Fee Market Kicks in with Weird Consequences

Bitcoin knocks at its capacity limits. After the Mempool did not empty at the weekend for the first time, the traffic jam on the Blockchain might become a permanent state. Full capacity already bears weird results, like that you can buy faster confirmations with credit cards. What can be done? Is there help in sight?

By itself it is no problem to send bitcoin. All you need is a wallet with manually adjustable transaction fees. Then just look at sites like JoHoe’s MemPool or 21.com’s Bitcoinfees, learn how to read them and calculate the correct fee for your transaction. Either you pay more, or you pay less and wait some time.

The fact is, however, that the Blockchain runs out of capacity, and this bears some weird and inconvenient consequences.

Everything OK – or not?

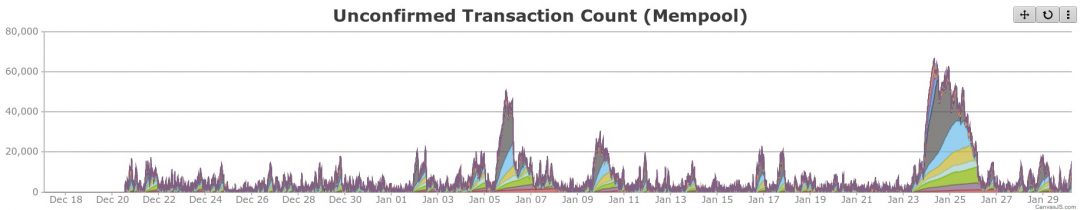

Until now the growth of the Mempool of unconfirmed transactions has been mostly unproblematic. Usually, everything was fine, and the Mempool was low. Sometimes it inflated, and you had to compete with others in a fee market for block space, but if you waited for the weekend, even a transaction with a very low fee went through smoothly.

Such a state was not perfect, but it was ok. It might, however, happen that it ended on the weekend of March 4-5.

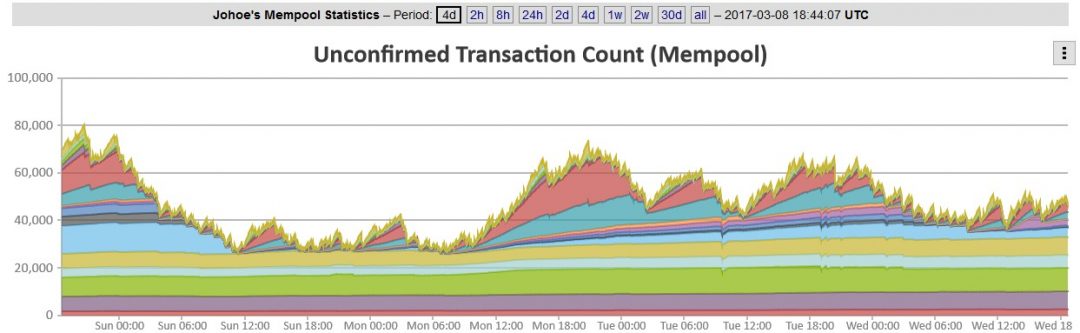

The week ending March 5 already saw, at most time, a queue of 20,000 to 50,000 transactions waiting to get on the block. But as the Mempool cleared on the weekends, it was possible to receive transactions with low fees and to merge your inputs cheaply. This exactly was, what did not happen over March 4-5. According to JoHoes MemPool-Visualization the MemPool contained at no day on the weekend less than 30,000 transactions or 50 MB; on Tradeblock it fell on 15,000 or 20 MB (the differences are the result of different Mempool politics).

Strange Consequences of the Fee Market

It is possible and desirable that the queue of unconfirmed transactions clears during this week or the next weekend. With “only” 70 MB the MemPool is big, but not difficult to handle. As long as it is below 150 to 200 MB, there is no reason to worry.

But right now, after three weeks in which a full Mempool has been more the rule than the exception, we can already document some weird and inconvenient consequences of the rising fee market.

