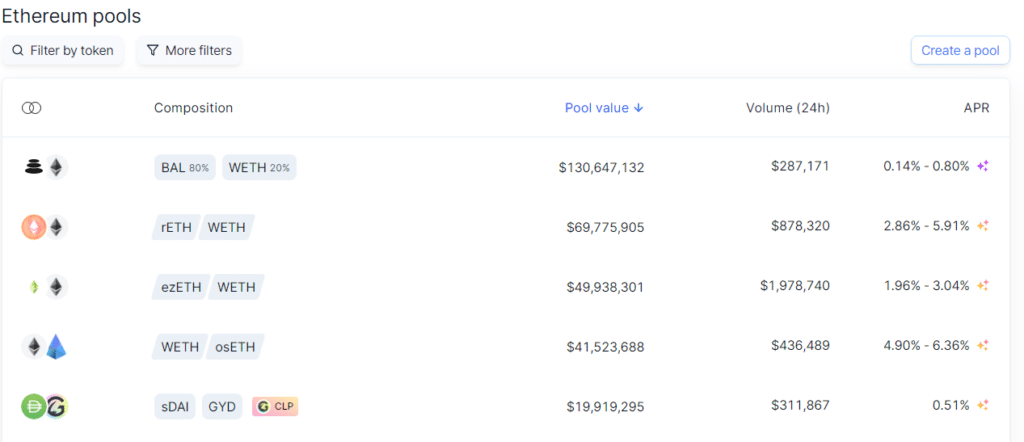

Liquidity mining

Liquidity mining, or yield farming, enables crypto holders to lend their cryptocurrencies to decentralized liquidity exchanges or other platforms to earn rewards.

These platforms use the provided assets in liquidity pools—smart contracts with reserves of two tokens in a trading pair—to facilitate trade and stabilize the market. By contributing to these pools, participants receive liquidity provider (LP) tokens, which can be staked to earn further rewards.

Liquidity mining offers several attractive advantages as a passive investment strategy:

- Potential for significant returns: The APR on liquidity mining can sometimes be substantially higher than traditional savings accounts, resulting in impressive returns on investment.

- Engagement in the defi ecosystem: Participants contribute to and benefit from the growth of decentralized finance.

- Additional token earnings: Beyond transaction fees, liquidity providers can earn extra tokens, which can be traded or staked for other income.

Risks associated with liquidity mining

Despite its benefits, there are also risks and disadvantages to consider.

- Impermanent loss: If asset prices fluctuate unfavorably after depositing them into a pool, the value returned may be less than the initial investment, a phenomenon known as “impermanent loss.”

- Smart contract risks: Bugs or failures within the smart contract could lead to significant financial losses.

- Market volatility: The profitability of these platforms is subject to the volatility of the assets and the fluctuating prices of the platform’s tokens.

Liquidity mining is a concept embodied by projects like Uniswap, SushiSwap, Balancer, and Curve Finance. These projects heavily depend on users contributing liquidity.

However, the variability in returns and associated risks underline the importance of thorough research before participating.

Cloud mining

With cloud mining, you can step into the world of crypto mining without the need for pricey hardware. Here, you rent computational power from massive data centers that take care of the mining equipment, electricity, and maintenance. In return, you earn a portion of the mined cryptocurrency based on the power you’ve leased.

Disadvantages of cloud mining

When considering cloud mining, you should consider profitability a key factor. Your earnings can be influenced by factors such as the efficiency of the data center, the operation’s performance, and the crypto market’s unpredictable nature. It’s essential to carefully assess these elements to gauge the success of your investment.

Moreover, market volatility, competition in mining, and changes in mining difficulty levels are additional risks that could impact the results of your cloud mining ventures. Be sure to weigh these factors carefully before diving into cloud mining as an investment.

Decentralized crypto lending

Decentralized crypto lending is another crucial component of defi, permitting individuals or entities to lend and borrow assets without traditional financial intermediaries like banks.

The system operates on smart contracts, with the terms written into lines of code, which govern transactions on decentralized lending platforms.

