Nvidia Blames China and Drying Crypto Mining Business for Disappointing Q4 2018 Results

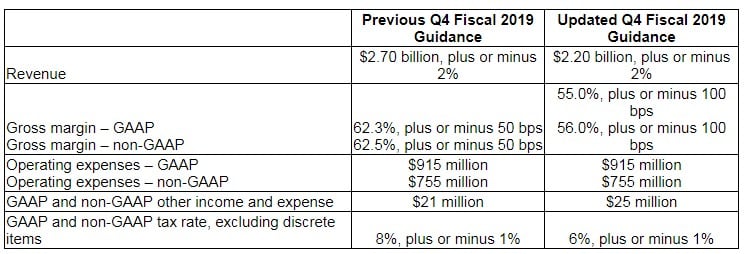

According to a report by VentureBeat published on January 28, 2019, U.S. GPU manufacturing company Nvidia’s stock fell by more than 15 percent on Monday over fears of the company’s poor performance in the crypto mining industry. The company has revised its Q4 2018 revenue estimate, which now sits at $2.20 billion compared to the previous estimate of $2.70 billion.

Mining Cryptocurrencies a Thing of Past?

It isn’t a stretch to say that crypto miners have faced the major brunt of the ongoing pessimistic market. The prolonged bear market has forced many of these miners to ditch the side-gig and look for alternative means to earn. Lackluster demand for mining equipment reflects on the quarterly estimates of manufacturing companies like Nvidia, AMD, and others.

An official press release published on January 28, 2019, initiated the double-digit fall of Nvidia’s stock. The press release talks about less than expected revenue not only from Nvidia’s crypto mining equipment division but also from their gaming and data center business segments.

Shortly after, Nvidia’s stock tanked by almost 15 percent, wiping out $14.2 billion in market value. It is believed that Nvidia will report final resources for the quarter ending January 31 on its February 14 earnings call.

(Source: Globe News Wire)

Jensen Huang, founder and CEO of NVIDIA, noted:

“Q4 was an extraordinary, unusually turbulent, and disappointing quarter. Looking forward, we are confident in our strategies and growth drivers.”

The company put the onus of declining revenues on the regulatory climate in China and the fading allure of crypto mining business.

Tough Times for Nvidia

Nvidia’s crypto division has been under immense pressure in recent quarters. The dramatic collapse in the price of cryptocurrencies in 2018 led to a large accumulation of unused inventory at Nvidia’s warehouses. The cost of idle lying capital, coupled with the effect of continual red-candles on charts all played a part in Nvidia’s poor performance.

BTCManager reported on November 18, 2018, how the company’s Q3 2018 financial results showed the grim reality of the drying business of mining digital currencies.

Troubles continued for Nvidia coming into 2019, as reports emerged on January 1, 2019, stating how the firm is being targeted by class action lawsuits filed by the Schall Law Firm for allegedly misleading its shareholders.