How the Stablecoin Segment Transforms Following the UST Collapse

While Terra’s market failure and the collapse of its stablecoin UST negatively affected investors’ confidence in stablecoins, some projects had appeared to be more sustainable in effectively meeting such challenges and even strengthening their positions in the market.

Quantitative Tightening in the Crypto Industry

The UST inability to maintain its peg with the US dollar caused many traders and investors to question the adequacy and sufficiency of reserves held by other major stablecoins. According to Morgan Stanley’s analysts, the current situation in the crypto industry can be compared with the monetary tightening policy implemented by the Federal Reserve. The reason is that the actions of investors and stablecoin holders prevent the crypto market from unjustifiable expanding the supply of tokens, thus creating the risks of the inability to maintain the declared 1:1 parity with the US dollar.

Similar tendencies are also observed in the DeFi segment. In particular, the situation in Binance, FTX and Bitfinex indicates that many holders tend to swap their USDT for other stablecoins they perceive as being more sustainable. The reason is that USDT also experienced some short-term problems with maintaining its peg with the US dollar following the UST collapse. Although the independent audit confirmed the sufficiency of the USDT liquid reserves to maintain its operations, some market actors till prefer to reallocate their funds to minimize potential risks. The significant reduction in leverage in the DeFi segment occurs due to the higher levels of risks recognized by investors.

Stablecoin Segment After the UST Collapse

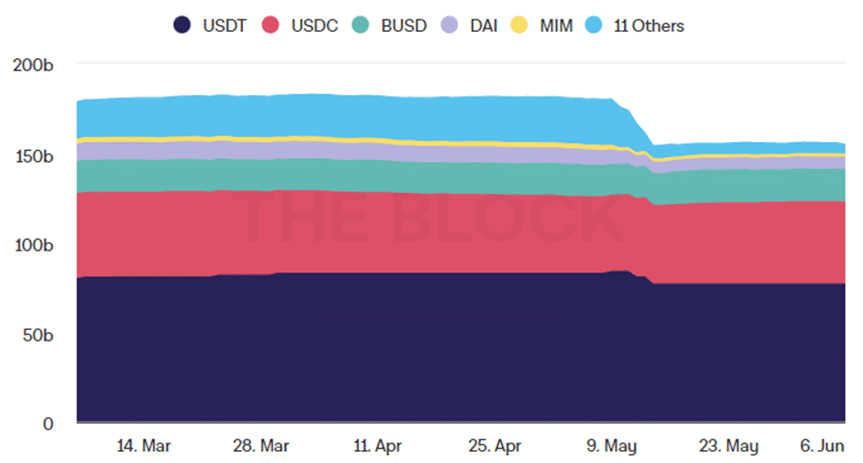

The overall stablecoin segment experienced the considerable decline following the UST collapse for the following two major reasons. First, the UST constituted the third largest stablecoin in the beginning of May, and its unpegging inevitably resulted in the diminishing capitalization of stablecoins. Second, the panic caused by this crisis provoked the rapid redistribution of funds from stablecoins to alternative assets. At the moment, the total market capitalization of all stablecoins is about $157.4 billion, while that was $179.85 billion in the beginning of May prior to the UST failure.

Figure 1. Total Stablecoins Supply (3-Months); Data Source – The Block

At the moment, the following five major stablecoins control more than 95% of the stablecoin segment: USDT, USDC, BUSD, DAI, and MIM. USDT remains the segment leader with its market share being equal to 49.89%. USDC experiences the major relative growth among fiat-backed stablecoins due to the high liquidity of reserves held. Its market share has increased from 24% to 29.5% during the past month. BUSD has become the third largest stablecoin in the market with its market increased from 8.8% to 11.8% mostly as a result of its main competitor’s collapse.

