Indian Financial Institutions Developing ‘Tap & Go’ Services

The Institute for Development and Research in Banking Technology (IDRBT), a banking research institute established by the Reserve Bank of India (RBI) and other major financial establishments in India, are increasingly working on developing contactless transaction-based financial networks to aid migrant workers and expat employees.

The IDRBT has been incubating and assisting startups with state-of-the-art banking and financial technology products and services that are on par with current global technology trends and regulations of the Indian banking and financial sector.

By providing training and consultancy services for startups and entrepreneurs, India’s reputable financial establishments have been focusing on enhancing the country’s banking sector, technology infrastructure, financial services, and products for migrant workers.

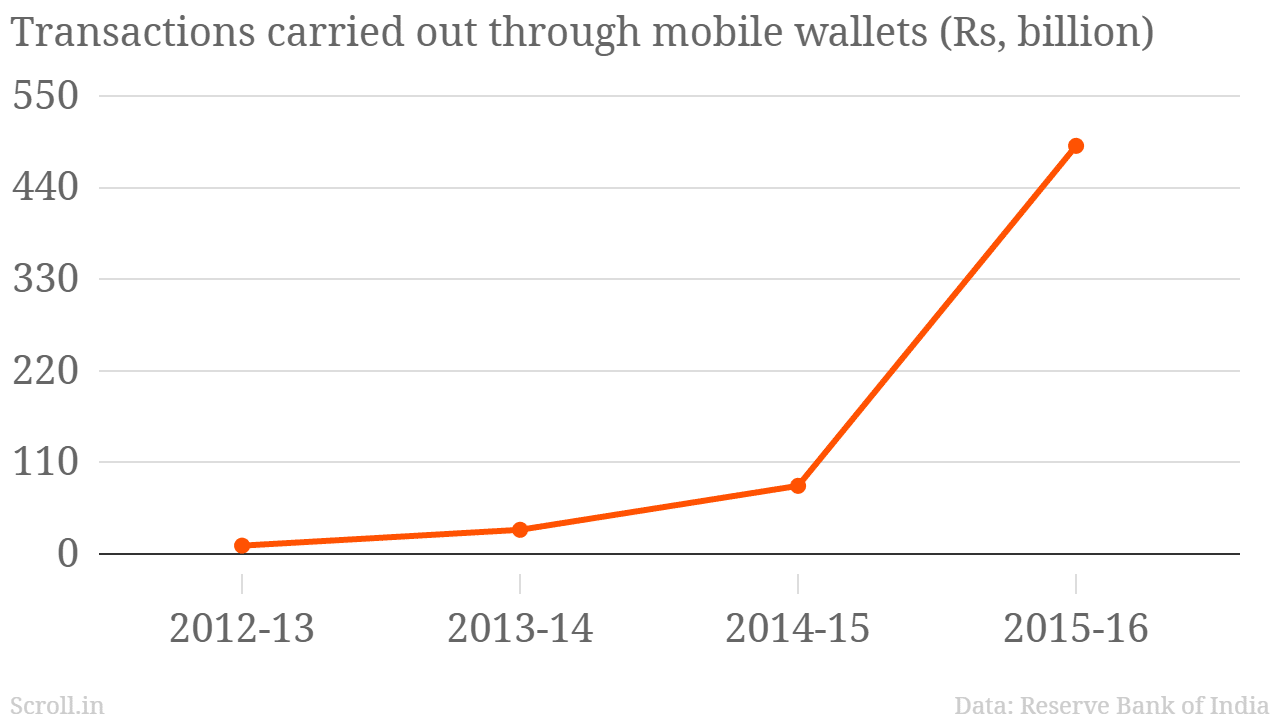

The emergence of financial technologies and innovative startups led to a surge in the popularity of mobile banking, social media banking and the usage of electronic wallets. Over the past year, the presence of “non-bank players” or independent financial service providers have become increasingly crucial to the country’s financial ecosystem. Data from the RBI also shows that the use of mobile wallets has exploded over the past four years.

