Joe Biden quits campaign: What it means for crypto

It’s important to stress that Joe Biden will remain president for the rest of his term. The question now is who will replace him in November’s election against Trump.

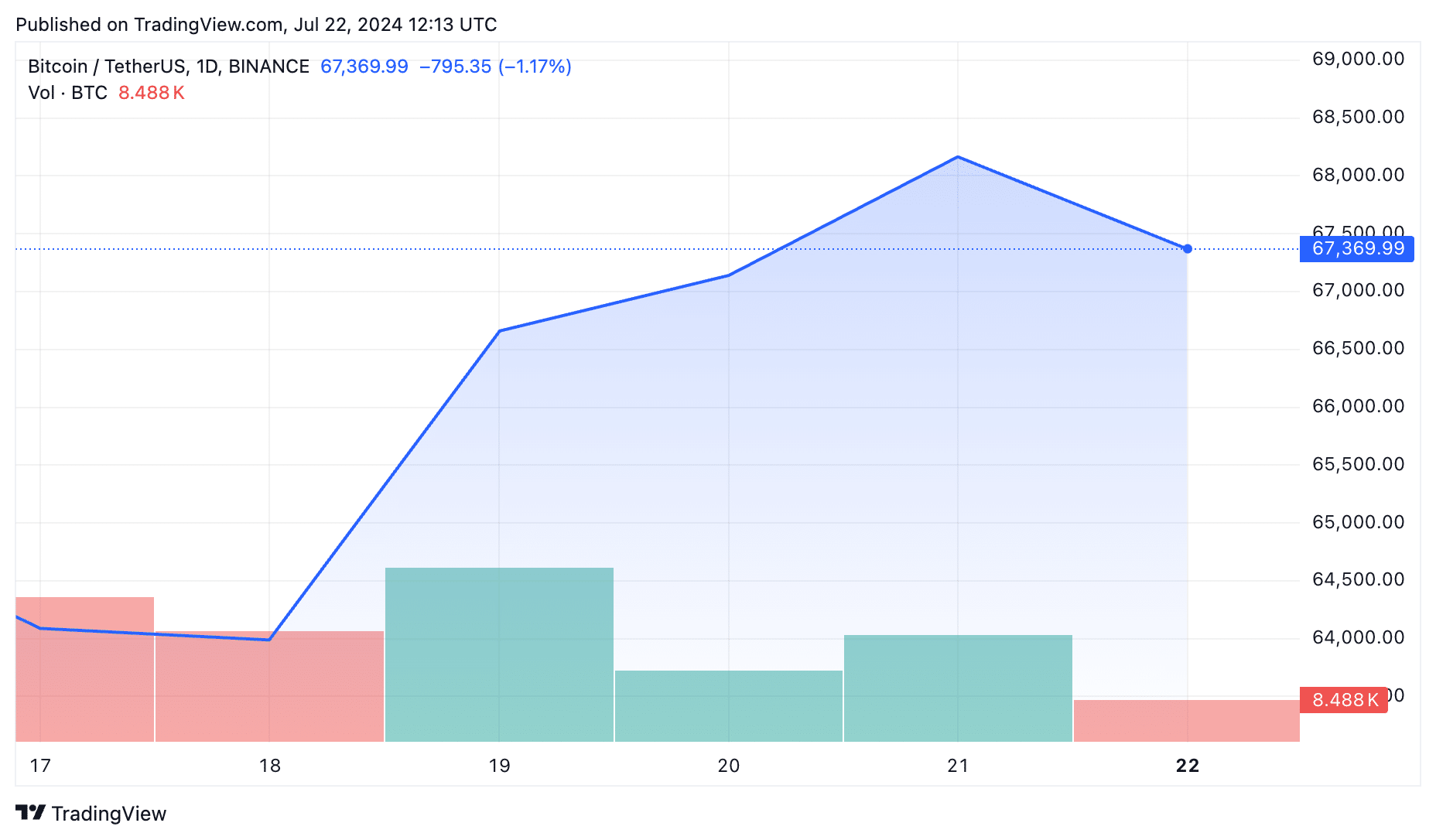

Joe Biden’s abrupt departure from the U.S. presidential race initially caused some panic in the crypto markets.

