Mt. Gox ‘Sell Off’ Had Absolutely Nothing to do With Bitcoin’s Downturn

CryptoMedicated provides a great outline of how the Mt. Gox whale may not have precipitated the large drop in the price of bitcoin since December 2017. The analysis is reposted here for greater visibility, and to inform readers that this narrative that is being promoted in the cryptocurrency community as definitive may not have much substance to it.

Perhaps the most absurd theory that to be thrown around the cryptocurrency world in the past few days is that the most recent depreciation in the price of bitcoin is due almost solely to the Mt. Gox ‘sell-off.’

Above is a picture of the recent drop in price over the previous seven days from the time of writing. The price dipped approximately 27.23 percent from its previous spot price of approximately $11,700 down to a price as low as $8,400 at one point in time. Currently, at the time of writing, it is trading at $9,047 per bitcoin on the Bitstamp exchange, which still represents a total depreciation of 21 percent over the last seven days.

According to many in the crypto community, this is due almost entirely to the ‘sell-off’ of bitcoins by Mt. Gox.

Source: https://www.usethebitcoin.com/how-will-bitcoin-react-to-mt-gox-sell-off-pause-until-september/

Anyone reading these headlines might be inclined to believe that the Mt. Gox sell-off had such a substantial impact on the prices that it was solely responsible for the downturn itself.

In the absence of common sense, logic, and an alternative/opposing viewpoint, this theory could seem plausible.

What’s ‘Mt. Gox’?

Mt. Gox was one of the very first mega-exchanges in the cryptoworld. At one point in time, it was responsible for more than 80 percent of all trading involving bitcoin. Given the primitive nature of bitcoin around the time that Mt. Gox was at its height (2011-2014), it was essentially a pillar of the community.

What Went Wrong?

Around late 2013, rumors of insolvency started buzzing following the Mt. Gox hack. However, despite the warning signs and red flags that were going around the community, many continued to trade regardless. It certainly didn’t help that Mt. Gox has gone through painstaking efforts to reassure investors that they were entirely solvent and that customer funds were at no risk of being lost.

The company’s original statement was, “A bug in the bitcoin software [that] makes it possible for someone to use the Bitcoin network to alter transaction details to make it seem like a sending of bitcoins to a bitcoin wallet did not occur when in fact it did occur. Since transaction appears as if it has not proceeded correctly, the bitcoins may be resent. Mt. Gox is working with the Bitcoin core development team and others to mitigate this situation.”

Shortly after that, the exchange collapsed entirely in February of 2014, resulting in the loss of 750,000+ bitcoins when everything was said and done. This number represents approximately 3.5 percent of all Bitcoins that will ever be created. So, to say that this loss devastated the community is an understatement.

What’s the Point?

Long story, short – investors were pissed and heads rolled because no entity is going to get away with losing that much money without there being significant backlash from both the community as well as governments.

So, one of the bankruptcy trustees, Nobuaki Kobayashi, who is responsible for handling Mt. Gox’s fiduciary responsibilities to the individuals that lost money has sold off hundreds of millions of dollars of bitcoin in recent weeks in order to allegedly pay back the individuals that lost their money in the Mt. Gox breach.

(Sidenote: Since bitcoin is considered an asset in the eyes of the governmental jurisdictions that preside over Mt. Gox’s creators/owners, investors that lost money could have a plausible argument that they should be receiving the equivalent product if it is available to be given – i.e., bitcoin itself and not the equivalent exchange value at the time that the hack happened).

Here’s the Theory

So, the theory that the community has put forth in recent days/weeks is that the selling of this substantial number of bitcoin by those in power at Mt. Gox has essentially ‘flooded’ the market. Consequently, the sale has depressed the prices, causing the bear run that we are currently experiencing (at its lowest, bitcoin has lost over $13,000 from it’s previous high value of $19,500+/bitcoin).