Within these platforms, lenders contribute their crypto to a liquidity pool. At the same time, borrowers can obtain loans from the same pool by providing collateral, usually worth more than the loan itself, to reduce the potential for default.

A significant advantage of decentralized crypto lending is its potential for high returns, often surpassing traditional savings accounts.

Risks associated with decentralized lending

Despite the benefits, decentralized crypto lending carries notable risks. The cryptocurrency market’s volatility can significantly affect returns, and the collateral value might drop below the loan value, leading to losses if borrowers default.

Moreover, the inherent risks associated with smart contracts, such as bugs or vulnerabilities, add a layer of complexity and potential danger.

Dividend-earning tokens

Dividend-earning crypto tokens are a class of cryptocurrencies that provide holders with a regular income stream, typically derived from the profits generated by the underlying blockchain project.

The operation is relatively simple: holders keep the tokens in their digital wallets, automatically qualifying them to receive dividends often paid in additional tokens or other cryptocurrencies.

A notable example of such a scheme is BTCS, a penny stock company that attracted attention by announcing dividends paid in Bitcoin amidst an 82% rise in the FMV of its assets in 2023.

Such performance indicates skillful market navigation and underscores the potential for investors to earn regular income from their crypto holdings.

Disadvantages of dividend-earning tokens

The viability of dividend-paying crypto tokens comes with several considerations. A major factor is the dependency on the project’s success; dividends could be reduced or null if it fails to profit.

Volatility is another challenge; the inherently unstable value of cryptocurrencies can cause drastic fluctuations in both the tokens’ worth and their dividends.

In addition, the regulatory landscape of cryptocurrencies remains uncertain, which could affect the projects’ ability to pay dividends.

However, despite these inherent risks, some investors are drawn to the promise of a passive income stream from these assets.

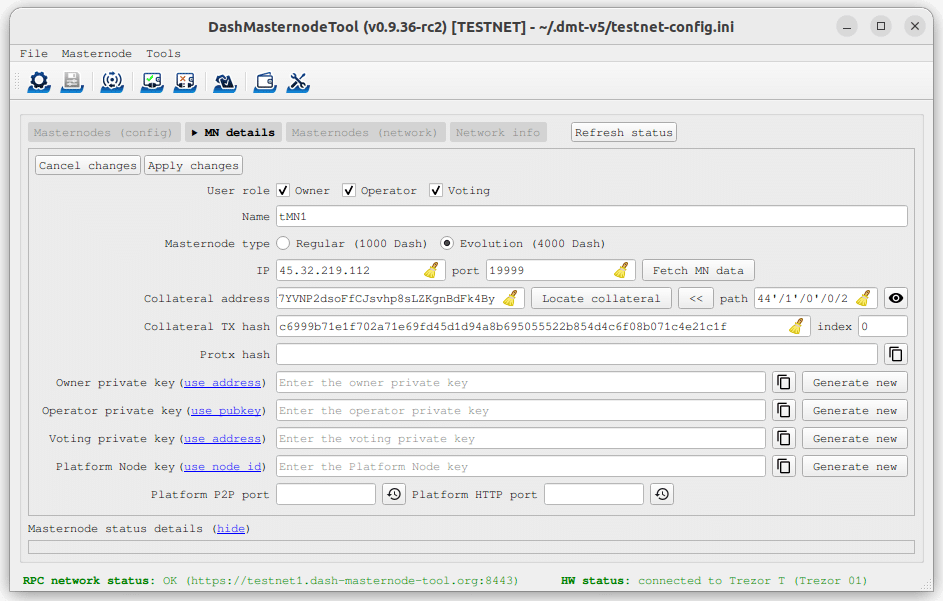

Masternodes

Masternodes are specialized servers within a blockchain network with functions that regular nodes cannot handle. They enable specific services like instant transactions, private transactions, and direct sending.

To run a masternode, an operator must own a predetermined amount of a particular cryptocurrency as collateral.

