Lithuania Releases New ICO Guidelines

The Republic of Lithuania recently released Initial Coin Offering (ICO) guidelines for the nation on June 6, 2018.

While it may be challenging to promote innovation while protecting consumers and the financial system of any potential shocks, Lithuania believes they can no longer ignore the development of emerging technologies such as blockchain technology. With this in mind, the Eastern European nation revealed regulations for ICOs.

According to Vilius Sapoka, the Minister of Finance of Lithuania, the guidelines are “another step towards more certainty and transparency in regulatory, taxation, accounting, and other requirements as well as better cooperation between different stakeholders.”

The Eastern European country appears very open-minded towards emerging technologies, and considers their leadership in FinTech and advanced IT sectors as providing “persistence alternative access to finance to SMEs and startups.”

Lithuania’s Ministry of Finance has acknowledged that the country is one of the first in Europe to outline a detailed framework and guideline for legal, taxation, and accounting when it comes to ICO projects.

Sapoka said:

“We acknowledge that the brave new crypto economy world is here to stay, this is why we encourage and invite its participants to innovate and create in Lithuania.”

Regulatory and Taxation Guidelines

The Lithuania ICO Guidelines describe the fundraising method as “any initial coin (token) offering with the purpose of attracting capital or investment for the development of a new product or service, company or its activity.”

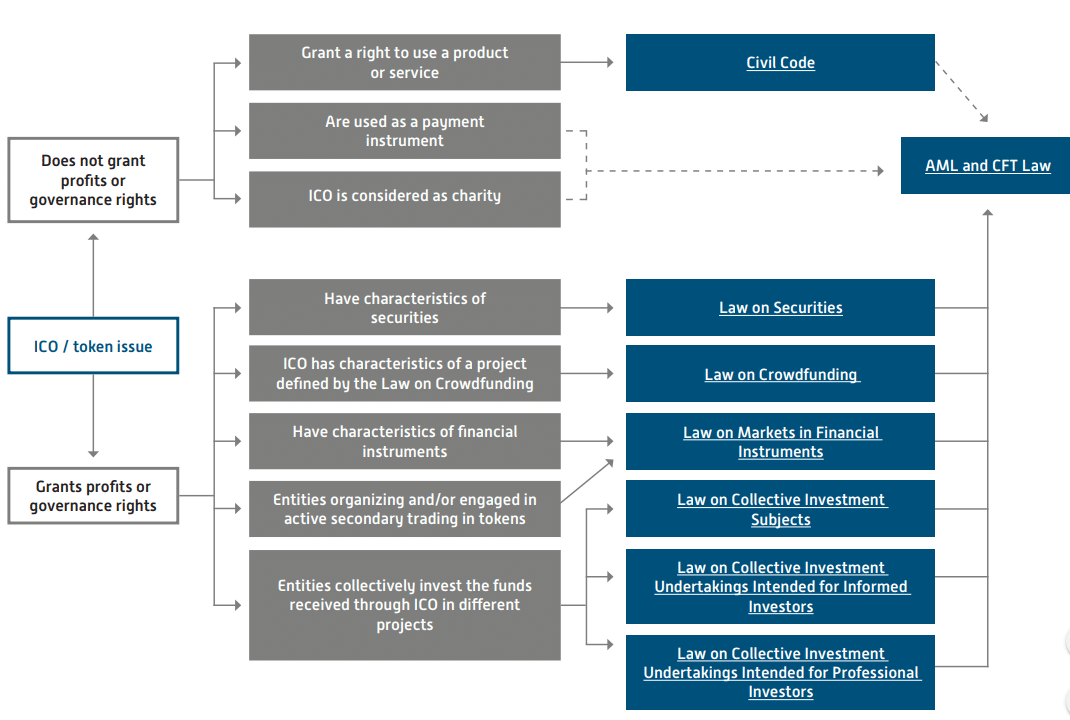

While a specific regulation does not apply to ICOs, the country stated they are subject to rules from the Republic of Lithuania and the supervision of the Bank of Lithuania. The laws range from laws on crowdfunding, securities, financial instruments and the Civil Code.

The government has published a flowchart to help ICO promoters understand the different laws they need to abide by:

(Source: Lithuania Finmin)

With regards to taxation, “the virtual currency is recognized as current assets that can be used as a settlement instrument for goods and services or stored for sale.”

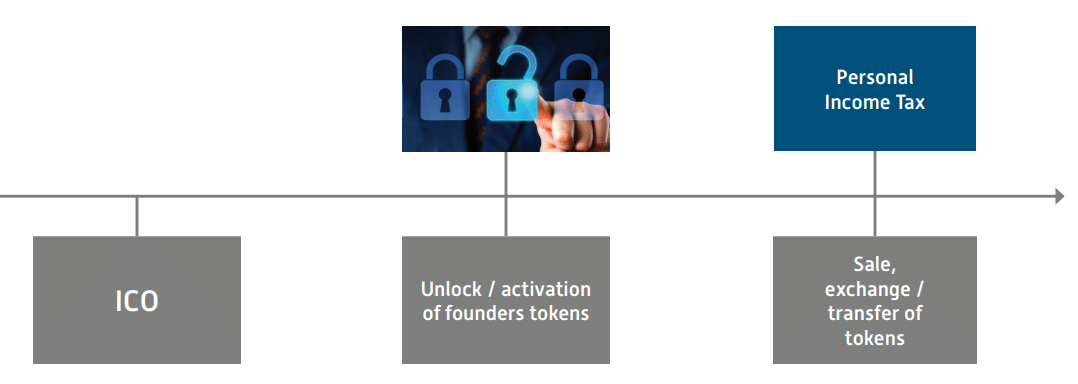

Additionally, ICOs are subject to corporate and personal tax except for a few conditions. As for cryptocurrency mining, no goods or services are supplied for consideration. Hence, the activity is not subject to value-added tax (VAT).

(Source: Lithuania Finmin)

AML Law Guidelines

The Lithuanian Ministry of Finance noted ICOs encounter business expenses, and these must be recorded in a profit and loss statement. The accounting of the cryptocurrency tokens would depend on whether they are a payment, utility or securities token.

As for Anti Money Laundering (AML) and Counter-Terrorist Financing, the Ministry of Finance is currently preparing amendments with the Bank of Lithuania. The first round of revisions will focus on cryptocurrency exchanges, wallet service operators with the intent of increasing transparency and ushering greater stability and security from the cryptocurrency market.