LUNA Falls 88% in 5 Weeks: Causes and Effects of Its Failure

LUNA’s price has fallen by 88% from its all-time high level reached on April 5th, thus exposing huge problems with its stablecoin UST and native token LUNA as investors lose confidence in Terra’s sustainability.

State of the Market

Terra has reached its lowest price level in more than a year after the exposure of the fundamental problems with its UST stablecoin and the overall integration of UST and LUNA for offering unsustainably high staking rewards to LUNA holders. The algorithms used by Terra for stabilizing the value of its stablecoin proved to be manipulative, leading to the large-scale investors’ outflow from the LUNA segment. At the moment, Terra occupies the 69th position in the market, while before the fall, it was among the Top-10 cryptocurrencies for several months in a row.

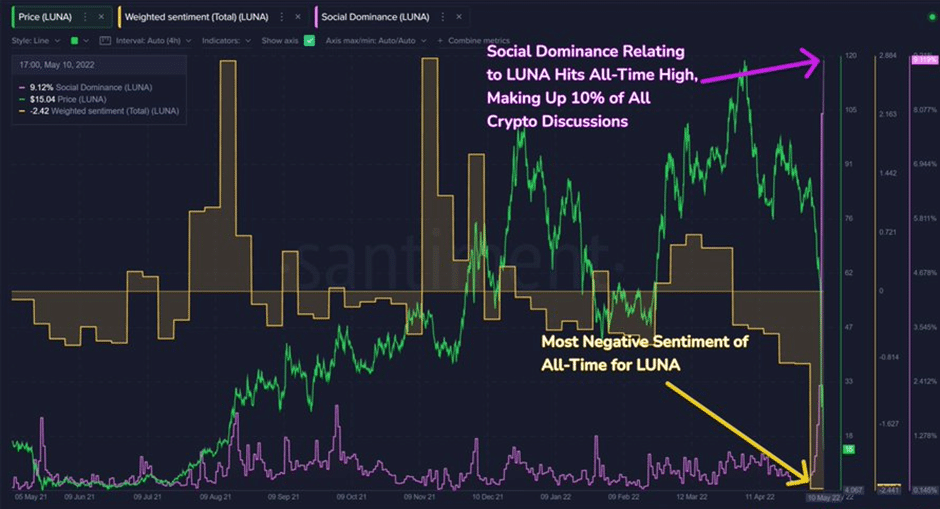

Terra’s collapse is also among the major news and discussions in social media. Crypto enthusiasts are highly concerned with the major market failure of one of the supposedly reliable crypto projects of the recent months. According to the blockchain analytics company Santiment, the all-time high negative sentiments of LUNA has been reached in social media. At the same time, the overall prevalence of Terra-related discussions has reached 10% of the overall crypto discussions, indicating a considerable crypto community controversy regarding the implications of LUNA’s failure. Most investors and traders remain highly pessimistic of Terra’s future market potential.

Causes of Terra’s Collapse

The close evaluation of Terra’s market performance reveals that its ultimate failure was inevitable for several reasons. First, the demand for LUNA tokens was artificially maintained by integrating them with the UST stablecoin and offering the unjustifiably high staking rewards. While such measures stimulated the short-term demand for LUNA, its long-term sustainability was threatened. Second, its algorithms were not based on the sustainable accumulation of crypto or fiat reserves. As a result, Terra could appear to be unable to maintain its peg with the US dollar, when the extra demand emerged in the market.

Third, Luna Foundation’s $1 billion financing plan has failed according to Larry Cermak. The reason is that the Foundation was unable to generate the required amount of funds to finance its initiatives. Moreover, the panic exposed the major limitations of its stablecoin model. Fourth, Terra’s management decided to sell its entire BTC holdings after the UST lost its parity with the US dollar. As a result, the stablecoin lost its major cryptocurrency support. Moreover, the lack of the proper blockchain functions performed by LUNA resulted in the collapse of the demand for this token.

Market Implications

Terra’s collapse has several important implications for LUNA, the segment of algorithmic stablecoins, and the entire crypto industry. Regarding Terra, it is unlikely that it will be able to restore its Top-10 positions (both in relation to its UST stablecoin and native token LUNA) as it will be unable to maintain its earlier unsustainable market expansion model. Moreover, the damaged reputation may constitute a serious obstacle for attracting new investors. The most likely scenario is that investors will shift to more sustainable crypto models in the near future.

In regards to algorithmic stablecoins, they may experience additional pressure in the short run due to the increased concerns of market participants. However, if they rely on sustainable algorithms (for example, DAI’s approach to stablecoins), they can successfully satisfy the demand for their services regardless of short-term deviations. Therefore, the segment of algorithmic stablecoins can be modified under the impact of the growing users’ concerns. At the same time, the most sustainable stablecoins should be able to successfully overcome these challenges.

Regarding the development of the overall crypto market, the current tendency of the rapid expansion of different types of stablecoins can be subject to change. Investors and holders can recognize their risks and do not perceive them as risk-free investments. Moreover, they may also become more critical to their collateral or approaches to maintaining their price stability. The overall demand for cryptocurrency may also slightly decline in the short term. When the existing risks are reconsidered, investors may begin entering the market, leading to the rapid recovery in the following months.