Operators who maintain these nodes are rewarded with cryptocurrency, and some blockchains may offer generous compensation mechanisms, depending on market dynamics. Notable cryptocurrencies with masternode capabilities include Dash, PIVX, and Zcoin.

For individuals seeking to engage in this form of investment, the process can provide a steady flow of income, assuming the selected cryptocurrency maintains or its value increases.

Risks associated with masternodes

As with any crypto-based investment, the crypto market’s volatility could lead to fluctuations in masternode profitability.

Also, running a masternode requires a significant technical understanding, as maintaining server health is crucial to its success. Initial capital can also be hefty, particularly for established cryptocurrencies.

Additionally, operational costs like hardware and power can also affect the net gains from running a masternode. Therefore, potential investors must thoroughly research and continuously monitor market trends, calculate anticipated ROI, and maintain rigorous digital wallet security to manage inherent risks effectively.

Crypto affiliate programs

Another way to earn passive income in crypto is through affiliate programs that pay you a commission for directing people to a project.

Binance and Coinbase offer two of the most renowned affiliate programs in the crypto space. Binance claims participants can earn as much as 50% commission on trading fees from their referrals. The exchange also claims that since the program’s inception, it has disbursed more than $2 billion in commission rewards.

While Binance uses a variable commission structure, Coinbase reportedly offers a fixed $10 commission paid in Bitcoin, subject to a new user registering via a referral link and buying a minimum of $100 worth of crypto.

Enrolling in such programs usually costs nothing, but some may require participants to fulfill certain conditions before setting up an account.

For instance, to qualify for the Binance affiliate program participants must have at least 5,000 followers or subscribers on their social platforms, including Facebook, VK, X (formerly known as Twitter), and YouTube.

Crypto communities and businesses can also take part in Binance’s affiliate program. They have separate requirements for qualification, which can be found on the exchange’s website.

Once participants receive their unique link or code, they can share it across blogs, forums, and social media platforms. The commission is usually earned when a prospective customer signs up with the project using the unique referral code or link and when they start trading or using the project’s services.

How crypto affiliate programs work

For those who wish to start earning via a crypto affiliate program, the first step is registering for the program. After they have been approved, they will receive a unique reference link or code, which they can promote to their audience or social circle through social media posts, articles, blogs, and even videos.

When other parties use the participate’s referral link or enter their unique code during the sign-up process, they become linked to the account as a referral, and any trades or transactions they carry out on the platform will earn the participant a commission.

It is important to note that the structure and percentage of the commission may differ depending on the program, so participants should thoroughly review the terms and conditions before proceeding with registration.

How to earn passive income through crypto affiliate programs

For those interested in generating passive income through crypto-related affiliate programs, experts suggest the following tips to kickstart your journey:

- Opt for a reliable platform. Prior to endorsing any cryptocurrency platform, it is crucial to ensure its credibility, with a focus on security and dependability. It would be a shame to steer any followers towards a scam.

- Tailor promotions to the audience. To optimize profits, participants could gear promotions specifically towards their target demographic, catering to their preferences, be it for trading in altcoins, memecoins, or acquiring NFTs.

- Diversify promotional channels. Ideally, participants shouldn’t limit themselves to a single medium for promoting. Instead they should utilize a variety of outlets, like blogs, social media, newsletters, and even paid promotions, if there is room in the budget. This approach will help amplify their reach and enhance commission opportunities.

- Deliver meaningful content to the audience. Participates should try to ensure they are not solely promoting the platform but also offering valuable insights to their audience. This could be crafting informative blog posts, creating instructional videos, or conducting webinars to educate their followers or subscribers.

Risks associated with crypto affiliate marketing

Crypto affiliate marketing is not without risks, including legal infractions, susceptibility to scams, intense competition, and potential damage to either a participant’s or a crypto platform’s reputation.

Affiliate programs need to adhere to online advertising and consumer protection laws, such as disclosing affiliate relationships, avoiding misleading claims, and respecting privacy, data protection, and intellectual property rights. Additionally, in some jurisdictions, like Singapore, it is illegal for crypto services to promote their products to the general public through third parties.

