Curve Finance achieves record $7b in daily trading volumes

As crypto whales compete for assets after the USDC depeg, the daily trade volume on the DeFi protocol Curve Finance reached all-time highs on March 11, smashing previous records.

Since the collapse of Silicon Valley Bank (SVB), which triggered a wave of uncertainty across markets and caused USD Coin (USDC) to depeg from the US dollar, Curve Finance surpassed $7 billion in the 24 hours since the event. This is the highest volume the company has ever seen in a single trading day.

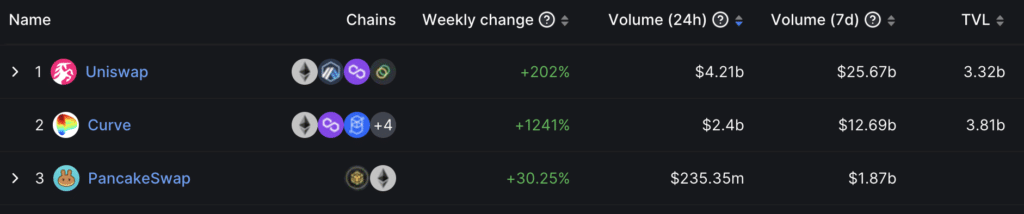

At the time of writing on March 13, Curve Finance’s daily volumes were around $2.4 billion. According to DefiLlama, Curve took second place among DEXes, surpassed by Uniswap only.

The three most prominent stablecoins, USDC, Tether, and TrueUSD, are all supported by Curve’s liquidity pools (TUSD). Due to a sell-off of USDC, the decentralized financial platform is now experiencing imbalanced pools, which has caused the stablecoin to drop below its $1 peg. Fear, uncertainty and doubt (FUD) have spread across cryptocurrency markets over the last few hours.

As of Jan. 31, USDC had a market capitalization of over $42 billion and was the second-largest stablecoin. It is used as collateral in several different stablecoin ecosystems. Its depeg instantly affected other stablecoins, such as the MakerDAO-issued DAI, which has recovered since this article was written.

However, despite these developments, MakerDAO submitted an “urgent executive proposal to limit risks to the protocol” to avoid panic selling. The proposal sought to restrict the ability to mint DAI using USDC.

MakerDAO is one of the major holders of the stablecoin, and it has reserves worth approximately $2.85 billion USDC (3.1 billion USDC), making it one of the most significant holders overall.

Circle announces new USDC minting

Amid the recent depegging of the stablecoin, USDC bulls are active as the stablecoin gained over 4.5% in price valuation at the time of writing. Trading at $0.99, the asset is struggling to peg back to its zone. The stablecoins market cap also increased by over 4%, taking it to $40,826,989,539 as of the time of writing.

Amid U.S. watchdogs’ intervention in the recent market events, Circle has announced the addition of additional financial partners that would facilitate the automatic minting and redemption of USDC for its users. This is part of Circle’s strategy to diversify its banking relationships and protect the foundation of its internet-based monetary and payment systems from the dangers associated with fractional reserve banking.

Even with bank contagion hurting crypto markets, Circle CEO Jeremy Allaire has declared that the business would continue to ensure the trustworthiness, security, and 1:1 redeemability of every USDC in circulation. Currently, short-term U.S. Treasury Bills ($32.4B) account for 77% of the collateral backing the USDC reserve, with the remaining $21.7B held mostly in cash at BNY Mellon.

BNY Mellon acts as custodian, while BlackRock handles active liquidity and asset management of the reserves. Circle publishes monthly USDC attestation reports on its website to be transparent with its investors.