Ethereum price can reclaim $2k in August, Santiment predicts

Santiment predicts that Ethereum price can reclaim the psychological $2k price mark by August.

Since reaching its peak of $2,132 in April 2023, Ethereum (ETH) has struggled to regain its bullish momentum.

According to Santiment, the psychological area of value at $2,000 has become a pivotal point for traders, determining their optimism or skepticism towards the asset. As bitcoin(BTC) dominated the market in June, ETH only managed a meager 4.8% gain against BTC, failing to excite traders.

ETH’s subdued price action has resulted in fewer discussions about the asset, paralleling levels seen in mid-May. However, history shows that altcoins often thrive when traders are fixated on other assets.

Currently, all eyes are on XRP, following Ripple Labs’ partial victory against the Securities and Exchange Commission (SEC) on July 13.

Gauging market sentiment

The report shows that profit-taking still slightly outweighs losses, but this balance could shift if ETH experiences a significant drop, potentially triggering panic selling.

The most favorable opportunities arise when both groups are in negative territory, indicating a potential undervaluation. The report notes that most ethereum tokens remain held in self-custody, with less than 7% residing on exchanges. This suggests a lower likelihood of large sell-offs and reinforces confidence in the asset’s long-term potential.

Ether price analysis and whale movements

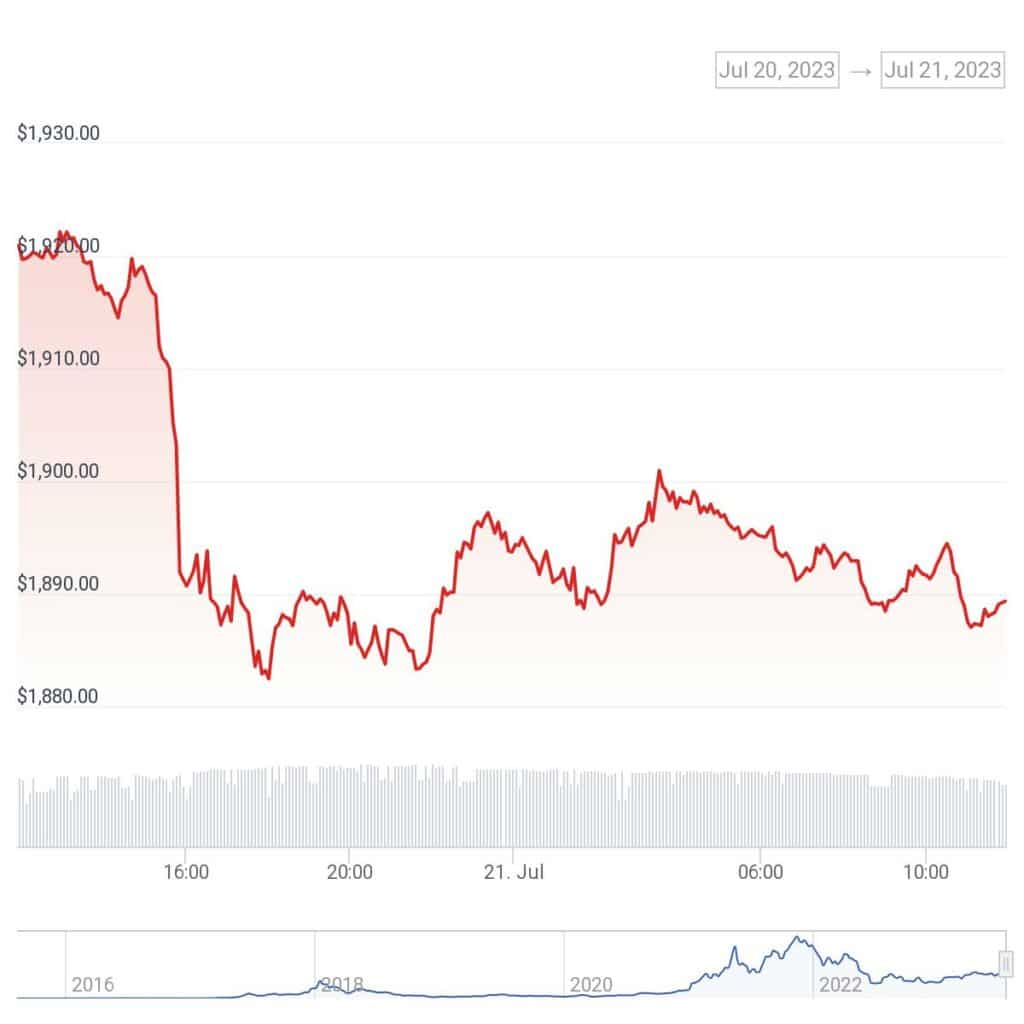

At press time, ethereum (ETH) is valued at $1,892, representing a 5.5% decline over the last seven days. The 24-hour trading volume of ETH stands at $10.4 billion.

With a circulating supply of 120 million ETH, the token has a market cap of $227.2 billion, according to CoinMarketCap.

We can identify some crucial price levels and indicators from the daily chart. The support level at $1,800 may serve as a crucial line of defense against further losses, with buyers likely to step in to defend the price at this level.

On the other hand, the $2,000 level acts as resistance, where selling pressure tends to increase, preventing the price from rising further in the near term. For ethereum to regain bullish momentum and potentially break above this resistance, it would need strong buying momentum and positive market sentiment.

The Relative Strength Index (RSI) on the daily timeframe is currently at 43.34. There might still be room for further downside movement before reaching oversold territory, where a potential rebound could occur.

In the past 48 hours, four large Ethereum holders, often called “whales,” moved 78,900 ETH coins to the cryptocurrency exchanges Gate.io and Coinbase. This significant movement of funds attracted attention in the crypto community.

Additionally, an ethereum wallet that had been inactive for eight years suddenly came alive and transferred 61,216 ETH, valued at an impressive $116 million, to the Kraken exchange. This unexpected awakening of the dormant whale sparked curiosity and could be interpreted as a bearish signal.

However, maintaining a patient outlook, Santiment predicts that ethereum could surge back above $2,000, possibly even before August arrives.