Unfortunately, Cointelegraph has indulged this absurd theory in one of their most recent articles. So, in order to assess the merit of this argument, it’s best that we view the contents provided in their entirety:

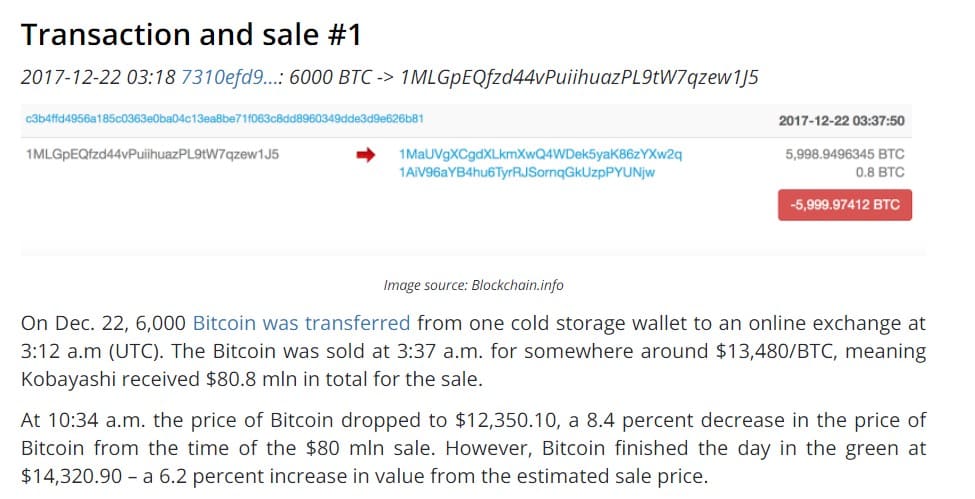

As reported by Cointelegraph, there was an overall appreciation in the price of bitcoin 24 hours from the time that 6,000 bitcoin were ‘dumped’ on the market on December 22. However, the subsequent decline in price following the alleged ‘dump’ (tracked via wallet transfers – we don’t know the exact time that any of these coins were sold), was not something that should be unexpected.

The chart above is a price chart for bitcoin (USD) on the 12-hour time frame. A square is placed around the time frame that the alleged dump took place. As once can see, there was already a steady drop in bitcoin’s price for several days before any dump occurred.

To use a bit of technical analysis here, the dump actually coincided with a strong reversal signal from the Williams %R indicator. Thus, if it were truly artificially deflating the price, the price action here, as well as the signals from the indicator (divergence on the Williams %R), would not reflect the values that they are showing in the picture above.

Why?

Because the Williams %R, like the RSI, is a momentum indicator. This means that it is tracking the momentum of the price. Based on the mathematical formula that this indicator uses to display values, if the ‘dump’ of bitcoin actually impacted the price that strongly, then it would not be diverging with the price (showing decreased momentum).

This is an indisputable fact.

Here’s the next example that is provided of the alleged ‘dumping’ by Mt. Gox depreciating the price:

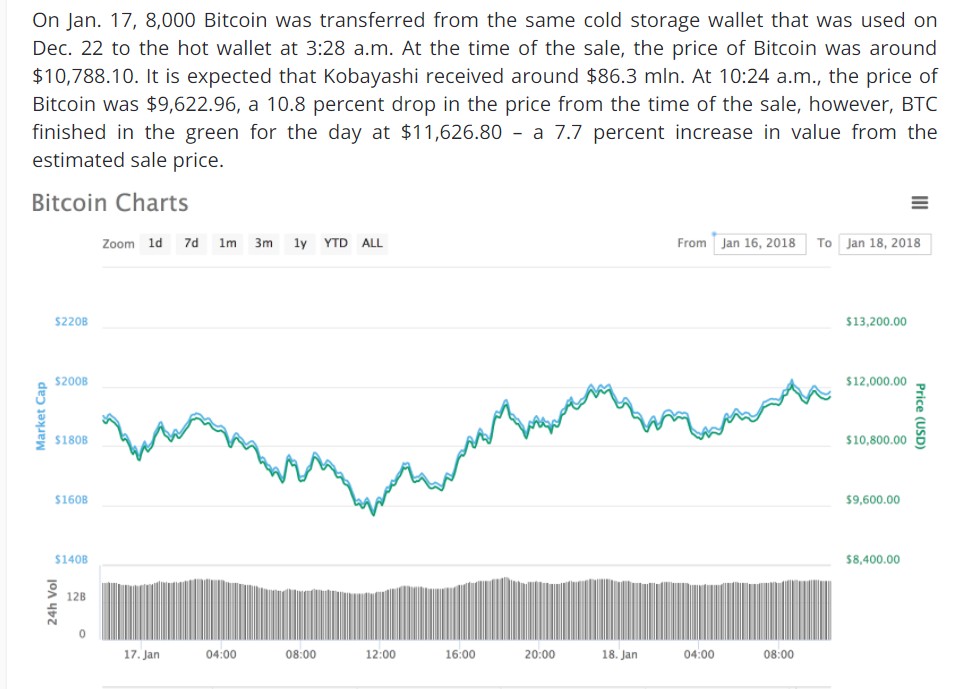

Once again, the statement posted within this article above the price chart have a few troubling logical inconsistencies within them. So, let’s unpackage this carefully:

“On Jan. 17, 8,000 Bitcoin was transferred from the same cold storage wallet that was used on Dec. 22 to the hot wallet at 3:28 a.m. At the time of the sale, the price of bitcoin was $10,788.10. It is expected that Kobayashi received around $86.3 mln. At 10:24 a.m., the price of bitcoin was $9,622.66.”