Participants should also be aware of fraudulent practices targeting marketers and customers alike, including scam projects and compromised links.

Play-to-earn games

One of the more enjoyable ways to earn passive income in crypto is by playing crypto games that adopt the play-to-earn (P2E) model.

Picture a video game where gameplay efforts are rewarded with real cryptocurrency. It is made possible by the incorporation of blockchain technology in these games, granting players ownership over their in-game assets such as characters, items, and even virtual land.

This ownership allows players to sell their assets in exchange for crypto, thereby creating a stream of passive income.

In addition to trading in-game assets, there are numerous other methods for players to earn crypto within P2E games. These include prevailing in player vs. player battles, accomplishing quests, gathering resources, and even breeding and trading NFTs.

The potential crypto income from P2E games is dependent on several factors, including the specific game and the player’s skill level.

While some of these games do not require upfront investment, others require players to buy the game’s native token to unlock further features.

However, P2E gaming guilds have emerged as a solution to these initial investment hurdles. The guilds are collaborative organizations made up of investors, gamers, and managers who acquire in-game assets and then rent them out to other players. In that way, they can generate passive income by leveraging these non-fungible assets in their virtual environment.

Risks associated with play-to-earn games

Countless P2E games are sprouting right, left, and center, and figuring out the good ones from the bad can be quite a task since many of them exist with the intention of defrauding users.

Furthermore, many legitimate ones often lack quality, with subpar graphics, hasty development, and haphazard tokenomics.

Uninformed investments in such projects can lead to rapid capital losses since their native tokens may be more susceptible to fluctuations that may make them worthless.

Staking

Staking is the practice of holding a specific amount of tokens in a wallet, allowing individuals to take part in the generation of new blocks and the validation of transactions on proof-of-stake (PoS) or delegated proof-of-stake (DPoS) blockchains. This process not only bolsters the blockchain’s security and decentralization but also earns participants rewards in the form of transaction fees and multiple network incentives.

Some of the major networks offering staking opportunities include Ethereum (ETH), Cardano (ADA), and Polkadot (DOT). Each network has a different potential to earn staking rewards based on its settings and native cryptocurrency.

Ways of staking crypto

There are several ways to stake crypto: solo staking, staking pools, and using staking-as-a-service (SaaS) platforms.

In solo staking, participants set up and operate their own staking nodes, while SaaS platforms and staking pools allow them to delegate staking rights to third parties who manage the process on their behalf.

How to stake Ethereum

Ethereum currently has the biggest total staked value, and offers a variety of options for users, including individual staking, staking via a service provider, or participating in a staking pool.

The staker’s choice depends on their risk appetite, expected rewards, and trust in the option chosen.

When staking Ethereum, solo stakers require a minimum deposit of 32 ETH to run a validator node on the Ethereum network. However, for pooled and SaaS staking, the minimum deposit varies.

Before starting the process, pariticipants need to provide personal information such as their legal name, home address, and some form of government-issued identification as part of the know your customer (KYC) process aimed at preventing fraud and money laundering.

Staking on a crypto exchange

To stake through a crypto exchange, participants will need to follow the steps below:

- Create an account on the exchange, provide their personal information, verify their identity, and set up their payment method to buy ETH.

- Buy Ethereum using various payment options available, including bank transfer, credit card, or debit card.

- Transfer their purchased ETH to the exchange’s staking program. The steps to do this vary depending on the exchange but are generally located within the wallet.

- Specify their staking preferences, including the amount of ETH to stake and the staking duration.

- Start staking and begin earning rewards. The rewards are usually added to your account periodically, depending on the exchange’s payout schedule.

Staking using a crypto wallet

For staking Ethereum via a cryptocurrency wallet, follow these steps:

- Choose an Ethereum-compatible wallet such as MetaMask, Electrum, Ledger, or Trezor.

- Transfer ETH to your selected wallet from an exchange or another wallet.

