Lido Finance Has Become the DeFi Protocol with the Highest TVL

Lido Finance has reached the level of total value locked (TVL) of $19.52 billion, thus surpassing its competitor Curve ($19.3 billion). Anchor Protocol, MakerDAO, and Aave are other DeFi projects from the Top-5 leaders according to their TVL.

Implications for the DeFi Segment

TVL is one of the major metrics used for representing the market conditions of the DeFi segment. This indicator includes all assets that are staked in a specific protocol. The TVL ratio also has significant implications for investors because it represents the relationships between the supply, maximum supply, and market price.

On this basis, investors can determine those assets and projects that are currently undervalued, thus representing additional opportunities for profit generation. The latest data indicate that the competition in the segment continues to increase, thus confirming the rapid development of this market segment, despite the prevalence of the “crypto winter” in the industry.

Lido Finance has reached maximum progress over the past week. Its market capitalization has increased by 4.25%, while its main competitor and the former leader Curve lost about 2.42% of its market value over the same period.

Anchor is the only other protocol from the Top-5 that has demonstrated a positive dynamic in the past 7 days (+3.82%). Despite considerable fluctuations, the DeFi segment continues to grow, and all major protocols may significantly benefit during the next stage of the bullish growth in the following months.

Causes of Lido Finance’s Growth

The major cause of Lido Finance’s rapid growth in the declining market refers to investors’ anticipation of Ethereum’s upgrade completion. The transition to the proof-of-stake mechanism may be highly important for dramatically reducing the energy use in the network, thus potentially attracting more investors and contributing to the growth in its capitalization and market dominance. Thus, many ETH holders have decided to rely on staking in order to gain temporary benefits offered by LDO.

Another cause is LDO’s unique market offerings in terms of a sweetener, the pegged stETH to the value of the cryptocurrency that can be used on different decentralized applications. In this manner, users can generate even higher value by providing additional liquidity to other platforms.

The correct utilization of LDO’s staking opportunities allows for generating additional investment returns with minimal risks.

At the same time, such an increase in the demand for LDO’s staking services may also be temporary as it is closely associated with the anticipation of the transition to Ethereum 2.0. The absence of additional innovation may strengthen the relative position of Curve with the high likelihood of restoring its leadership in the segment.

Price Implications

The current price formation patterns largely depend on the combination of the following forces that affect the market valuation in different directions: the demand for DeFi protocols that demonstrates a rapid growth and the growing concerns over the crypto market stability that threatens many potential investors from entering the market. Technical analysis may assist in determining the key price levels that will determine the short-term price movements of LDO and other major DeFi protocols.

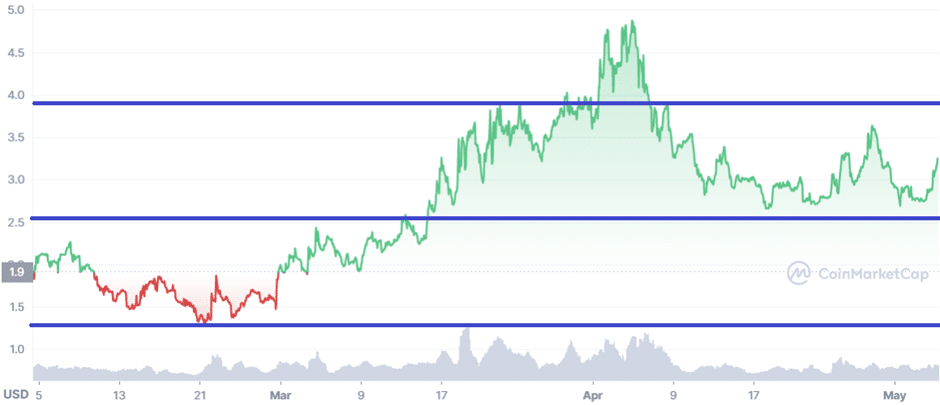

The major support level corresponds to Lido’s price of $1.3 which reflects the local minimum reached in the past 3 months. In addition, Lido Finance has another important support level at $2.55 that allowed reversing the negative short-term trend observed in the recent weeks. However, the DeFi protocol faces a major resistance level at the price of $3.9 that prevents LDO from testing the historically maximum price levels. In any case, the positive long-term trend is still effectively preserved.

Curve faces similar challenges in the market, although it is subject to even higher volatility in the past few weeks. While Curve is effectively integrated with all major platforms and networks, it faces the major challenge of further developing its ecosystem to meet the expectations of strategic investors and DeFi users.

Curve has the major support level at the price of $1.90 which refers to the local minimum reached within the past few months. The first major resistance level is at the price of $2.80 which currently restricts the price movement within the horizontal channel.

The second major resistance level is at the price of $3.55 which will signify the start of a new bullish cycle. Curve’s long-term positions are also strong, and the competition between Lido Finance and Curve may largely determine the structure of the DeFi segment in the following months.