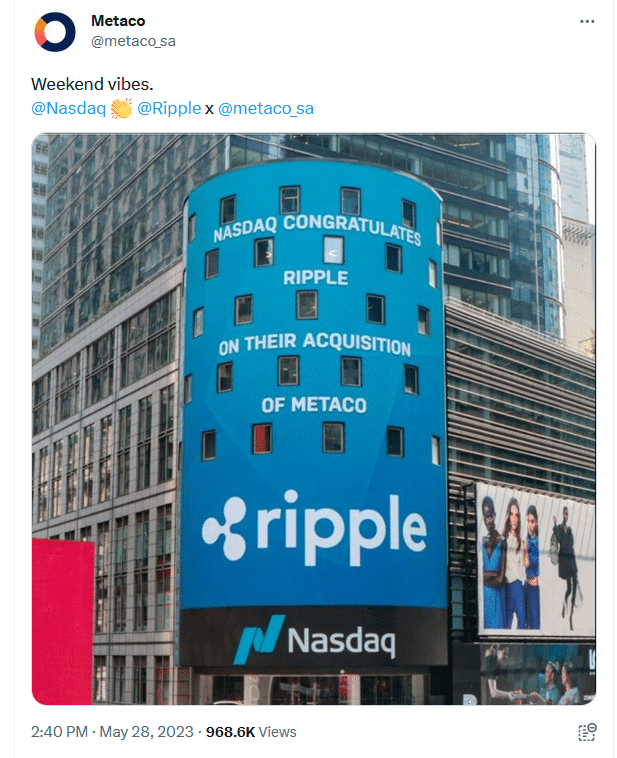

NASDAQ congratulates Ripple on Metaco’s acquisition, fuels IPO rumors

NASDAQ, one of the largest stock exchanges by volumes in the United States, has congratulated Ripple, the blockchain payments company, following its acquisition of Metaco, a Swiss-based crypto custody platform.

In a tweet shared by Metaco on May 28, NASDAQ applauded Ripple though crypto users read more from the broker’s decision to publicly congratulate the embroiled Brad Garlinghouse-led blockchain company. The stock exchange’s message is also fueling rumors of a potential Initial Public Offering (IPO) and listing in the future.

On May 17, the San Francisco-based Ripple acquired Metaco, a Swiss-based firm specializing in asset custody, trading, and decentralized finance (DeFi), for $250 million.

The purchase led to speculations on Ripple’s ambitions. There were argument that the blockchain company is extending its presence in Europe and possibly foraying into the decentralized finance (DeFi) space in the future.

NASDAQ’s congratulations, therefore, adds a new layer of intrigue to the future direction of Ripple.

NASDAQ’s endorsement: teasing a Ripple IPO?

NASDAQ can presents an enticing platform for future aspirations of the blockchain company.

Ripple’s ambitions to go public via an Initial Public Offering (IPO) have been public knowledge for some time. Even so, the ensuing legal turmoil with the United States securities and exchange commission (SEC) has cast shadows on these plans.

NASDAQ’s recognition, while not a direct invitation, could be interpreted as a nudge to Ripple that should it consider going public, the bourse could be a fitting destination.

Legal hurdles: Ripple’s road to IPO

The cornerstone of Ripple’s path towards an IPO lies in the resolution of its ongoing legal standoff with the SEC.

For those less familiar with the case, it stems from allegations by the SEC that Ripple conducted an unregistered securities offering by selling XRP, a digital asset Ripple argues should be classified as a cryptocurrency and not a security, just like bitcoin (BTC).

Ripple’s future, especially its aspiration to go public, hinges heavily on the outcome of this lawsuit. The eventual resolution would clarify the regulatory status XRP, a key factor in attracting a broader investor base.

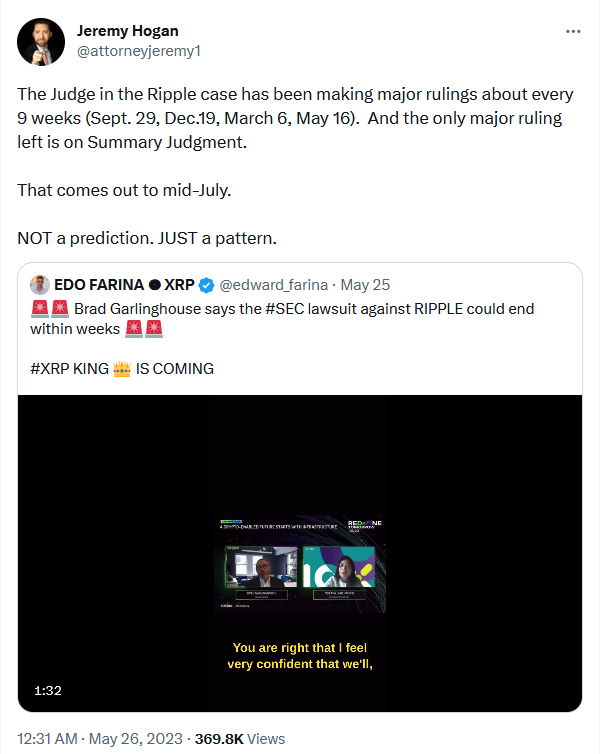

According to Jeremy Hogan, a legal analyst, the lawsuit between Ripple and the SEC may conclude by July.

Should Ripple succeed in overcoming its legal hurdle with the SEC, they may likely plan for an IPO.