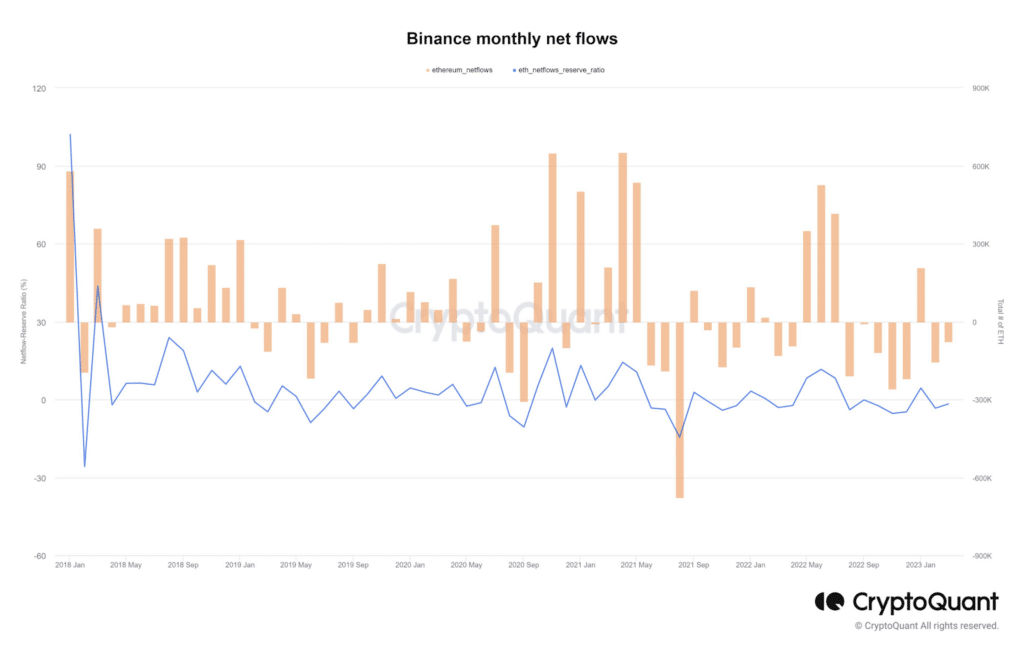

CryptoQuant shows outflows from Binance after CFTC lawsuit

Data from on-chain analytics provider CryptoQuant showed that investment outflows from Binance during three of its most recent stressful events remained within historical ranges.

This means the crypto exchange largely managed to beat the fear, uncertainty, and doubt (FUD) caused by the events.

CryptoQuant, on March 30, released snippets of a recent assessment it made on the behavior of Binance’s net outflows following recent adverse events, including the commodity futures trading commission’s (CFTC) lawsuit against the exchange, its CEO, Changpeng Zhao, or CZ, and a former compliance officer.

In the assessment, CryptoQuant also considered the repercussions of negative news on Binance’s bitcoin (BTC), ethereum (ETH), and stablecoin reserves.

According to CryptoQuant, when the CFTC sued Binance, it registered a daily net outflow of -4,505 BTC and -76,146 ETH. The on-chain data analytics provider considered those levels well within Binance’s historical ranges, meaning it was not the worst pullout of funds by investors the exchange had experienced.

You might also like: Crypto markets react to Binance’s battle with CFTC

No FUD formed against Binance shall prosper?

Of the most recent events affecting Binance’s performance, the one that affected its net outflows the most was when the broader crypto market suffered a bout of FUD sparked by fears that regulators were targeting the industry, especially some of its most prominent players such as Binance.

In that period of uncertainty, Binance registered a net daily outflow of -40,353 BTC and weekly losses of 78,744 BTC.

Regulatory FUD also cost Binance about 278,000 ETH, which CryptoQuant noted was well within the crypto exchange’s historical range.

The company also measured Binance’s outflows after the New York department of financial services (NYDFS) ordered Binance’s stablecoin partner, Paxos, to stop minting Binance USD (BUSD).

Per its findings, Binance suffered its most significant net outflow, amounting to -5,027 BTC, on Feb. 12, following the Paxos verdict. Investors also pulled out about 79,706 ETH from the exchange at that time.

Regarding Binance’s stablecoin reserves, CryptoQuant’s assessment shows it had a net flow of -$871 million on Dec. 12, 2022, at the height of the regulatory-instigated FUD.

However, its most significant loss came in March 2023, following the CFTC lawsuit, when the exchange’s stablecoin reserves were knocked back by almost $1 billion, according to CryptoQuant.

Per the assessment, Binance’s bitcoin reserves are still healthy despite the three stress events. If anything, the data analytics company said the exchange’s BTC reserves have grown by about 72,000 BTC since December 2022.

Its ETH reserves have also registered modest growth and currently stand at 4.48 million, up from 4.42 million at the end of 2022.

Read more: Binance may have hidden its presence in China for years