European VC crypto investments at record $5.7b in 2022, DeFi sees 120% increase

Venture capital (VC) investment in cryptocurrency startups based in Europe reached a record high of $5.7 billion in 2022, despite the ongoing bear market and the collapse of prominent industry players like FTX, as shown in a new study released by European investment firm RockawayX.

According to the study, VC investment in crypto startups based in Europe hit an all-time high of $5.7 billion in 2022. European DeFi startups also saw impressive growth, with $1.2 billion invested, a 120% increase from the previous year’s investments of $534 million.

RockawayX CEO Viktor Fischer noted that the crypto market is cyclical, and even during the 2018 “crypto winter,” startup funding activity remained stable.

“Investments made when digital asset prices were depressed materialized in tech and usage traction alongside ‘bull market’ price recoveries.”

Viktor Fischer, RockawayX CEO.

You might also like: First Citizens Bank set to complete SVB takeover

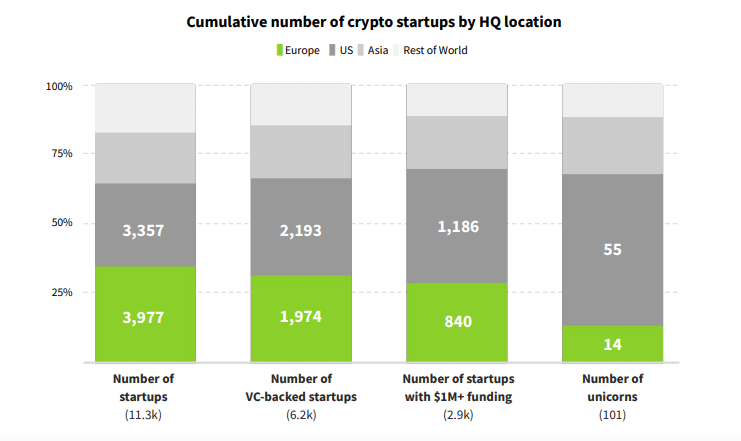

Europe boasts the largest number of crypto startups, with 3,977 based on headquarters location. However, the region lags behind the U.S. in the number of startups backed by venture capital.

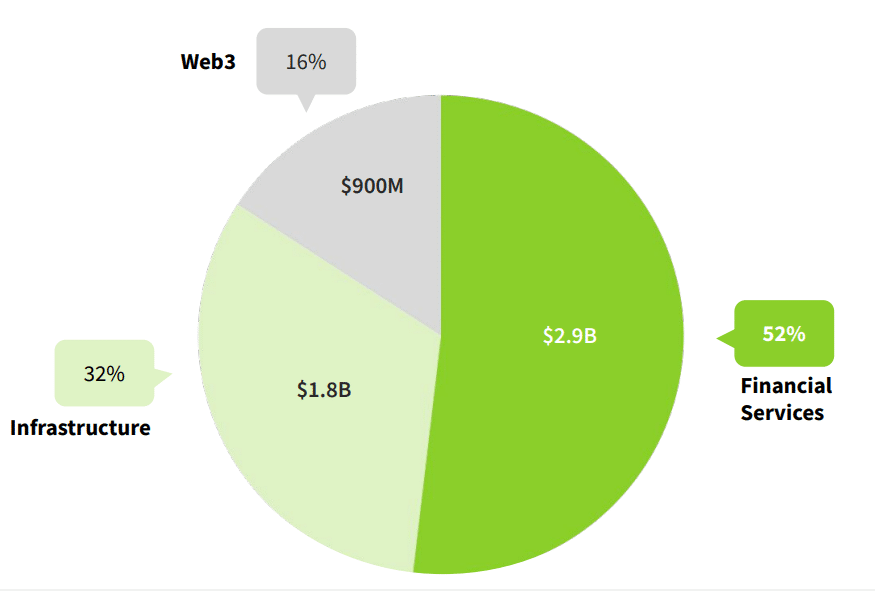

Among the most prominent global investors in European startups are Animoca Brands, Coinbase, Blockchain Capital, and the Digital Currency Group. The financial services sector received 52% of all European startup investments, followed by the infrastructure sector with 32% and the web3 sector with 16%.

However, compared to the previous year, investment in financial service-based startups declined by 19%, while infrastructure grew by 24%.

The anticipated release of the MiCA regulations in April 2023 is expected to cement Europe’s growing status as a crypto-friendly region.

However, the final result of the regulations has been postponed twice by the E.U., both times due to translation issues. Regulations passed in the E.U. must be translated into all 24 languages of the member states.

Read more: Crypto venture firm founder says banking crisis makes crypto bullish