Development Activity Leaders Tend to Lose Their Market Value

“Crypto winter” has created a unique situation in the market as the major development activity leaders (such as Uniswap, Solana, and Polkadot) continue to lose their market price and capitalization.

Development Activity Leaders

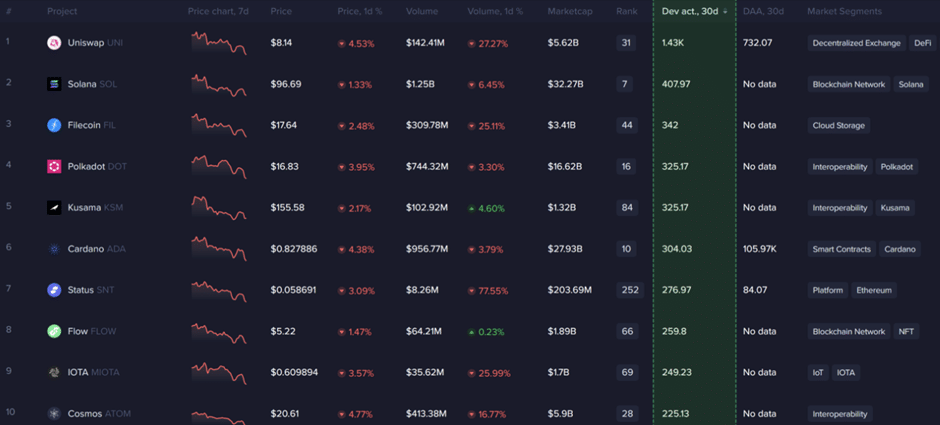

Development activity constitutes an important metric for strategic investors because it illustrates the frequency of GitHub updates made by developers within a specified timeframe. Thus, this indicator confirms the growing involvement of many developers in such projects as well as the likely introduction of new features and expanded functionality in the near future. The latest statistical data on development activity provided by Santiment indicate that the structure of market leaders remains almost the same. Uniswap is the top-cryptocurrency in terms of its development activity, followed by such projects as Solana, Filecoin, and Polkadot.

Among the Top-10 projects that demonstrate the highest rates of development activities, the following spheres remain dominant: decentralized exchange, blockchain network, interoperability, and IoT. Ultimately, all major crypto spheres continue to develop despite the current recession in the market. Vitalik Buterin recognizes “crypto winters” as being the optimal period for making strategic crypto investments that may contribute to the technological development of the major blockchain projects. According to this logic, the above projects (especially UNI, SOL, and DOT) should demonstrate the highest long-term rates of market appreciation.

Price Action: UNI, SOL, and DOT

Despite the expected market and valuation growth in the long term, the current market conditions appear to be highly negative for all development activity leaders. All of the major leaders in this segment have suffered the following losses during the past 7 days: Uniswap has lost 13.5%; Solana – 8.7%; and Polkadot – 10.3%. Their losses are even more significant as compared with such crypto leaders as Bitcoin and Ethereum: -6.2% and -7.3% respectively. These data imply that despite high levels of development activity investments in these cryptocurrencies remain ineffective for short-term investors.

There are several major factors that have contributed to the price and market valuation decline of these projects. First, the reduced investment activity has resulted in the lower demand for decentralized exchange operations. Thus, even the most established DEX projects such as Uniswap cannot maintain the positive dynamics of their prices and market development. Second, the growing risks incurred by the crypto segment contribute to the growing inconsistencies in the utilization of smart contracts and interoperability technologies. Finally, the regulatory measures taken by the Federal Reserve and the rising interest rates in the US prevent investors from investing in high-risk assets, including cryptocurrencies.

Expected Price Dynamics

At the moment, the price dynamics of UNI, SOL, and DOT is subject to both positive (such as innovations and development activity) and negative factors (such as the regulatory policy and the declining demand for crypto assets). However, technical analysis allows determining the major support and resistance levels that will define price movements in the following months.

Uniswap has a strong support level at the price of $7.7 that reflects the local bottom reached within the past few months. Currently, UNI approaches this level with a high likelihood of using it for changing its local trend. At the same time, UNI has the following two major resistance levels: at the prices of $11.9 and $12.8 respectively. Only after exceeding these levels, the token can approach historically maximum levels. Investors are recommended to open long positions only after the current support level is confirmed.

SOL has the major support level at the price of $78 tested several times during the past 2-3 months. As SOL’s price dynamics is mostly horizontal, it needs to overcome the following main resistance levels that prevent it from effectively maximizing its capitalization in the future: $110 and $140 respectively. If SOL exceeds the first resistance level (that may become its new support), a long position can be reliably opened.

Polkadot demonstrates a similar dynamic to that of Solana. The major support level is observed at the price level of $14.2 that allowed reversing the previous negative trend. DOT has the following major resistance levels: $20.5 and $23.5 respectively. Considering the strong resistance at $23.5, sustainable market growth may be possible only after exceeding this level.