Crypto regulations tightened in 80% of major jurisdictions in 2023, analysts say

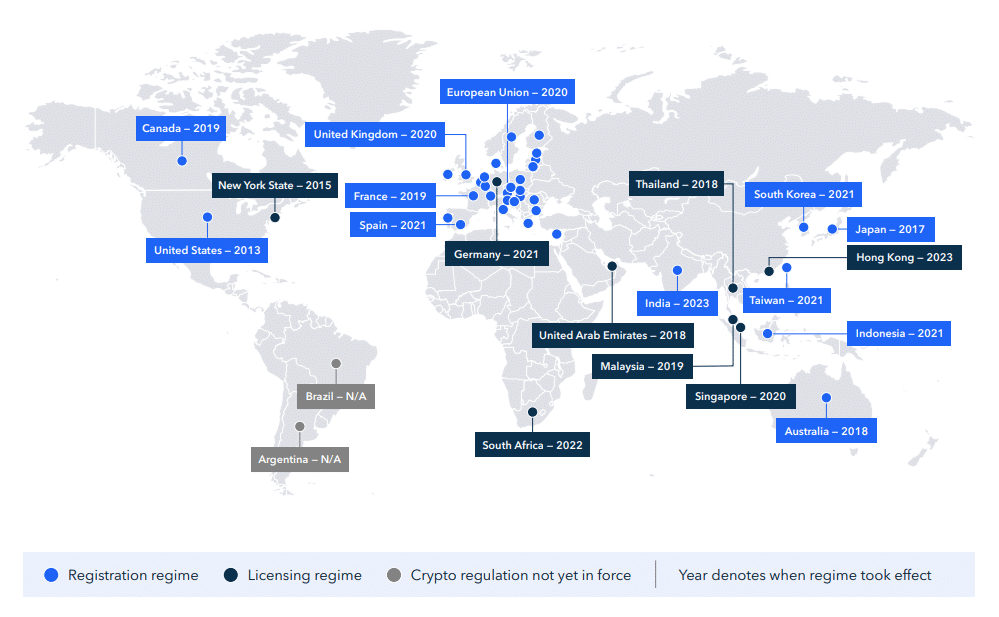

According to data compiled by TRM Labs, around 80% of 21 major jurisdictions, representing around 70% of global crypto exposure, have strengthened crypto regulations in 2023.

In a research report published on Jan. 8, blockchain analytics firm TRM Labs disclosed that nearly 80% of jurisdictions globally have implemented measures to tighten regulations within the crypto space. Almost half of these jurisdictions specifically advanced initiatives for enhanced consumer protection.

While various jurisdictions prioritize different national goals, analysts at TRM Labs have discovered that crypto exchanges operating in countries with established licensing and supervision frameworks demonstrate “lower rates of illicit activity than those in less regulated jurisdictions.”

Despite the absence of a comprehensive regulatory framework for cryptocurrencies in the U.S., TRM Labs anticipates pivotal rulings from federal courts in 2024 on whether specific crypto assets could be deemed securities.

“We can also expect the enforcement momentum to continue, especially against mixers and other anonymity enhancing tools.”

TRM Labs

Analysts acknowledge uncertainties within the decentralized finance space, particularly regarding issues of responsibility, accountability, and the practical exercise of oversight and authority by regulators. While definitive answers to these questions may not surface in 2024, TRM Labs says the year should be expected as a moment of “implementation and benchmark setting in the next, hopefully less wild, chapter of digital assets.”

The current position of American regulators on crypto remains uncertain, as their previous signals suggested that existing financial laws are still applicable to digital assets. In December 2023, the U.S. Securities and Exchange Commission (SEC) explained its denial of Coinbase’s Rulemaking Petition, citing three reasons: existing laws already apply to crypto securities markets, the SEC addresses crypto securities markets through rulemaking, and the need to preserve Commission discretion in establishing rulemaking priorities.

Nonetheless, Coinbase сhief legal officer Paul Grewal said the company would still attempt to have the SEC abdicate its duty to determine crypto regulation standards via another appeal.