Bitcoin fell by close to $1,500 in a little under 30 minutes as investors digested the news, with uncertainty about who might take over as the Democratic nominee.

But the downturn was short-lived to say the least as traders began to realize that, at least when it comes to crypto policy, this could be something of a bullish development.

Industry leaders have been left exasperated by the Biden administration’s approach to digital assets amid claims it has stifled innovation and ultimately contributed to consumer harm.

Back in March 2022, there had been optimism when the president signed an executive order on cryptocurrencies — and tasked government agencies to assess their risks and benefits.

At the time, Coinbase declared that it adopted a “rather neutral stance” toward digital assets — and was “a sign that the White House is taking the promise of this technology seriously.”

Six months later, Biden released an official framework setting out how crypto should be regulated. But many in the industry felt it was light on detail and substance.

Of particular concern was a lack of clarity over which agencies should be tasked with overseeing the market — creating something of a tug of war between the Securities and Exchange Commission, and the Commodity Futures Trading Commission.

Coinbase has been repeatedly banging the drum for action — and in June 2023, the exchange’s chief legal officer Paul Grewal warned the U.S. is “falling behind” compared with other countries.

“The U.S. is pushing the technology and the innovators overseas due to lack of clear rules and regulations for crypto. The rest of the world is not waiting for us, and they are taking advantage of our absence.”

Paul Grewal

Grewal went on to praise the bipartisan efforts made by Congress to deliver clear rules of the road for crypto firms to follow — but to this day, tangible legislation is yet to emerge.

Most recently, Biden controversially vetoed a bill that would have scrapped a controversial accounting policy enforced by the SEC, known as SAB 121.

Kirstin Smith, the CEO of the Blockchain Association, declared that this rule was “nothing more than a punitive, anti-digital asset tool” — and one that made it prohibitively difficult for financial institutions to custody crypto on behalf of their customers. At the time, the president had said:

“My administration will not support measures that jeopardize the wellbeing of consumers and investors. Appropriate guardrails that protect consumers and investors are necessary to harness the potential benefits and opportunities of cryptoasset innovation.”

Joe Biden

And while the president said his administration was “eager” to work with Congress in developing “a comprehensive and balanced regulatory framework,” one is yet to emerge.

At times, Biden’s administration also inadvertently became caught up in one of the biggest scandals to ever overshadow the crypto industry: the sudden collapse of FTX.

Disgraced CEO Sam Bankman-Fried had donated $5.2 million to Biden’s presidential campaign in 2020, making him the second-largest contributor.

SBF had also given tens of millions of dollars to Democratic candidates before his empire crumbled, and it emerged that customer funds had been misappropriated.

White House Press Secretary Karine-Jean Pierre later faced uncomfortable questions about when this cash would be returned to help compensate the victims.

What happens now?

It’s important to stress that Biden will remain president for the rest of his term — but at the moment, he’s still recuperating from COVID in Delaware.

Now, attention is turning to who will take over as the Democratic nominee — and while current Vice President Kamala Harris appears to be an early favorite, there are no guarantees.

Jake Chervinsky, chief legal officer at the Variant Fund, says the party now has “a huge opportunity to win back a big share of the crypto vote.”

On X, he called for the new candidate to:

- Recognize crypto as an important technology and commit to ensuring it flourishes

- Accept that the SEC’s approach to regulation has failed

- Set out policies that strike a balance between innovation and consumer protection

- Outline who would lead key agencies such as the SEC and CFTC

- Collaborate with entrepreneurs and investors in the crypto industry

In the coming days, it should become clearer who will be taking on Trump in November — but no matter which Democrat it is, they’re very unlikely to be as pro-crypto as the Republican ticket.