FTX unveils FTX 2.0 strategy, FTT token surges 17%

Under the guidance of CEO John Ray III, FTX unveiled resurrection plans in a new project known as FTX 2.0.

Documents recently filed in the United States Bankruptcy Court for the County of Delaware provide insight into the comprehensive planning and execution of the relaunch by John Ray III and his team.

Ray invoiced the company’s bankruptcy estate for over $290,000. FTX also paid an extra $1.3 million to other workers who took over the exchange and were responsible for the insolvent division.

The filing showed that Ray was actively involved in developing the strategy for FTX 2.0, even though he claimed to spend most of his time on administrative and legal matters.

Lawyers for FTX in bankruptcy court, Sullivan & Cromwell, revealed last month that the CEO had been busy with several projects, including advising cybersecurity firm Sygnia on how to improve its global cryptocurrency platform, reviewing the terms sheet for the exchange’s restructuring plan, investigating the steps required to relaunch the platform, and finalizing the FTX 2.0 document for distribution to potential investors.

According to the court documents, John Ray III researched possible buyers for FTX 2.0. Particularly noteworthy is the interest of venture finance company Tribe Finance in reviving the defunct crypto exchange.

FTT rallies ahead of reports

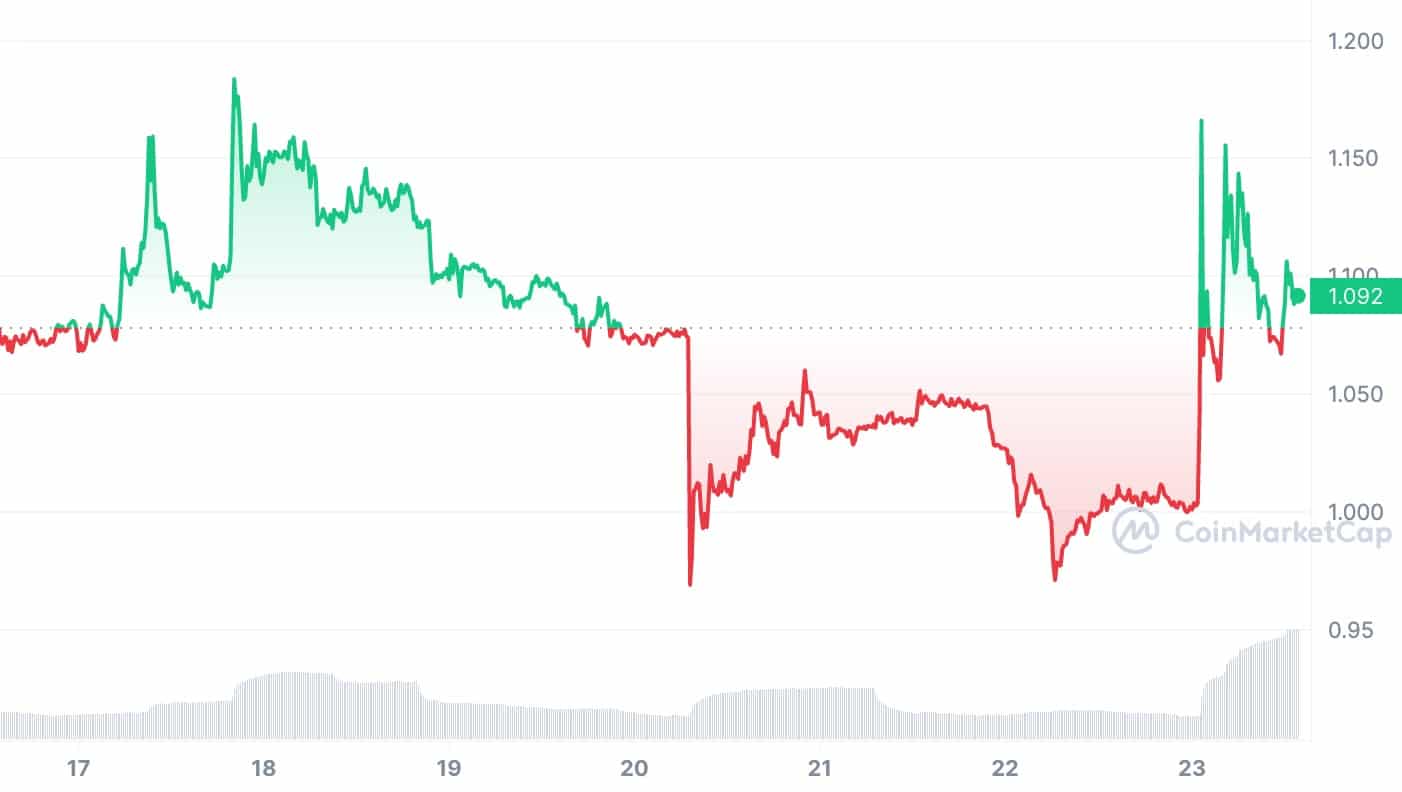

The native token of FTX, FTT, saw an 8% increase to trade at $1.08 as of press time, down from a high of $1.16, as the news of FTX’s resurrection and ambitious aspirations spread. Refreshed faith in FTX’s potential under the new FTX 2.0 architecture has been reflected in the market.