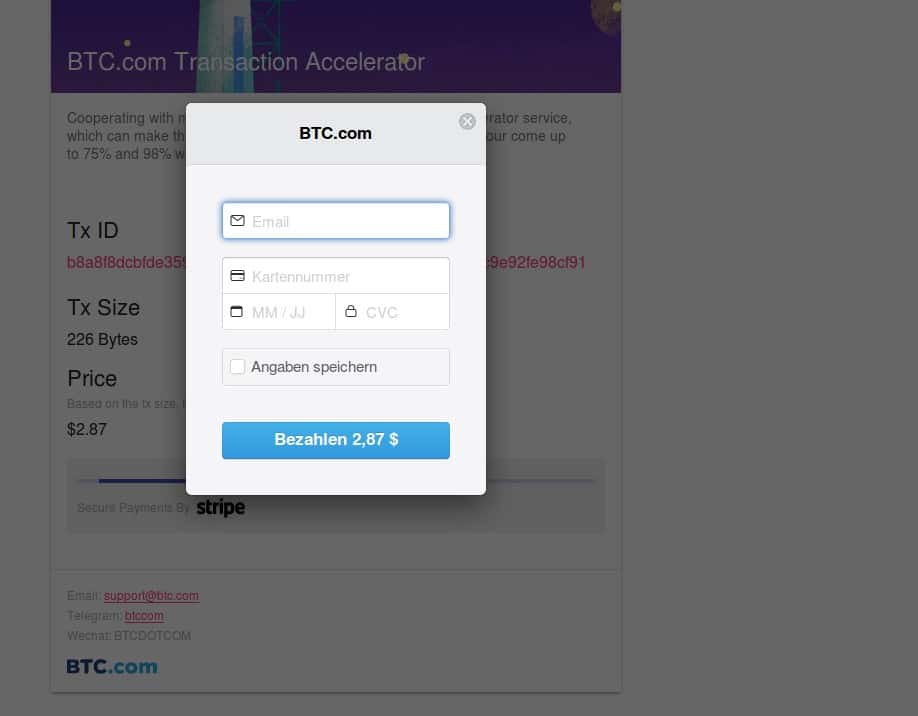

BTC.com offers to Pay for Confirmation, with Credit Cards

The website BTC.com is owned by BitMain, the producer of the AntMiner series and the owner of AntPool. Since recently, it provides the option to speed up a confirmation for a specific transaction. Payment for this service only happens with a credit card. Secure, cheap and fast with Stripe.

That you have to make a payment with a credit card to get your bitcoin transaction confirmed is somehow profoundly ironic. Bitcoin was made to replace credit cards right? It feels like you need to write a letter to get an email through,because the internet runs out of capacity.

A large Part of the UTXO is Smaller than the Fees Required to Send it

Bitcoin are stored in so called UTXO, short for “unspent outputs,” that is any balance in bitcoin which is assigned to a certain address and not spent by now. Any payment with bitcoin deletes an UTXO and creates a new one, making bitcoin like real coins, sitting in your wallet with different denominations.

However it is possible to build very small UTXO, like 10 cents, 50 or even 0.01. Due to the change, most transactions do contain this happens quite often. This small UTXO has now become partly unspendable. According to Bitinfocharts more than 50 percent of current UTXO have a balance smaller than 0.001 Bitcoin (roughly one dollar.) Under current fee rates, a significant part of these UTXO cannot be spent without very long and unpredictable confirmation times.

Old Wallets Stop Working

Good for you, if you have a wallet with a well-balanced fee policy, but bad for everybody who does not have one. If you store your bitcoin on old wallets, not updated for a year or two, the chances are good that the fee calculation is broken and that you have no option to set them manually. In this case, your wallet is more or less unusable. The fee market partly destroys backward-compatibility of wallets.

What Can You Do?

For most users, this situation is rather inconvenient. You need a good wallet, and you need to know the correct fee rates. To correctly handle Bitcoin transactions is going to become a science.

Unfortunately, there is no ‘master plan.’ It might be helpful to use wallets like Electrum or GreenAddress, which have implemented Replace-by-Fee (RBF) and allow users to resend a transaction with higher fees.

But if it is too late, if a payment was made, without RBF, without the correct fees – what can be done? Often not much; you can use the free transaction accelerator of ViaBTC, but do not have high hopes, as they only accelerate a certain number of transactions each hour. Also, what could be helpful is the paid accelerator of BTC.com.

A more tricky option is to try to double-spent the transaction; export the private key, import it on another system, write the transaction again, but this time with higher fees. If you are lucky, it works. With some luck, you might also be able to use Child-Pays-For-Parents, which means that you take the change of your unconfirmed transactions – which is usually instantly back in your wallet – to create a new transaction with huge fees. This might incentivize miners to confirm your first transaction since they want the fees for the second.

But there is no ‘master plan’ that always works. Unfortunately.

How Long will this Go On? Is Help in Sight?

In current Bitcoin communities, the question how to escape this situation might cause serious disputes. Yes, there are options available to solve this problem by increasing the capacity of the Blockchain. But the community has not agreed on a solution, instead fighting amongst each other with growing hostility.

In short, the Core developers accuse the miners of acting to “block” SegWit and with this a small increase in the limit, while the miners accuse Core of blocking a real, sustainable block size increase with a hard fork, like Bitcoin Unlimited offers. The result; Core devs are unwilling to code a hard fork, and miner’s do not want to activate SegWit. Stalemate.

If the fee market is really a bad thing, or even a good one, depends on the perspective. If you like to collect bitcoin in Faucets, mine nano-amounts or use bitcoin for micropayments, then the fee pressure is bad news for you. It is also unfavorable if you want to pay coffee with bitcoin or are from a developing country, where $0.50 may be a significant amount of money. Such things are priced out, as the fee market prunes use cases of Bitcoin.

For those however who think Bitcoin primarily should be digital gold, everything is fine. A Bitcoin transaction still is tremendously faster and cheaper than the transport of gold or the exchange of shares and securities. And if you do a bitcoin transaction worth something like $10,000 or $1 million – then bitcoin still is extremely cheap and fast and secure.

Also, the price does not seem to be harmed by the capacity problem. If there is any correlation, it is that the prices rises when the Mempool is full. So independently how the story goes on – if we get more capacity with SegWit or Unlimited or not at all – Bitcoin will not die by it. But it will be seen, what bitcoin, the currency becomes and may be on a crossroad for its future form.