- Navigate to the staking option within your wallet.

- Follow the instructions provided to stake your ETH.

Risks associated with staking

There are several risks associated with each type of stake, on certain networks like Ethereum, when solo staking, participants who go offline can be made to pay a certain amount of ETH as a penalty.

Additionally, what may be deemed malicious behavior may result in ‘slashing’, the destruction of a portion of a validator’s stake and their ejection from the network.

In SaaS and pool staking a participant is forced to entrust their signing keys to a third party that could potentially act maliciously.

Unstaking also tends to take time, anywhere from a few hours to several weeks, depending on the crypto asset. It means that given the volatility of crypto markets, the value of crypto could become significantly higher or lower in the time taken to unstake it.

Finally, there are no guarantees of rewards. Protocol rules and network conditions may change drastically enough to result in lost rewards.

Taxing passive crypto income

One of the things advocates of passive income earning opportunities in crypto often fail to mention is their tax obligations.

Regardless of the method in which you accumulate passive income from crypto, it is crucial to remember that those earnings may be subject to taxation in certain jurisdictions. For instance, the Internal Revenue Service (IRS) recently ruled that crypto-staking rewards are taxable income, meaning they need to be reported in the year they were received.

Australia has similar rules in place, stating that staking rewards, airdrop tokens, interest earned through defi passive income projects, and salaries paid in crypto are all taxable income.

Therefore, it is essential to always factor in tax obligations for any passive crypto income to avoid conflict with your country’s tax authority.

Final thoughts

As has been shown, the crypto industry has a multitude of passive income generation avenues. The options are varied: holding assets, capitalizing on airdrops, engaging in affiliate programs, exploring play-to-earn games, or staking.

Disclaimer

That being said, these opportunities come with risks as well as possible rewards. The key to navigating the passive income landscape in crypto is due diligence. Understanding the associated risks and making informed decisions aligned with your financial goals and risk tolerance is paramount.

FAQs

Can you make daily passive income with crypto?

Yes, you can make daily passive income with crypto through several methods, including staking, lending, yield farming, liquidity mining, running crypto nodes, depositing funds in interest-bearing crypto accounts, participating in crypto affiliate programs, and even playing play-to-earn Web3 games.

However, while these methods can provide a passive income, they also come with risks. Always do your own research and consider your financial situation and risk tolerance before engaging in such activities.

What are the best coins for passive income?

Bitcoin (BTC) and Ethereum (ETH) continue to be top performers in the current market. However, smaller coins like Solana (SOL), Cardano (ADA), and Polkadot (DOT) have shown significant growth and potential for passive income generation. Ultimately, the best coin will depend on your investment objectives, risk tolerance, and financial situation.

What are the best passive income crypto projects?

Some of the best passive income crypto projects currently include Injective Protocol (INJ), which offers the highest staking yields at a 9.4% real reward rate, and Zilliqa (ZIL) with 7.8%. Others include Polkadot (DOT), with a real reward rate of 6.2%, and Kusma (KSM), at 4.7%. In the yield farming space, projects to consider include Sushiswap, Uniswap, and PancakeSwap.

Remember that the crypto market is highly volatile, and a project’s potential for profitability may disappear very quickly. Always research and stay abreast of all crypto-related news to know what may affect a project you are invested in.

Is cryptocurrency income taxable?

Depending on where you live, you may have to pay taxes on your cryptocurrency income. The way you’re taxed can depend on a few things, like how much money you make, what your tax filing status is, and how long you’ve had the cryptocurrency before you sold it.

In some places, cryptocurrencies are seen as property, so any profit you make from selling them is treated as capital gains for tax purposes. If you earn crypto through mining, this could also be considered taxable income.

In some countries, if you get paid in crypto for goods or services, or if you get it through an airdrop, the amount you get will be taxed at the regular income tax rate.

In certain jurisdictions, just holding onto your cryptocurrency isn’t considered a taxable event. You would only need to pay taxes when you make a profit, which only happens when you sell, use, or exchange your coins.