- The article alleges that the sale occurred nearly seven hours after the hot wallet transfer was made. There is no evidence behind this claim other than a notable depreciation in the price of bitcoin. Thus, it appears that the author is more a victim of confirmation bias than anything.

Here are a few objective technical indicators that cast serious doubt on the ‘evidence’ presented above:

That bottom indicator with the red line is called Average True Range. This refers to the average volatility of bitcoin. At the time of the second alleged ‘dump’ on January 17, the ATR was reading at a value of $1,541.30.

According to the CoinTelegraph, there was a depreciation of approximately $1,100 during this period, which is a depreciation in the price that is nearly 30 percent less than what the average volatility of bitcoin’s price was during this period. Please keep in mind that bitcoin was well into its bear market at this point in time.

Furthermore, According to a report released March 17, the bankruptcy trustee Nobuaki Kobayashi stated:

“Please note that the transfers of BTC and BCC from BTC/BCC addresses that I manage to other addresses do not itself necessarily mean that I sold BTC and BCC at the time of such transfers. Please refrain from analyzing the correlation between the sale of BTC and BCC by us and the market prices of BTC and BCC based on the assumption that the sale was made at the time the BTC and BCC were transferred from BTC/BCC addresses that I manage, as such assumption is incorrect.”

Once again, the Williams %R (the second chart with the blue line) seen above, shows a reversal a pronounced decrease in the downward momentum of bitcoin’s price before, during, and after the alleged dump.

Once again, if the entire total of these coins were dumped and this action truly caused a precipitous decline in bitcoin’s price as proponents of this theory claim, then the indicators would reflect this the same way that they do when pump and dumps occur on regular coins.

Above is a picture where the alleged ‘dump’ occurred (time is adjusted to account for the time zone difference – the author is in GMT-4; please not the time is approximate and not exact to the minute).

What you should pay special attention to is that the 24-hour volume of bitcoin around the point of the alleged dump is at $17.953 billion. This value averages out to approximately $748 million worth of bitcoin being traded per hour.

Given the fact that the market price was $10,700, this equates to approximately 70,000 bitcoin being traded every hour ($748 million/$10.7k).

According to the CoinTelegraph article, only 8,000 Bitcoin were dumped at this point. Thus, according to the data that we currently have before us, this wouldn’t even exceed the number of bitcoins being traded in a ten-minute timeframe.

Is That All?

Here’s yet another point that refutes the theory:

Above is a zoomed in screenshot of the 24-hour market cap volume (kudos to Coinmarketcap.com) during the time before and after the alleged dump.

This 24-hour volume reflects the volume of bitcoin being traded both before and after the alleged ‘dump’ of the price (once again, please note that the times are adjusted to reflect the GMT-4 time zone that the author is in).

One can see a clear decline in the 24-hour Trading Volume.

This fact is yet another thing that stands in clear contradiction of the theory that the Mt. Gox dumped caused a massive price depreciation of bitcoin because the 24-hour trading volume should have increased for two reasons:

- The influx of bitcoin being ‘dumped’ on the market randomly.

- The influx of traders that are now ‘panic selling’ or stop losses being triggered by the alleged dumping.

The 24-hour trading volume gives us firm confirmation that neither of those events occurred. And if #1 did occur, the impact was negligible at best.

Not Viewing the Rest of the ‘Examples’

The author has decided not to cover the remaining three examples that were given in the article because the evidence provided to the contrary would simply be redundant at this point.

Summary of Why the Mt. Gox ‘Dump’ Theory is Completely Bogus

#1 – Why Would They Want to Crash the Price of Bitcoin?

This perhaps should be the foremost question on any person’s mind that is entertaining or perpetuating this theory.

