Ethereum maintains position above $2k after ETF proposal surge

Ethereum (ETH) has been holding above the $2,000 mark as investment products significantly surged after the exchange-traded fund proposal.

The largest asset manager with $9.4 trillion of assets under management, BlackRock, registered an iShares ETH Trust on Nov. 9. Since the proposal, Ethereum saw a 9% rise, surpassing the crucial $2,000 mark.

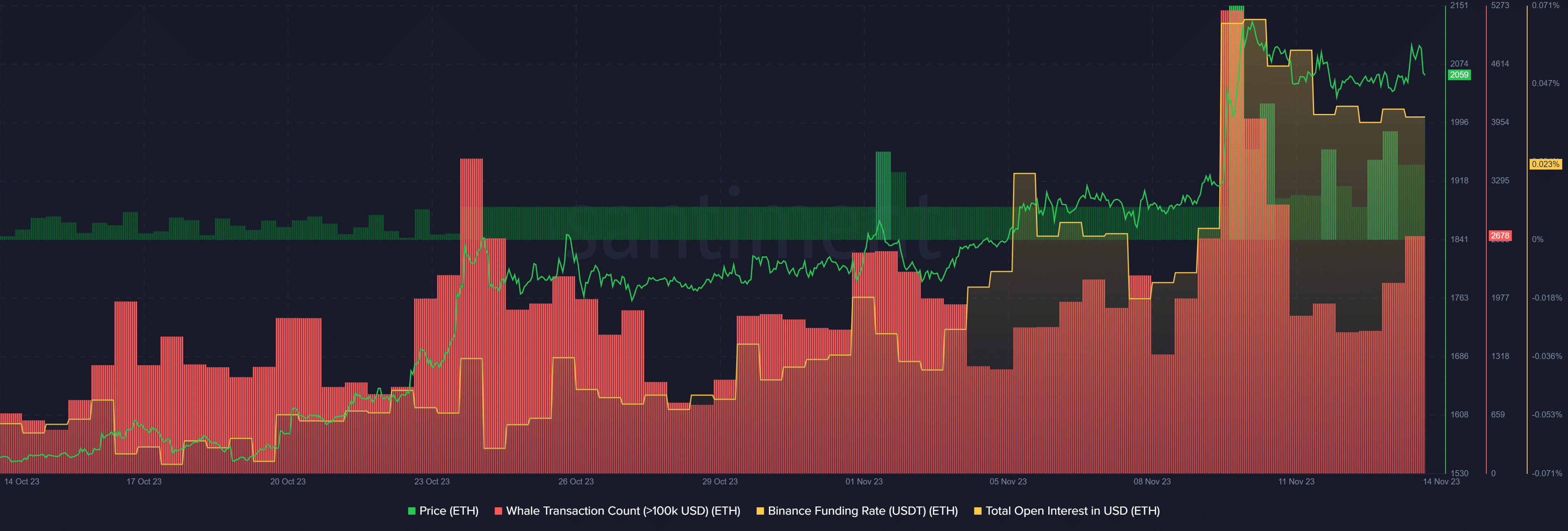

According to data provided by Santiment, following the rise, whale transactions consisting of at least $100,000 worth of ETH surged by 25% over the past 24 hours — hiking from 2,151 to 2,678 transactions over the past day.

According to a crypto.news report on Nov. 13, whales have accumulated over $58 million worth of Aave (AAVE), Ethereum, Arbitrum (ARB), Pepe (PEPE), and a few more altcoins over the past week.

With the hike in whale activity, data provided by Santiment shows that ETH’s price-daily active addresses (DAA) divergence took a deep dive, declining to negative 45.17%. When the price DAA divergence drops to below zero, the indicator suggests a “sell” signal since large whales might manipulate the market.

On the other hand, per Santiment, Ethereum’s total open interest (OI) declined from $4.15 billion on Nov. 10 to $3.85 billion at the time of writing.

Moreover, ETH’s Binance funding rate currently stands at 0.02%, suggesting the dominance of short position holders until further movements.

Ethereum is up by 0.7% in the past 24 hours and is trading at $2,050 when writing. The asset’s market cap rose to $247.5 billion with a 24-hour trading volume of $13.4 billion.