“The Banking Industry in India has been undergoing a rapid transformation and their significant focus is on driving electronic payments through mobile banking, social media banking, wallets and other consumer-centric payment services,” explained the IDRBT. “With the payments landscape fast evolving with new payment systems being implemented and payment banks emerging as new players, the role of bank and non-bank players in electronic payments and financial technology is becoming important for the ecosystem.”

However, a recent survey published by the IDRBT noted that migrant workers and expat employees are very limited in the ways they can send money to their relatives across the world. The organization states that the majority of migrant workers are using cash transfers to settle international transactions which are far more inefficient compared to electronic payment channels.

Rajashekara Maiya, head of product strategy at EdgeVerve, highlights the savings that could be made implementing cryptocurrencies for international payments, “In India, which happens to be the biggest market for remittance at over $70 billion, the highest transaction amount is as low as $200. Even for such amounts, users pay about 15 percent fees to the banks or other intermediaries. Once implemented, blockchain can allow the remitters to save about $7 billion.”

Targeting this international issue of the country’s workers, IDRBT Director S. Ramasastri stated in a recent interview with the Business Standard India that variations of digital currencies are to be introduced to optimise transfers of money.

“IDRBT has been working on some of the latest technologies like Merkle Trees that provide the foundation for Blockchain-based digital ledgers, which in turn are the base on which cryptocurrencies are built. In addition to the existing centres on mobile payments, cyber security, analytics, cloud computing and open source technologies, it is in the process of setting up a centre focusing on payment systems to focus on research in the area,” said Ramasastri.

With the development of Merkle Tree and Digital Ledger-based financial systems, Ramasastri and other experts, including Cisco India and SAARC’s Arindam Mukherjee, believe that cryptocurrencies will bring a major technological innovation to India’s economy as it did to many others.

“Cryptocurrency, mining-based internet currencies where encryption is used to regulate the generation of currency units, are the new kid on the block in the digital currency space, with Bitcoin being the best known amongst players (others include Litecoin and Dogecoin). The technology this rides on, the blockchain, is the major technological innovation that Bitcoin brought to the table for the finance sector,” stated Mukherjee.

Currently, the IDRBT and its partnering startups are planning to roll out various products and digital financial networks that will reduce costs, time consumption, and high fees for expat workers and businesses in India when settling both international and local payments. Although the government-funded IDRBT is hinting at developing their own digital payment networks and cryptocurrencies, they are studying Bitcoin and researching the benefits of using the digital currency in India’s economy today.

The National Payments Corporation of India (NPCI), the umbrella organisation for all retail payment systems in the country, are also looking into digital micropayments for merchants and for customers, while also researching the potential implementation of ‘Tap & Go’ payment services in the country.

“There is a need for ‘Tap & Go’ based payments and in this regards, experiments have been undertaken. This year, there are plans to launch National Common Mobility Card which can be used while travelling on all metros, buses and suburban trains in an interoperable way. NPCI specifications on National Common Mobility Card have been adopted for BMTC bus rides in Bengaluru. Similarly, there are plans to use Tag based toll gate payments which will enable the vehicles to move freely through the toll gates,” explains P. Hota, CEO of NCPL.

With financial establishments citing importance for innovative financial products for merchants and consumers, bitcoin companies in the country are partnering with international bitcoin merchant payment service providers to enable retailers and merchants in India to process their sales with Bitcoin.

Given around 60 percent of India’s population are unbanked, many experts see India as holding a lot of potential for bitcoin adoption and usage. At present, over 800 bitcoin are traded daily in India. On June 28, India’s largest bitcoin exchange partnered with the Amsterdam-based BitPay to allow merchants to accept bitcoin payments without having to deal with price volatility or regulatory issues.

“Coinsecure’s new payments service, built on the BitPay API, will help to change that. Their platform will allow merchants in India to accept bitcoin payments without the price volatility or legal and accounting complications of holding bitcoin,” said BitPay Marketing and Communication Specialist James Walpole.

Some of the largest bitcoin companies including BitPay are making their move to enter India’s financial industry to resolve the issues cited by notable financial establishments like the IRDBT and NPCI. Since the country’s regulatory bodies are keen on helping digital currency startups grow, the ecosystem of cryptocurrency startups will see a surge in their growth in the near future.