Changes Among Fiat-Backed and Algorithmic Stablecoins

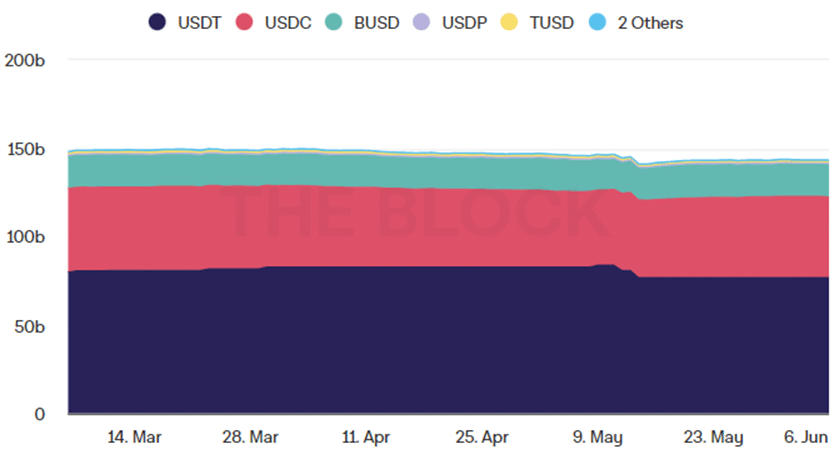

The total fiat-backed stablecoin supply has slightly declined after Terra’s crisis: from $146.3 billion to $143.3 billion as the most popular fiat-backed stablecoins were able to successfully confirm their stability. Moreover, the major changes were caused by the declined USDT supply with many traders being reoriented to USDC and BUSD. In particular, the USDT supply declined from $84.2 billion to $77.2 billion during the past month. In contrast, the USDC supply increased from $43 billion to $45.6 billion, and the BUSD supply rose from $16.9 billion to $18.05 billion. Thus, the major tendency among fiat-backed stablecoins is the weakening positions of USDT and the strengthening positions of USDC and BUSD, while other projects do not play any important role at the moment.

Figure 2. Total Fiat-Backed Stablecoins Supply (3-Months); Data Source – The Block

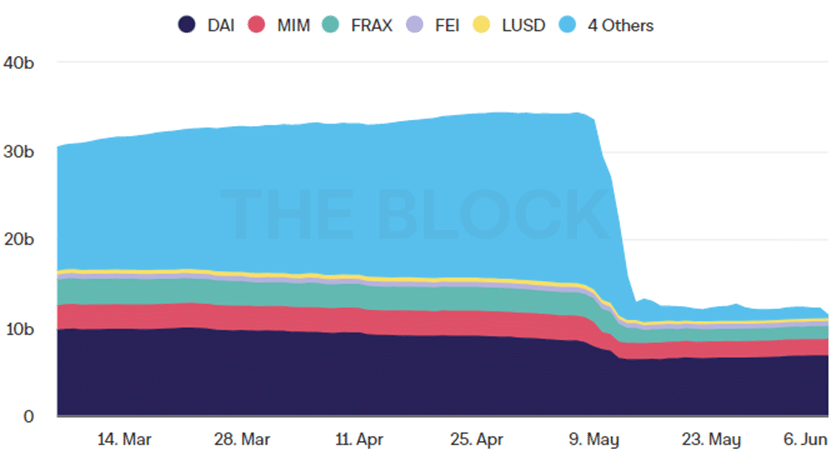

The situation is different for algorithmic stablecoins. Its total supply declined drastically from $19.3 billion to $11.35 billion as the UST was the largest algorithmic stablecoin prior to its collapse. DAI has become the leading algorithmic stablecoin in the segment. While its absolute positions somewhat weakened with its capitalization declined from $8.5 billion to $6.84 billion, it was still able to confirm its sustainability and effectiveness in keeping excessive reserves to account for potential cryptocurrency fluctuations.

Figure 3. Total Algorithmic Stablecoins Supply (3-Months); Data Source – The Block

The similar trend is observed in regards to MIM that experienced the moderate decline in the market capitalization from $2.8 billion to $1.9 billion but solidified its presence as one of the major algorithmic stablecoins in the market. Other projects, such as FRAX, FEI, and LUSD remain comparatively insignificant.