What plausible gain would the Mt. Gox bankruptcy executive have in ‘dumping’ the bitcoin all at once while the coin is already in a steep price decline? Any trader knows that ‘dumping’ on the market would, at the very least, cause some level of price slippage, which would result in a loss of profits that would have otherwise been gained if the coin was dumped immediately.

#2 – The ‘Dump’ Times Make No Sense

As you can see in the charts above, there were numerous opportunities for the Mt. Gox bankruptcy executive to ‘dump’ the bitcoin at a higher price. Why would they not do so? Bitcoin was valued at nearly $20,000 just weeks before.

Why would they wait until the value had depreciated by 40 percent ($20,000 to $12,000) to start dumping?

#3 -No Objective Evidence Exists to Corroborate This Theory

All that is known is that the bitcoins were moved from a hot wallet. There is no way to track how many were sold and when. For all we know, not a single bitcoin was sold. Thus, this theory is all built entirely on conjecture, to begin with.

The theories that have been put forth assume that ALL of the bitcoin moved from the hot wallet was simultaneously dumped. There’s absolutely no objective evidence or logic to support this notion in favor of a theory that they sold the bitcoin in a controlled and measured manner.

#4 – Arbitrage

If the bitcoin were all simultaneously dumped, then they would be dumped on one exchange. Thus, the process of ‘arbitrage’ would have covered the price here.

What is Arbitrage?

Let’s say you’re trading Ripple for $1.00 each on Bitfinex. Now, suppose you look over at Bittrex and notice that Ripple is going for 80 cents. What would you do? More than likely you’d attempt to buy as much Ripple as you can for 80 cents, then sell it for $1.00 on Bitfinex in order to make quick profits.

However, you wouldn’t be the only trader to make such an observation. So, as a result of you and others attempting to scalp profits from one exchange to another, the price of Ripple on Bittrex would subsequently rise due to the influx of buyers attempting to get a discounted deal on the token.

The price of Ripple on Bitfinex would also decrease because of the influx of those trying to ‘cash out’ their scalped tokens.

This happens every day on crypto and traditional markets (it is substantially more common in cryptocurrency though). Typically, trading bots that are designed to detect such opportunities, make these trades automatically, so the price between the two exchanges clears up quickly. And you can bet your last dollar that there are plenty of those bots in operation for bitcoin.

So, in conclusion, even if the dump did cause a massive decline in the price

#5 – Bitcoin Mining

This may be one of the strongest, yet most overlooked counter-arguments to this entire theory. We’re forgetting about the miners entirely.

What Does Mining Have to Do With Anything?

The only reason people mine is to get bitcoin. As bitcoin aficionados, we know all too well that the coinbase (not the company) reward for mining bitcoin is 12.5 bitcoin per block. It takes approximately ten minutes for each block to be mined, with some level of variation.

So, there are approximately 75 bitcoin awarded every hour (12.5*6 [one hour=60 minutes/10 minute blocks]). There are 24 hours in a day, so since 75 bitcoin are mined every hour, we can estimate that approximately 1,800 bitcoin are mined per day (24*75). There are seven days in a regular week, so since there are 1,800 bitcoins mined per day, there are approximately 12,600 bitcoins produced per week (1,800*7).

It is well-known that the process of mining bitcoin specifically has become exorbitantly expensive over the past few weeks and months because of the influx of miners on the Bitcoin network in recent months. Therefore, it is more than likely that miners are consistently ‘dumping’ bitcoins in order to pay for overhead costs, cost of equipment, absurd electric bills, and general living expenses.

Since the Bitcoin reward is the only way that miners receive compensation for their efforts (directly or indirectly), they cannot afford to “hodl” bitcoin in the same way that the general population can because they need to liquidate down their incomes to live (most electric companies don’t accept bitcoin as payment, and landlords and grocery stores are also unlike to do so).

Therefore, a humble estimate would be that miners more than likely sell at least 4,000-5,000 bitcoin per week.

Please note: This doesn’t even account for the extra bitcoin that is received in fees by the miners as well.

Indicators Strongly Show Otherwise

Above is an example of what the ATR (volatility tracker – oscillator) and Williams %R (momentum indicator like RSI) look like when an actual pump and dump is going on.

We should’ve seen something akin to what we see in the dump phase here, if that’s what was going on. However, we didn’t.

Conclusion

There’s just simply on objective reason to believe that the depreciation in bitcoin’s price was a result of Mt. Gox in any way, shape or form. There’s simply zero objective evidence or logic that supports this theory.