Largest Ever Bitcoin Short Trade ($119 Million) Closes on OKEx

In the current gradual climb in the price of bitcoin, a trader has exited a short position worth a blistering $119 million. As bitcoin slowly regains both respectability and value with almost genteel trading over the last few weeks, previous short positions are evaporating. Although the price rise has been gradual, it was enough for the holder of a massive short position to have to cash in.

A short position is a common trading ploy, and virtual coins and virtual exchanges are not exempt from the tactic. In essence, “shorting” involves betting on a price dipping and thus borrowing stock of whatever nature (in this case bitcoin) and replacing it later for cheaper, after that price tumble. The short position never has to outlay buying capital as the assets are borrowed, but can score handsomely when their replacement value dips by pocketing the difference.

The Risks of Short Selling

The margins and futures market is risky because there are other considerations to any short position. The owner may call the deal at any point, and in the worst case scenario, prices actually go up, not down, and the short position holder then is obliged to replace the borrowed goods at whatever current market value might be, even at a personal loss.

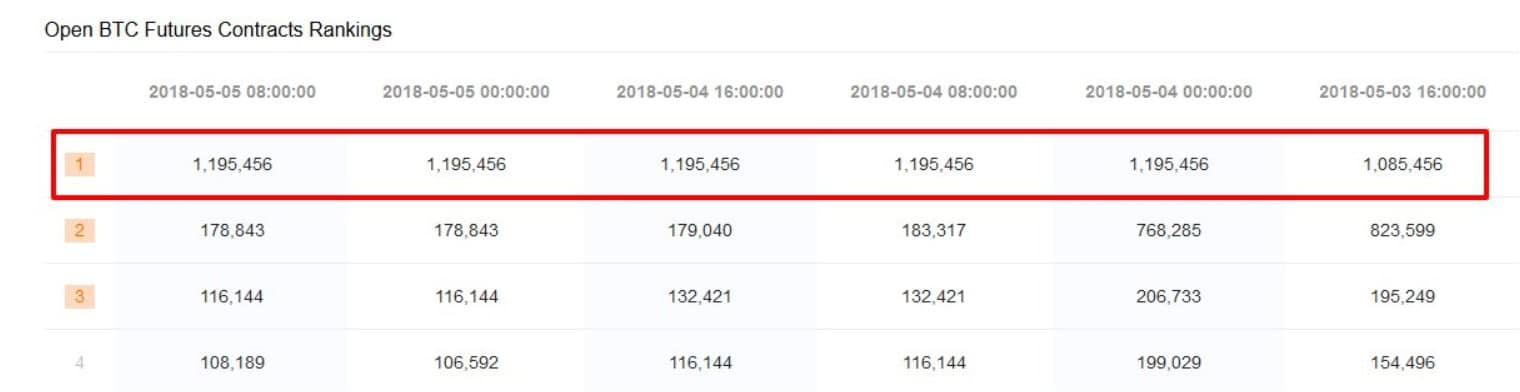

Source: BTCVIX Twitter

The OKEx exchange was launched by OKCoin and has maintained a clean bill of health, in spite of rumors that forced it to halt trading on occasion.

The top-listed short spot on OKEx has now bailed on any further HODL strategies and exited the position, possibly losing substantially.

Trader, in this case, would have lost $1.9 million if leverage was 100x or $19 million if leverage was 10x. In either case, that’s a lot of money to lose.

The second weightiest short position on OKEx was worth $73 million and has also closed with bitcoin now hovering around the $10,000 mark. In the far more volatile altcoin market, short positions become even riskier than they typically are in other markets. Shorting sees a trader borrow bitcoin at, say, $8,000 in the anticipation that it will still plummet to $4,000 in value.

The trader sells the bitcoin immediately at the prevailing price, even though it is borrowed, and waits for the price to plummet. Once the price has dipped substantially, from the proceeds of the original sale, the trader will buy and replace the borrowed bitcoin and declare a profit of whatever is left, as a difference between what they made selling borrowed goods and what they spent replacing them.

Will Hong Kong Rival Pamplona With a Bull Run?

In the example above, it’s easy to see that the short seller’s theory held and the value plummeted to $4,000, they would have made $4,000 when they sold at that predicted point. Conversely, had the market moved against short positions, and the price rose to anything from $8,001 and up, the short position trader would have immediately started losing.

With such massive figures, there has been speculation that some of the players in the deal were institutional. That remains unclear, but it has been noted that in spite of the weight of the two largest shorts, demand is rising and moving against the doomsayers. Managing to largely avoid extreme volatility and without much of the fanfare of 2017, bitcoin is rising in value. That the bitcoin price rode roughshod through the heavy shorts could be indicative of a bullish sentiment forming. The price of bitcoin is currently trading at $9,502.