MakerDAO proposes additional $750m investment in US bonds

MakerDAO is considering investing $750 million in US Treasury bonds to take advantage of the current yield environment, with the proposal expected to increase the ceiling to $1.25 billion.

If approved, the proposal will increase the ceiling to $1.25 billion, adding to the $500 million approved in October.

The DAO intends to use a ladder strategy with a biweekly rollover to invest in six-month US Treasury bonds. The notes will have maturities that are equally split over the entire period, with the flexibility to move to a more complex or different ladder scheme if needed.

The motivation for the proposal is to generate additional revenue on Maker’s PSM Assets, with the ability to accommodate material adjustments and upgrades as required under prevailing, relevant Maker RWA-related policies. Given the current market turmoil, the move could help Maker reduce counterparty and credit risk.

MakerDAO advances in the DeFi space

Maker was in the news when it allocated $500 million in Treasury and corporate bonds, with detractors saying it didn’t conform to the spirit of decentralization. ShapeShift founder Erik Voorhees was among those who criticized the decision.

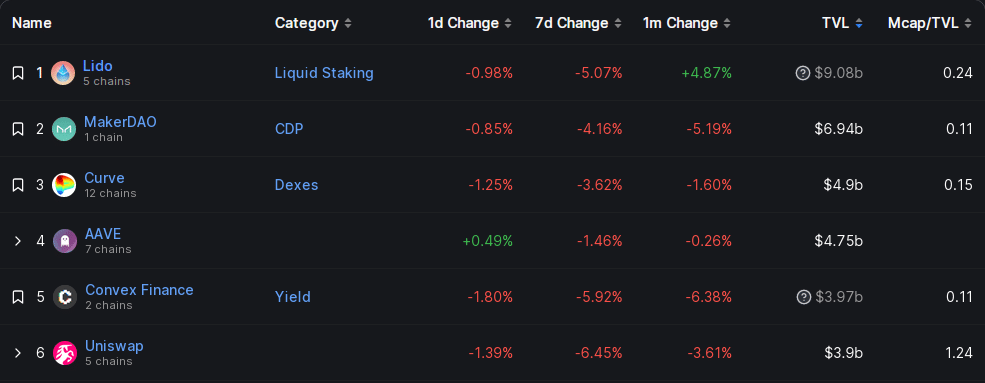

MakerDAO is a decentralized money market and one of the first DeFi platforms, allowing token holders to lend out assets for a yield and borrowers to take loans by depositing collateral. Despite criticism, Maker remains one of the most powerful entities in the DeFi space, with a total value locked (TVL) of $6.94 billion as of Mar. 8, making it the second largest DeFi protocol by TVL after Lido Finance.

Last month, the MakerDAO community set aside 5 million DAI for a legal defense fund to cover aspects of legal defense that traditional insurance wouldn’t cover. It also announced an Aave competitor called Spark Protocol, which will leverage DAI for liquidity and provide a lending product as its first offering. Recently, it sparked discussions for a proposal allowing DAI to borrow from MKR tokens.