HUMA Finance token falls over 45%, erasing post-launch gains

Huma Finance’s native token, HUMA, has plunged 45%, wiping out post-launch gains, though the token continues to attract attention with trading volume still exceeding $600 million.

Huma Finance (HUMA) has erased its post-launch gains, plunging 45% in the past 24 hours and currently trading at $0.062. This follows a spike to $0.12 after its Token Generation Event on May 26. Despite the price drop, trading volume remains strong, exceeding $600 million in the past 24 hours.

HUMA was launched via Binance Launchpool, where users could farm the token by staking Binance Coin (BNB), FDUSD, or USD Coin (USDC) between May 23 and May 26. As is common with Binance Launchpool projects, HUMA was quickly listed on other major exchanges, including Bybit, OKX, Bitget, MEXC, Gate.io, KuCoin, and BingX.

During the TGE, Huma Finance also opened the claim window for its Season 1 airdrop, allocating 5% of the total token supply to early adopters. The claim period will remain open for one month. A second airdrop, covering 2.1% of the total supply, is scheduled for approximately three months after the TGE.

What is Huma Finance?

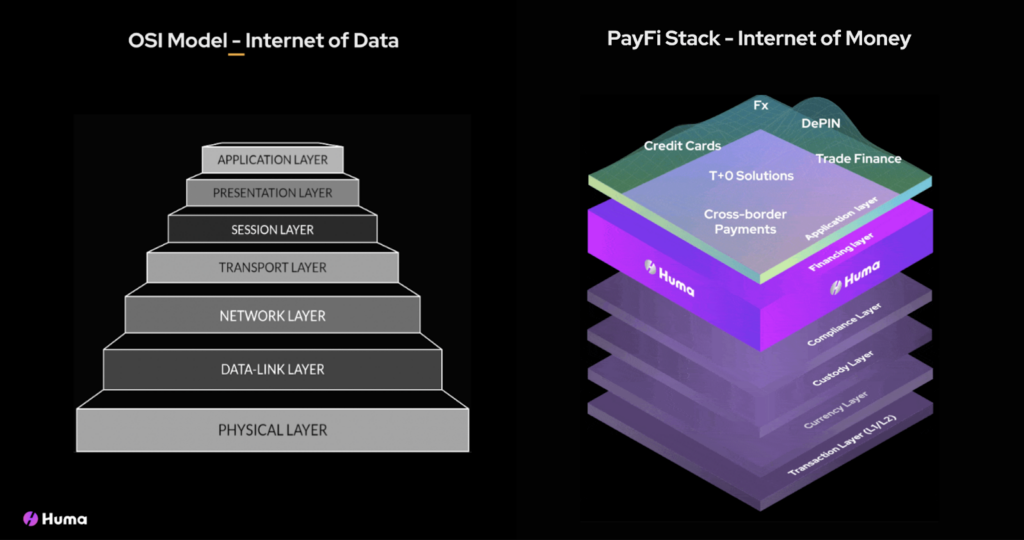

Huma Finance is developing a new financial infrastructure called the PayFi Stack, aimed at replacing outdated TradFi systems with faster, programmable, and globally accessible alternatives. The PayFi Stack is designed to standardize and scale blockchain-based financial applications, enabling seamless integration of payments, credit, and compliance on a global scale. It consists of six core layers, each performing a distinct function to support the overall system.

At the base is the transaction layer, which uses Layer 1 and Layer 2 blockchains to ensure high-speed, low-cost, and secure transactions. Above this is the currency layer, which manages digital currencies—especially stablecoins like USDC and PYUSD. These stablecoins ensure price stability and regulatory compliance, with some offering yield to offset transaction costs. The currency layer also includes programmable stablecoins that embed conditions directly into payments.

The custody layer focuses on secure and efficient asset management. It supports various custody models, from institutional solutions using multi-party computation to decentralized smart contract-based methods. These systems allow real-time settlements (T+0) without compromising asset control or security.

Next is the compliance layer, which handles regulatory requirements such as KYC, AML, and stablecoin licensing. It integrates real-time compliance checks into the transaction flow, adapting to regional regulations like MiCA in Europe or frameworks in Singapore and Japan.

The financing layer enables on-chain capital markets by connecting fund supply with demand. It allows the tokenization of real-world assets, structured using smart contracts to create different risk tranches. Finally, the application layer sits at the top, allowing developers to build financial products like payment gateways, lending platforms, and investment tools. These applications draw on the capabilities of the lower layers to ensure speed, compliance, and ease of use, emphasizing strong UX design and secure transaction handling.

HUMA is central to the Huma Finance ecosystem, functioning as a governance token. It’s also used for staking to help secure the network and reward participants. Additionally, HUMA serves as an incentive mechanism, distributed to liquidity providers, borrowers, and active users to drive ecosystem growth. Holding or staking the token can also provide eligibility for future airdrops, with the second distribution scheduled to take place approximately three months after the TGE.